15 US States Move Forward with Plans for Bitcoin Reserves

Fifteen US states have begun taking steps toward establishing government-owned Bitcoin reserves, following President Donald Trump's recent executive order to explore creating a national cryptocurrency stockpile. The movement gained momentum after Trump's election victory and his continued support for making America "the crypto capital of the planet."

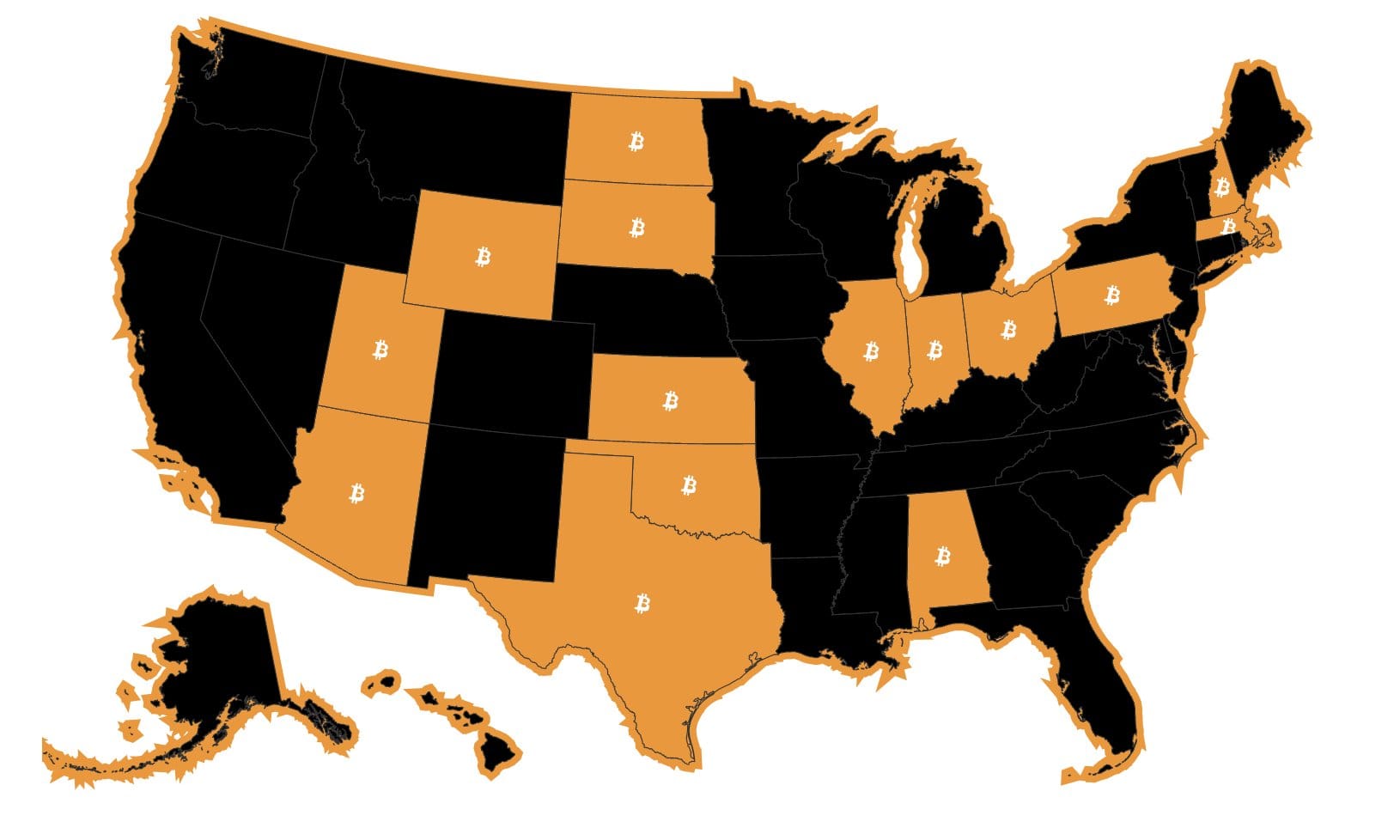

Pennsylvania led the initiative by introducing the first state-level Bitcoin reserve bill in November 2024. The list of states now pursuing similar legislation has grown to include Alabama, Arizona, Florida, Kentucky, Massachusetts, Montana, New Hampshire, North Dakota, Ohio, Oklahoma, Pennsylvania, South Dakota, Texas, Utah, and Wyoming. South Dakota became one of the latest states to join when Republican State Representative Logan Manhart announced plans to introduce a Bitcoin reserve bill.

The concept of government Bitcoin holdings gained national attention when Trump, during his presidential campaign, proposed using 200,000 Bitcoins seized from criminal activities to create a strategic national stockpile. This was followed by Wyoming Congresswoman Cynthia Lummis' Senate bill, which proposes purchasing 1 million Bitcoins over a five-year period.

States are exploring various approaches to building their reserves. Oklahoma, New Hampshire, and Pennsylvania have proposed allocating up to 10% of public funds for Bitcoin purchases. Texas legislators have drafted a bill that would allow residents to pay government taxes and fees in Bitcoin, with the state holding these payments for at least five years.

Supporters of state Bitcoin reserves point to portfolio diversification and inflation protection as key benefits. Zack Shapiro from the Bitcoin Policy Institute, a non-profit crypto think tank, suggests that states need to reconsider how they store wealth, particularly given potential reductions in federal spending on state initiatives. However, critics like David Krause, a finance professor at Marquette University, warn about the risks, describing Bitcoin as "the most volatile asset class" he has ever seen.

The establishment of state Bitcoin reserves could significantly impact cryptocurrency markets. With Bitcoin's fixed supply cap of 21 million coins, large-scale government purchases could drive up prices substantially. While some view this initiative as speculative, others draw parallels to the evolution of private equity, which transformed from a novel concept to a standard component of institutional portfolios within three decades.