xWin platform will help investors stake DeFi tokens with ease for rewards

xWin is an upcoming fund management platform currently in the beta stage that helps users to stake on different liquidity pools for rewards with ease. The protocol is built using the Binance Smart Chain, which is faster and cheaper. The project chose the BSC since it wanted to maximize the cost of investing in tokenized ecosystems. The chain's superior speed and lower transaction fees allow for this to occur.

xWin helps users access fund managers or automated vaults from where they can easily launch their funds in the platform. It connects these users with the best fund strategies from professionals. The protocol plays many roles, which the section below will cover.

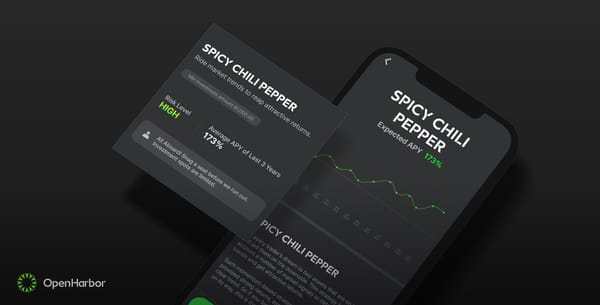

As an investment platform, xWin allows the user to create a fund of their own where investors can subscribe to any funds they prefer and enjoy the returns based on someone else's trading expertise or wealth management skills. xWin provides Sector Index Vaults, which provides users with exposure to DeFi, or a sector-specific basket of tokens that can be added to individual portfolios for diversification. You will realize that the platform does support primary market creation and redemption by utilizing token distribution. And all the funds available on the platform will distribute the unit token to investors in real-time.

The platform also provides a liquidity pool vault which helps the investor, also known as a farmer, to stake their tokens into Pancakeswap, which serves as a liquidity pool, and perform farming using LP tokens in a single click. Here you don't have to worry about adding or removing liquidity and even how to farm since everything is automated and takes care of itself.

There is a trading vault that is quite similar to an index vault, with the only difference being high trading frequency and the allocation between available assets is reset based on the trading trend and momentum. As a fund owner, you can control the vault or automate the task based on technical analysis signals.

Integration With Various Protocols

xWin is integrated with Band Protocol which serves as a decentralized data governance protocol. Here xWin integrates with on-chain price feeds on band protocol. The prices are used to evaluate the vault's total value for each price unit. And also, access the price impact tolerance validation during swapping in Pancakeswap to prevent unfair price tolerance.

The platform is also integrated with Pancakeswap to allow for all the swapping activities between BNB to other tokens and vice versa. Here only those pairs with sufficient liquidity are included in xWin vaults. And to make the liquidity provision process easy, the Pancake liquidity pool and farm are also being integrated into the xWin LP vault.

Features That Make xWin Stand Out

Suppose you are looking for features that help xWin stand out. In that case, the sector index exposes the user to the DeFi and sector-specific basket of tokens, which can be added to your portfolio for diversification. There are trading vaults where users can follow experts on various trading strategies such as technical and fundamental analysis.

Then there is a liquidity pool vault which makes farming easy by automatically splitting your BNB token 50/50, stake the tokens into Pancakeswap’s liquidity pool and farm with LP tokens. And most importantly, you can use the xWin platform to earn the xWin (XWIN) token, which you can trade on a decentralized exchange.

Last but not least, XWIN farming allows investors can further to boost the investment returns by farming the selected tokens issued by xWin vaults in XWIM farm to earn more XWIN tokens.

Founding team And Advisors

xWin is backed by a team of highly experienced individuals in various fields, mainly technology, finance, and marketing. The founding team is made up of Calvin Thong and Fumihiro Arasawa.

Calvin holds a bachelor’s in computer science and a master’s in applied finance from Macquarie University. Previously he worked as a portfolio manager in ETF and index funds in BlackRock.

Fumihiro is experienced in business consulting, having worked for reputable firms in Japan and Vietnam. Then, Yuki is a UX designer who previously worked for an advertising agency.

The advisory board is made up of four individuals.

Mariya Ebirayim, the marketing advisor, has over 8 years of experience in the Fintech investment industry and five years of experience in PR with an emphasis on Blockchain and Fintech.

Professor Seiichiro Yonekura, specializing in business history.

Daisuke Kobayashi, the trading advisor, has extensive experience in the financial sector in Japan, with over 20 years of trading experience.

Dai Oshima, the marketing advisor, has worked at major Japanese company over 20 years as a marketing specialist.

xWIN cooperated with Yokohama Kitanakadori Law office for legal issues.

Check our guide of the most promising crypto