Ant Investment Foundation (ANT) and HBHEX Partner to Open a New Chapter in Global Crypto Investment

Driven by the digital economy, cryptocurrencies have become one of the most dynamic asset classes in the global investment landscape. Over the past decade, the average annual growth rate of leading digital currencies such as Bitcoin and Ethereum has significantly outpaced traditional assets including gold, equities, and real estate. At the same time, blockchain technology continues to drive transformation across industries—from payments and finance to cross-border settlement and supply chains.

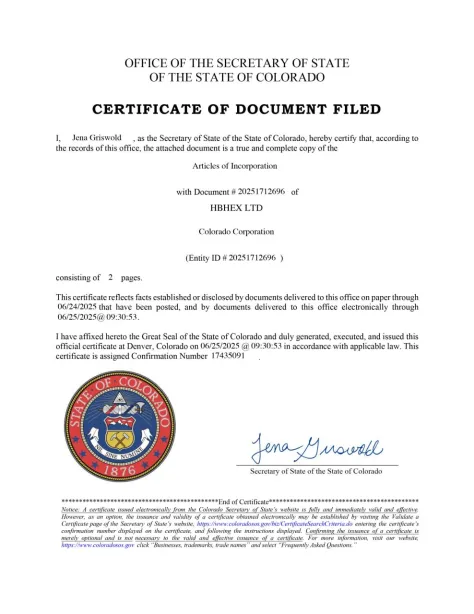

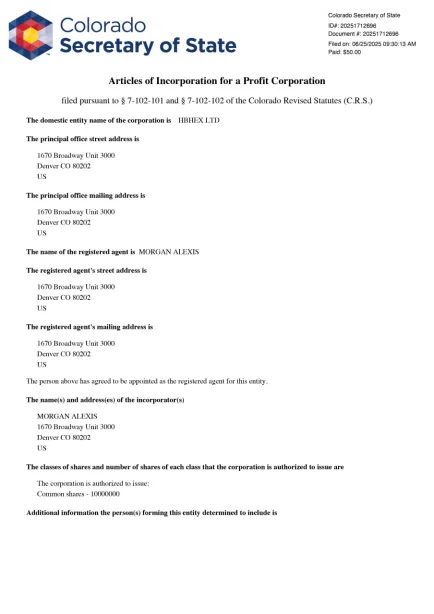

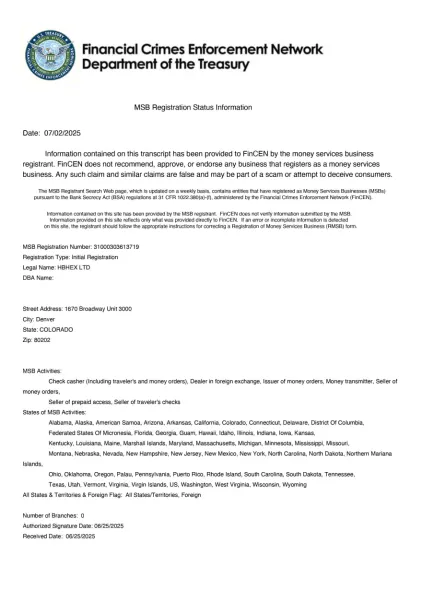

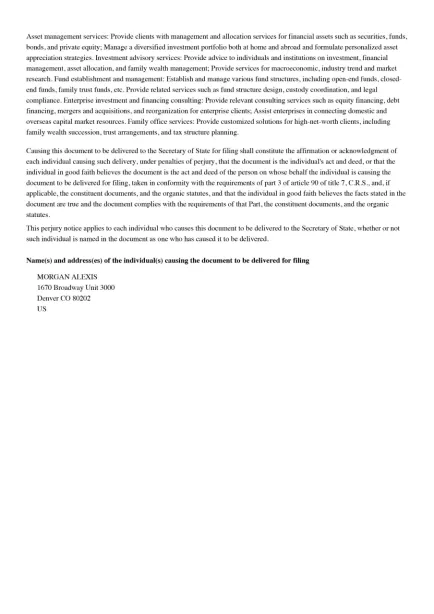

Against this backdrop, HBHEX has emerged as a fast-growing player. As a compliant centralized exchange (CEX) and digital wallet platform established in the United States, HBHEX brings together blockchain specialists from more than a dozen countries and regions. Its leadership team includes alumni of globally recognized fintech and technology firms such as Morgan Stanley, IBM, PayPal, Amazon, Google, and Binance.

HBHEX’s Core Strengths

Global Presence: Serving millions of registered users across Asia, Europe, and the Americas.

Diverse Products: Spot trading, simple options, leveraged futures, and perpetual contracts designed to meet investors’ varying needs.

Ultra-Fast Matching System: Offers a high-speed and efficient trading experience for top-tier digital assets.

Innovative Models: The “Secondary Contract Investment” framework has gained recognition across the industry.

Security and Compliance: Comprehensive risk controls safeguard funds; preparations are underway for an IPO to enter the global capital markets.

Market Outlook

Bitcoin (BTC): Continues to be regarded as “digital gold,” with institutional holdings increasing amidst inflationary and geopolitical pressures.

Ethereum (ETH): A foundational platform for smart contracts, DeFi, and Web 3.0 infrastructure.

Emerging Sectors (AI+Crypto, GameFi, RWA): Attracting significant investment interest as adoption and use cases expand.

Latest Milestone

On July 27, 2025, HBHEX’s daily trading volume surpassed $100 million (US$109,066,683.54). This achievement places HBHEX firmly among the world’s top 100 exchanges and highlights its rapid ascent in the digital asset sector.

Why This Partnership Matters

By partnering with the Ant Investment Foundation (ANT), HBHEX is positioned to accelerate its global expansion and strengthen its role in shaping the next phase of digital asset investment.

Secure, stable, and compliant operations

A broad suite of products and services

Efficient user experience tailored to retail and institutional traders

Recognition by global capital markets, with IPO plans in motion

With cryptocurrencies continuing to drive innovation and capital growth, the collaboration between ANT and HBHEX underscores new opportunities for investors worldwide.

Registration link: https://hbh99.com?c=v69omzx2

Invitation code: 3c7931

Media Contact Information

HBHEX

HBH EX

ashun18861@gmail.com

https://hbh888.com/