1inch Aggregation Protocol launches version 3, implements lower gas fees

High gas fees are growing to become a major concern in the cryptocurrency space, with users currently spending an average of $20 on Ethereum transactions. DEX aggregator 1inch hopes to tackle this problem in its recently launched version 3 protocol.

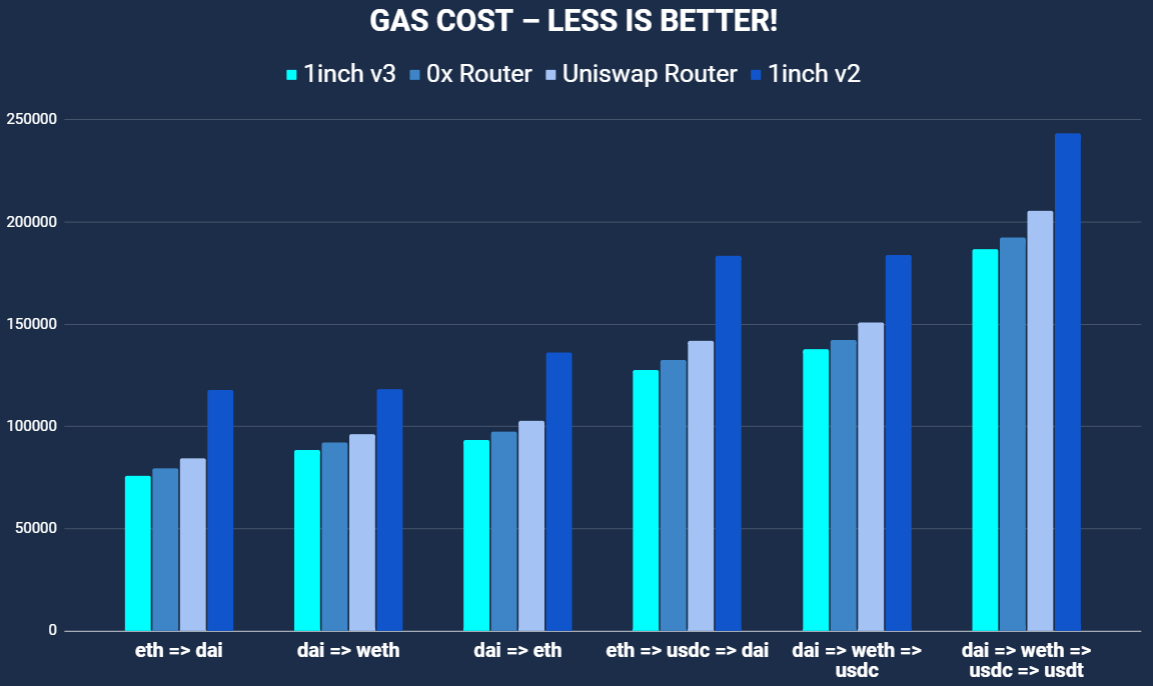

One of the major highlights of the 1inch Aggregation Protocol v3 is that it facilitates lower gas fees. Thanks to an “assembly code optimization,” the new upgrade can significantly reduce gas fees.

The benefit of the protocol also extends to crypto swaps. While it was previously cheaper to swap tokens on Uniswap and its forks such as Sushiswap, v3 has flipped the scale. For clarity, swapping ETH for DAI on 1inch is now 10.3% cheaper than doing the same on Uniswap.

Despite the upgrade, the team disclosed that its traditional “split across several paths” will be used if it offers better cost-saving to the customers. Overall, 1inch will, by default, opt for the best cost-saving option.

In addition to lowering gas fees, the 1inch Aggregation Protocol v3 brings a greater level of liquidity to the network. The team remarked:

By swapping tokens on 1inch, users get access to the highest value of liquidity available. As of mid-March 2021, the total value of liquidity available on 1inch was $16.5 bln for Ethereum and another $2.3 bln for Binance Smart Chain.