How Bull Run Affects Crypto Processing?

Excitement, energy, and a whole lot of activity — that's kind of what a crypto bull run feels like. It is a period of rapid price increases that can bring a surge of action to the crypto world. This, in turn, can affect how transactions are processed while understanding such nuances can help you better navigate through this digital landscape. So, let's look at it in more detail.

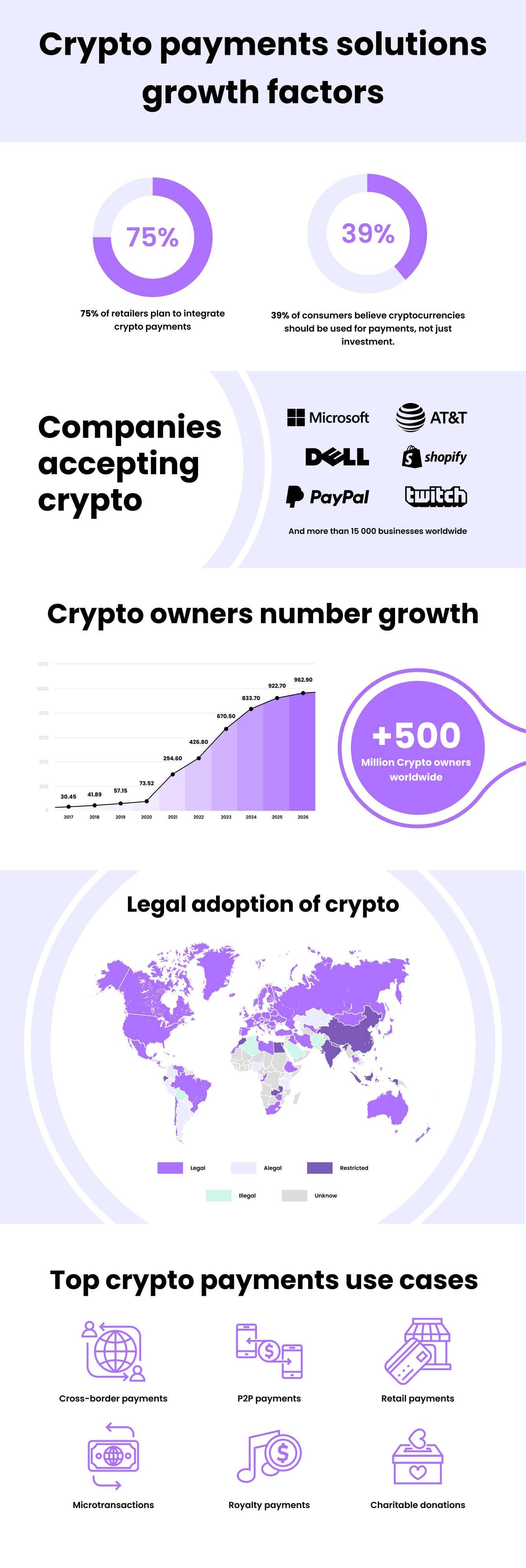

On the infographics below, presented by white label cryptoporcessing software provider WhiteFlo team, you can explore main factors growing crypto processing market.

What makes crypto transactions boom?

The crypto world thrives on excitement, and during a bull run, that excitement translates to a surge in transactions. But what exactly fuels this rise? Here's a breakdown of some key factors.

Soaring interest. Bull runs are often fueled by a surge in public interest. As more people hear about the potential of cryptocurrencies, they're drawn to participate, leading to a higher volume of transactions.

Price appreciation. When crypto prices rise, it can create a buying frenzy. People jump in, hoping to capitalize on the gains, further increasing transaction activity.

Institutional investment. With major financial institutions increasingly recognizing the potential of crypto, their investments can significantly impact transaction volume.

Fear of Missing Out (FOMO). Sometimes, the sheer excitement and rapid price movements can trigger FOMO, leading people to rush into buying crypto, further boosting transaction activity.

Challenges and Opportunities Ahead

The surge in transactions during a bull run brings not just excitement but also its own set of challenges and opportunities. Here's what to watch out for:

Network congestion. With a massive influx of transactions, crypto networks can become overloaded, leading to slow processing times and even higher fees. This can be frustrating for users and potentially hinder wider adoption.

Volatility. Bull runs are often accompanied by price volatility, which can create uncertainty and risk for investors. It's crucial to stay informed and manage your risk tolerance during these times.

But amidst the challenges, there are also opportunities. The pressure of increased transactions can act as a catalyst for innovation within blockchain networks, encouraging the development of scaling solutions that could eventually lead to faster processing times and lower fees.

Moreover, the surge in transaction volume during a bull run plays a crucial role in driving cryptocurrency further into the mainstream. This wider acceptance validates the technology and paves the way for its broader applications and future growth, opening up a realm of possibilities for its integration into various sectors of the economy.

Market Expansion in Response to the Bull Run

During bull run periods, the market itself expands and adapts to accommodate the surge in activity. We see a blossoming of new services catering to the growing user base. This might include the launch of innovative crypto exchanges, secure custody solutions, and even user-friendly tools to help manage crypto assets more effectively.

The increased interest spills over to alternative coins (altcoins) as well. With Bitcoin basking in the limelight, investors naturally explore options beyond the established leader. This leads to a rise in activity for altcoins, diversifying the entire crypto landscape and creating a more dynamic marketplace.

But perhaps the most significant response involves the pressing issue of network congestion. Bull runs, with their massive transaction volume, act as a catalyst for the development and adoption of scalability solutions. This could involve advancements in existing technologies like layer-2 scaling or a complete shift towards entirely new blockchain protocols that can handle the increased load.

Essentially, the market reacts to the demands of the bull run by offering new services, exploring alternative investment options, and focusing on improved transaction processing. This proactive response helps the crypto market position itself for sustainable growth, even after the initial surge subsides.

Key Indicators of Growth in Crypto Processing

By monitoring key indicators, we can take the pulse of the network. The most basic yet crucial metric is transaction volume. A sustained surge during a bull run signifies a growing user base and increased adoption. For proof-of-work blockchains like Bitcoin, the network hash rate reflects the combined computing power dedicated to securing the network. A rising hash rate during a bull run indicates increased security and network strength.

We can also track the number of active addresses on a blockchain, revealing the level of user engagement. A surge in active addresses suggests more users are actively participating in the network. Transaction fees, while often frustrating, can also be indicative of network congestion. Fluctuating fees during a bull run might signal increased demand for processing power, highlighting the need for scalability solutions.

How Market Players Are Adapting

These indicators help us gauge the impact of a bull run on crypto processing infrastructure and identify areas ripe for innovation. But the surge in transactions also throws down the gauntlet for market players. They're in a race against the clock to adapt and keep pace with the growth.

Crypto exchanges are on the frontlines, experiencing a massive influx of users and trading activity. They're constantly working on improving their infrastructure to handle higher volumes and ensure smooth transactions for their users. For proof-of-work blockchains, miners play a crucial role in securing the network. During a bull run, they might invest in more powerful mining hardware to maintain network security and potentially benefit from increased block rewards.

The pressure of network congestion fuels innovation among blockchain developers. They're actively working on scaling solutions like layer-2 protocols or exploring entirely new blockchain architectures to handle the growing demand. Savvy investors see bull runs as opportunities to invest in projects focused on scalability solutions or infrastructure development. This additional funding helps accelerate the development of technologies that can ensure smoother and faster transaction processing in the future.

The Potential Impact of Crypto Market Fluctuations on the Crypto Processing Market

The crypto market is known for its volatility, with prices experiencing dramatic swings both up and down. This volatility can have a significant impact on the crypto processing market, as it can lead to changes in demand for processing services.

Increased demand during bull runs

During bull runs, when crypto prices are rising, there is typically a surge in demand for crypto processing services. This is because more people are buying and selling cryptocurrencies, and they need a way to process their transactions. This increased demand can lead to higher fees for crypto processing services, as well as longer processing times.

Decreased demand during bear markets

During bear markets, when crypto prices are falling, there is typically a decrease in demand for crypto processing services. This is because fewer people are buying and selling cryptocurrencies, and there is less need for processing services. This decreased demand can lead to lower fees for crypto processing services, as well as shorter processing times.

The impact of volatility on businesses

The volatility of the crypto market can have a significant impact on businesses that operate in the crypto processing market. These businesses need to be prepared for changes in demand, and they need to be able to adapt their services accordingly. They also need to be able to manage the risks associated with the volatility of the crypto market.

The future of the crypto processing market

The crypto processing market is still in its early stages of development, and it is expected to grow significantly in the coming years. This growth is being driven by the increasing adoption of cryptocurrencies, as well as the growing number of businesses that are accepting crypto payments.