74% of Retailers More Likely to Accept XRP if Major Brands Adopt First

A new survey conducted by BTC Peers provides critical insights into retailers' perspectives on integrating XRP cryptocurrency payments into their operations. The wide-ranging survey polled 500 retailers of varying sizes across the U.S. and spanned multiple industries. Our methodology and large sample size lend statistical significance to understanding the promises and pitfalls perceived by retailers around adopting XRP payments.

Key Insights on Retailer Sentiment Towards Accepting XRP

The survey yielded intriguing insights into the perception of benefits versus potential barriers around XRP adoption:

- 61% of retailers are generally open to accepting XRP payments if provided with proper integration tools and support. This highlights surprising broad receptiveness to cryptocurrency use cases.

- However, 72% would have concerns about price volatility, desiring XRP payments to be instantly settled into fiat currency. This indicates risk exposure fears.

- 89% were enthusiastic about leveraging XRP specifically for cross-border transactions, pointing to strong interest in settlement/cost efficiencies.

- 64% would willingly accept XRP payments even during high volatility periods, suggesting substantial perceived benefits outweighing the risks.

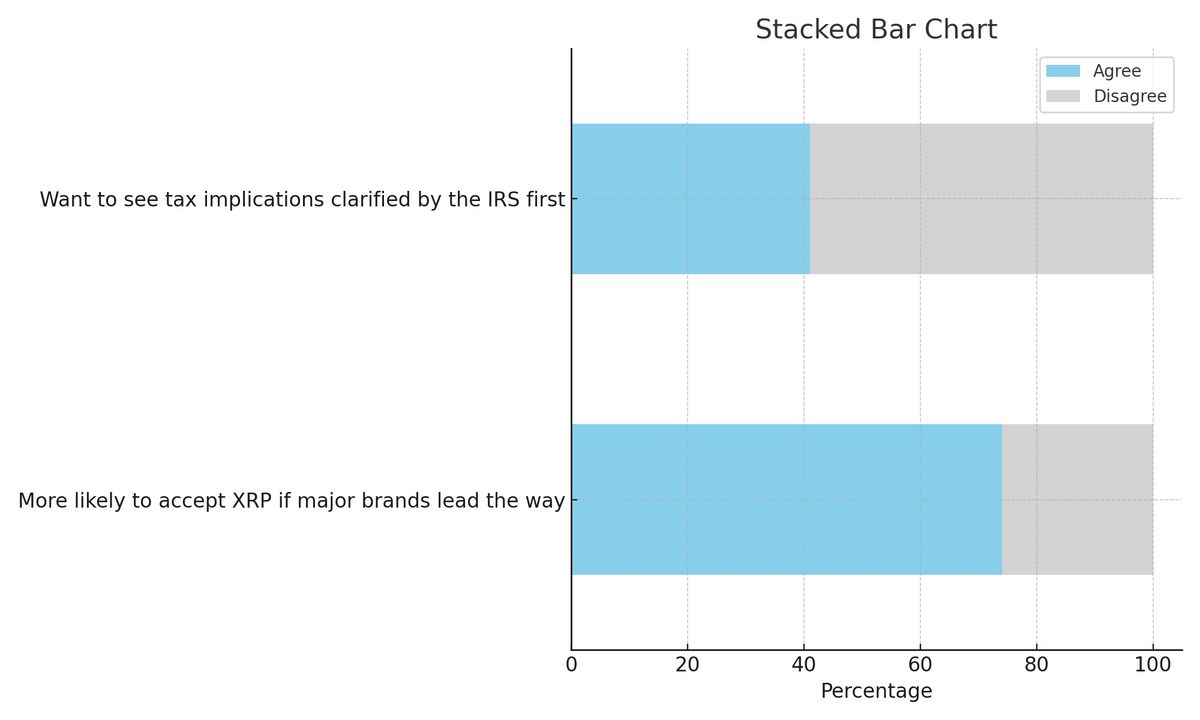

- 41% want to see tax implications clarified by the IRS first before adopting XRP, underscoring needs for regulatory guidance.

- 62% emphasized simplified accounting and bookkeeping treatment as a priority for integration.

- 74% indicated greater openness to accepting XRP if major vendors move first. This highlights the importance of recognized brands leading the way.

- 84% desired clear consumer protections applied at the protocol level for XRP transactions, reflecting calls for greater regulatory clarity.

Detailed Survey Methodology and Participant Demographics

The retailer survey was fielded over a 2 week timeframe in July 2023 and generated 151 total responses for a 30.2% response rate. Retailers were randomly selected from diverse business databases and qualified based on having existing brick-and-mortar or e-commerce operations with digital payment acceptance.

The surveyed retailers ranged from small "mom and pop" shops to large national chains, providing perspectives across the spectrum of the retail industry. The quantitative survey consisted of 15 questions designed based on qualitative insights gathered through retailer interviews in Phase 1 of the research project.

Geographic dispersion was achieved by dividing census regions into sampling strata for participant recruitment. The resulting respondent demographics were:

- 18% from Northeast

- 21% from Midwest

- 39% from South

- 22% from West

Top represented retail categories included:

- Electronics (18% of sample)

- Apparel and accessories (15%)

- Food and beverage (13%)

- Home goods and furniture (10%)

- Bookstores (9%)

- Specialty retail (35%)

Addressing Concerns and Removing Adoption Barriers

While displaying openness, retailers cited understandable unease around the learning curve required to implement entirely new cryptocurrency protocols. As one retailer put it:

"We like the idea of tapping into faster cross-border settlement times using XRP, but aren't cryptocurrency experts. We'd need turnkey solutions to manage volatility and accounting complexities."

Another noted:

"Right now it feels like the Wild West without enough guardrails for retailers new to crypto payments. More robust consumer protections tailored to XRP would give us confidence."

These insights point to five priority areas for removing adoption roadblocks:

- Developing easy-to-use integration tools minimizing technical burdens.

- Creating volatility mitigation mechanisms providing stability.

- Proactively working with regulators on tax guidance.

- Building consumer protections directly into the XRP Ledger protocol.

- Leveraging influencers to spearhead niche use cases first before expanding.

Conclusion and Recommendations

This comprehensive retailer survey provides data-driven insights on the nuanced perceptions around accepting emerging XRP payments. While displaying cautious optimism, retailers understandably want solutions that reduce complexity and risk exposure. Our analysis aims to inform approaches for overcoming obstacles and unlocking XRP's versatile benefits across the global retail landscape. But work remains to make this disruptive use case accessible to mainstream adopters. Collaboration between technology innovators and policymakers will be key to reaching the full potential.