Squilla.Loans Short Review

The crypto lending market is highly saturated, where a lot of players are competing for borrowers. So far the main players are Nexo and Crypto.com, but as the market is continuing to grow, more and more companies are entering it.

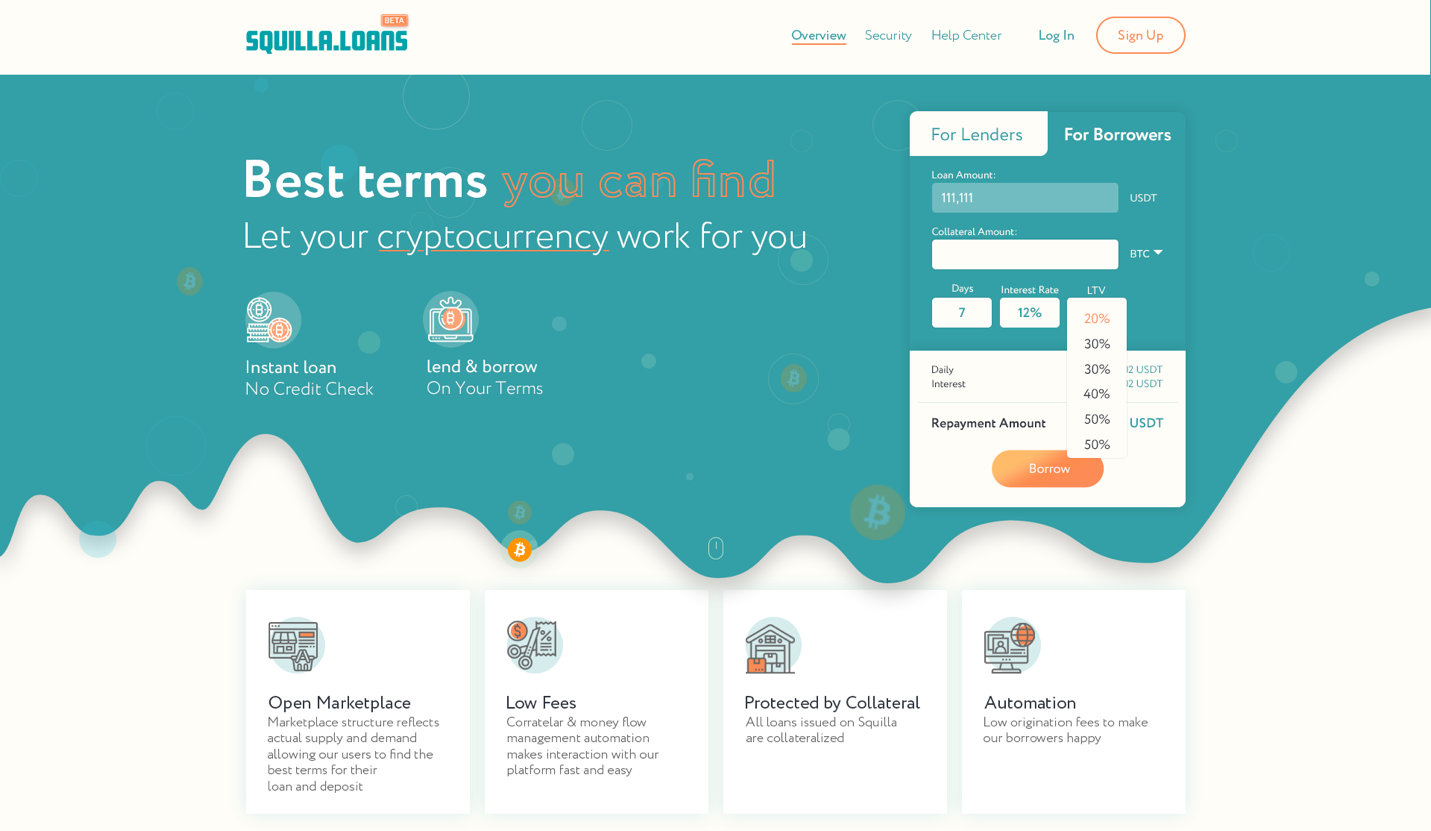

The newcomer is Squilla.Loans, they want to introduce under-collateralized loans with over 100% LTV (up to 150% LTV) in Q2 of 2020. Their aim is to test the infrastructure on familiar to everybody crypto-backed loans with 50-70% collateral and smoothly transition to high collateral.

Their actual client will get the benefit of accessing the new loans among the first.

The platform has BETA in its headline, but let's go through their offering and basic functionality.

Peer-to-Peer

The platform was built in a pure p2p, where Borrower and Lender are connected directly. Squilla just facilitates and automates the transaction, ensuring the safety of collateral and on-time liquidation.

Borrowing

A borrower has two options:

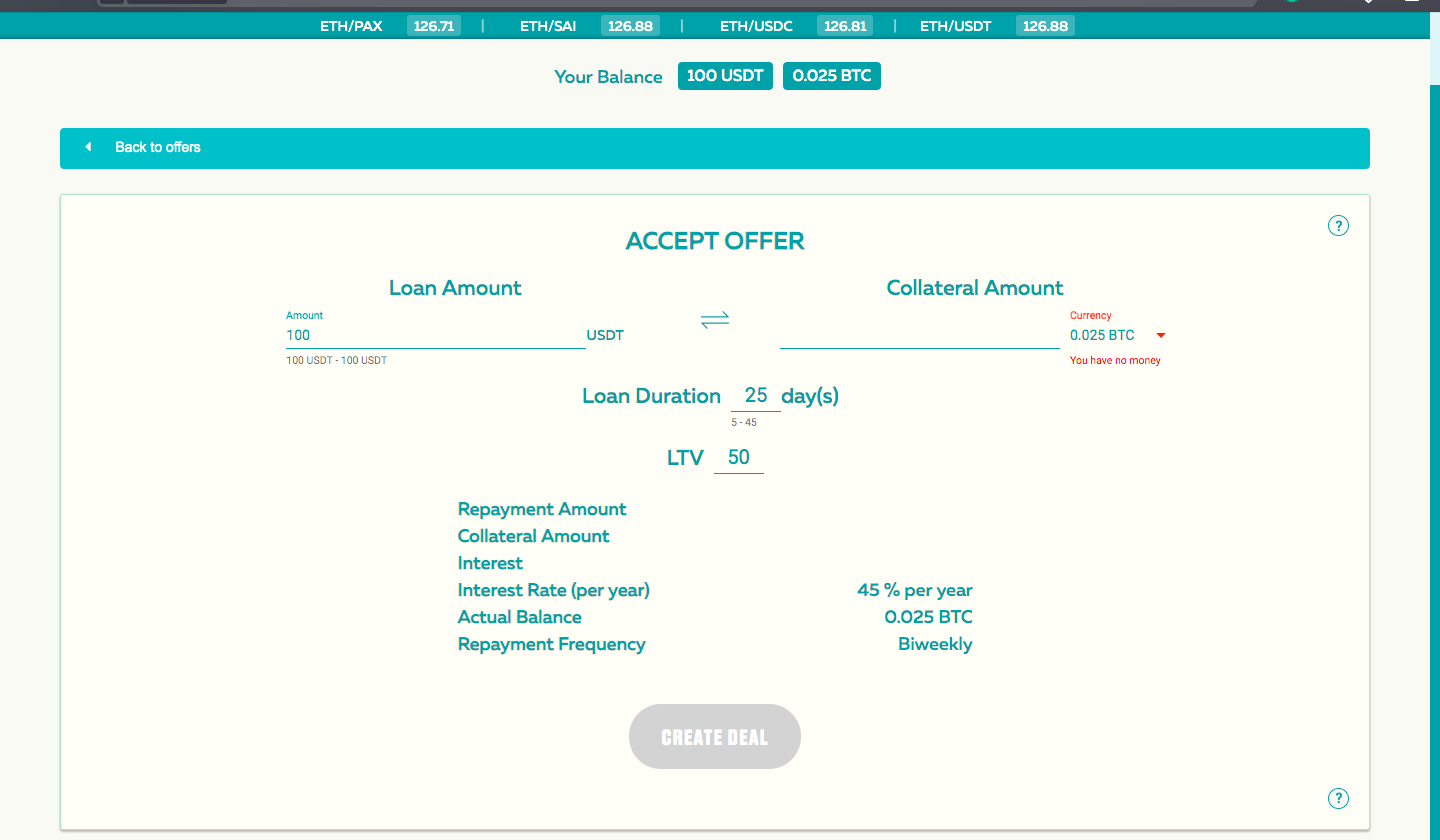

Accept active offer

It is the fastest option. However, if you need some specific terms and you can not find them on the list, you have your second option.

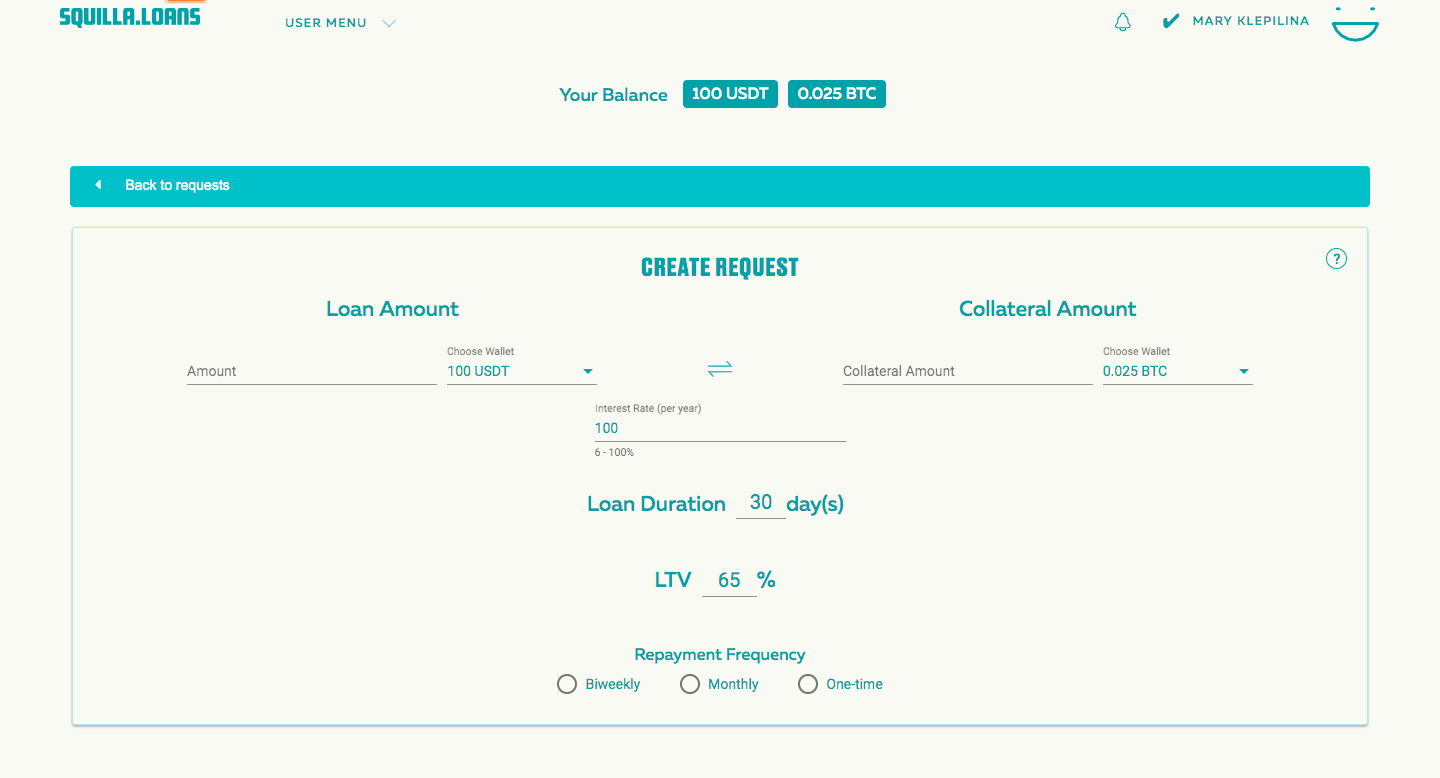

Create a request

The platform is quite flexible, allowing borrowers to choose super specific terms, currency, and interest. But you need to keep in mind, that your request has to be "in the market" otherwise it will never be funded.

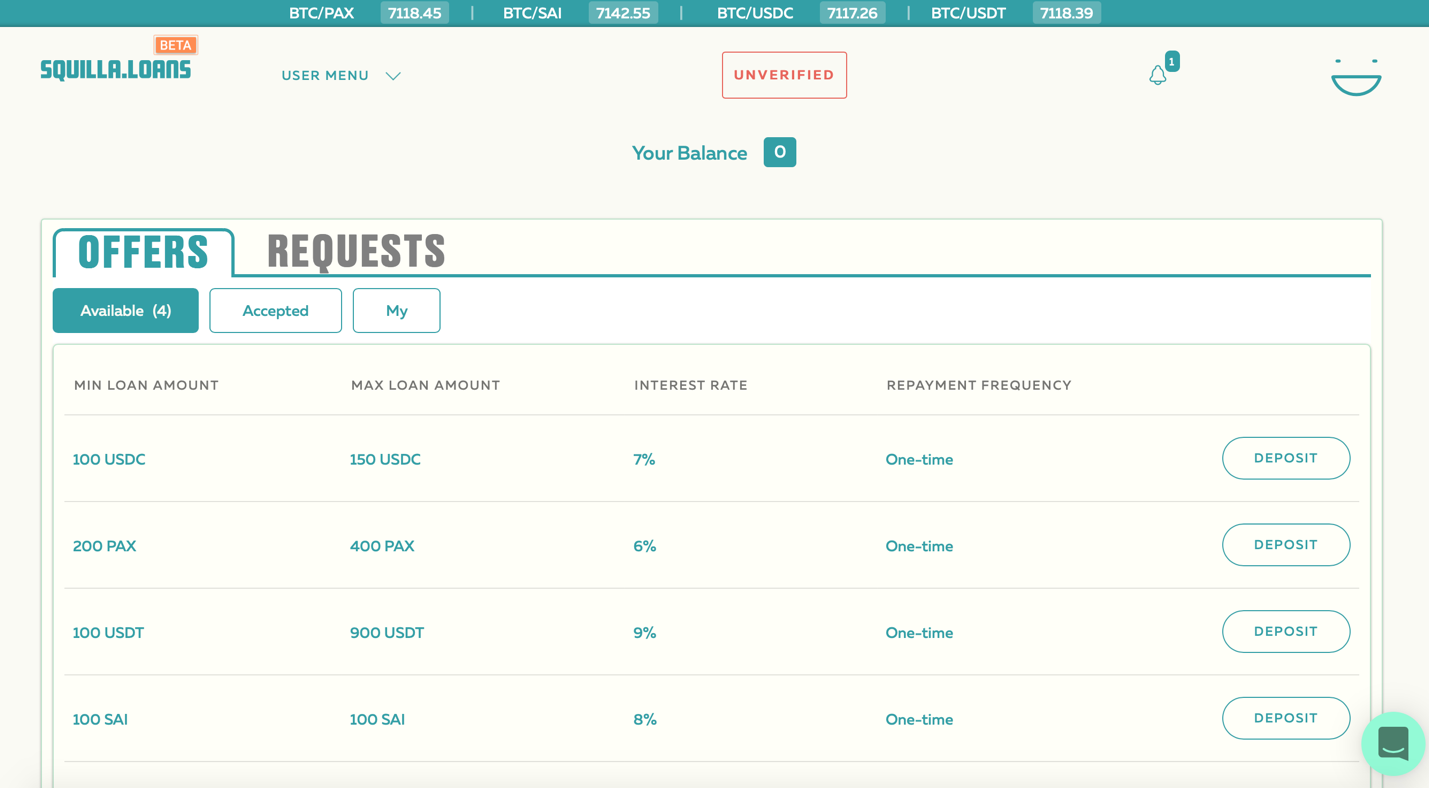

Lending

The lender has the same two options:

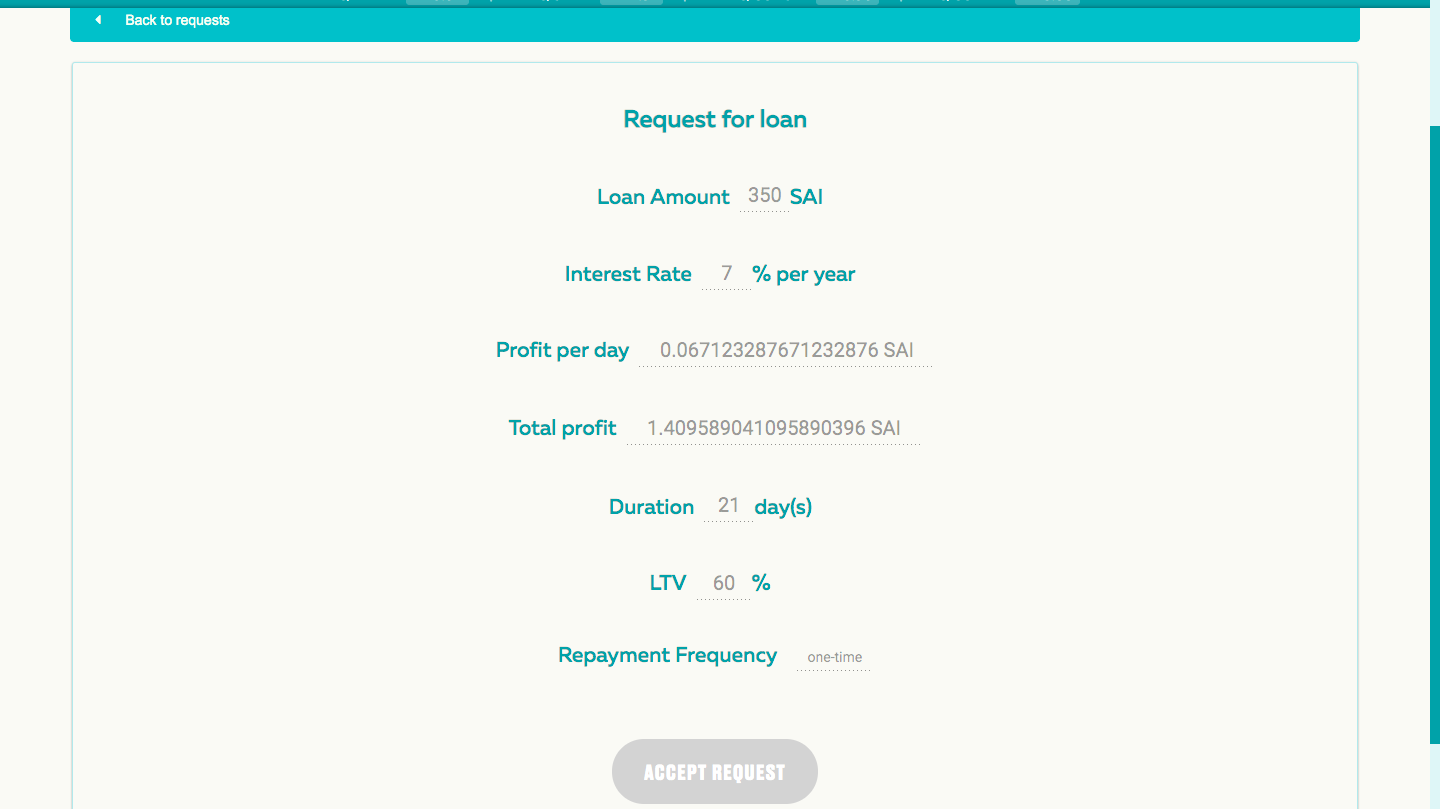

Fund an active request:

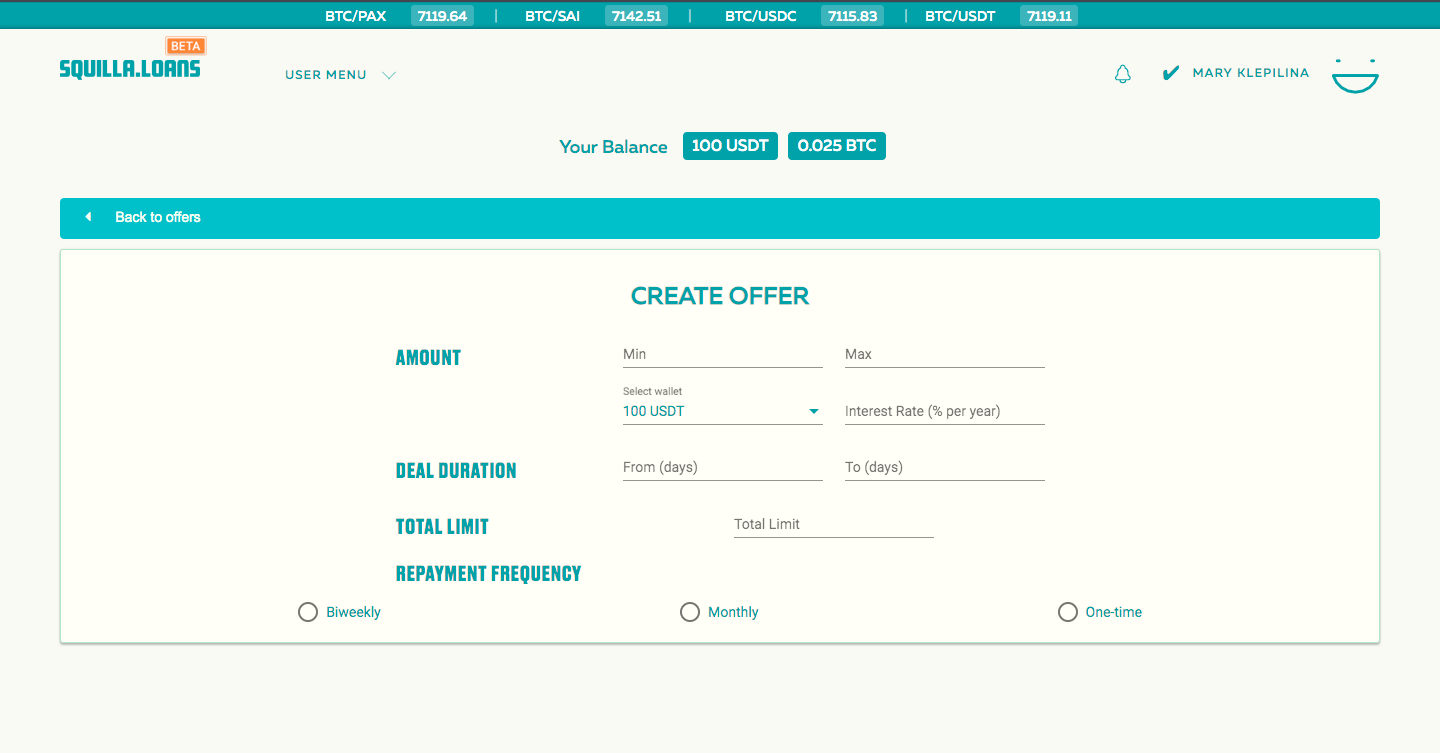

Or create a new offer:

And it is where it gets interesting. Lenders have interesting options, allowing them to be flexible and find just the right structure for their portfolio.

For example, if a lender wants to give out only small loaons to diversify repayments and risk, he can choose the total limit of the offer and minimum and maximum loan amount in the region.

Example:

Total limit: $2,000

Min-Max loan amount: $200

In that case, the lender will give out up to 10 loans, 200 dollars each.

Conclusion

Overall, I can conclude that squilla.loans is an interesting option for both, lender and borrowers, but they will face real problems attracting both parties to that 2-sided marketplaces and providing enough liquidity to make the wheel spinning.