About 25% of Ethereum’s circulating supply is locked up in smart contracts

Nearly one-quarter of Ethereum’s circulating supply is now locked in smart contracts.

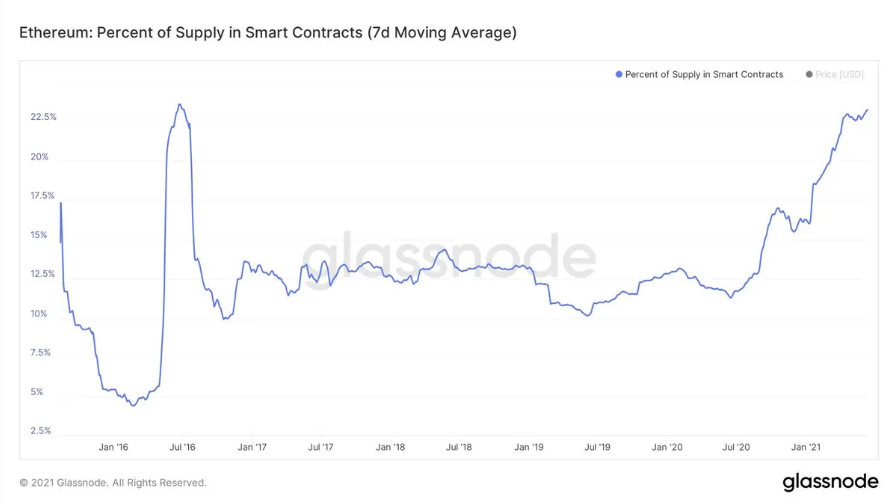

Founder of ETHhub Anthony Sassano shared the discovery on Twitter, noting that around 23% of all ETH is now locked in smart contracts.

This chart is absolutely incredible.

— Anthony Sassano Ξ 🦇🔊 (@sassal0x) June 13, 2021

The amount of ETH in smart contracts is now at a similar level to what it was during The DAO event (around 23% of all ETH).

In June of 2016, that was ~$230 million worth of ETH.

Today, it is ~$63 billion worth of ETH. pic.twitter.com/DGpeKvL3Hm

According to him, the current levels are similar to what it was during the DAO event in mid-2016. At that time, the digital asset was priced at a mere $13, and the value of locked ETH was $230 million. However, at current market prices, that amount is now worth $63 billion.

As seen in the chart, Ethereum became a popular choice for decentralized autonomous organizations (DAOs) in mid-2016. The first DAO launched on the Ethereum blockchain after raising $150 million from token sales. However, the hype was short-lived as the DAO was hacked due to vulnerabilities in its codebase. To restore the stolen funds, a hard fork was performed, which resulted in the birth of Ethereum Classic.

Interestingly, since 2016 Ethereum has managed to exercise its dominance over other seemingly competing blockchains. It is still the bedrock of several smart contracts and decentralized finance (DeFi) projects. And more recently, Ethereum will be transitioning to Proof-of-Stake consensus from its current Proof-of-Work consensus.

Speaking of ETH 2.0, the number of ETH locked up in the Beacon Chain deposit contract has surpassed 5 million ETH. At current prices, this is around $13.5 billion, representing about 4.65% of Ethereum’s entire supply.

Check our guide of the most promising crypto