Amid Bitcoin ban, Nigerians still actively trading crypto, statistics reveal

Roughly 3 months after the West African country’s apex bank banned all crypto transactions via financial institutions as reported by BTC Peers, Nigerians, surprisingly have found alternatives to invest and regularly trade these digital assets, statistics claim.

According to leading Bitcoin analytics provider, UsefulTulips, P2P (peer-to-peer) Bitcoin trading in the country surged to 27% after the directive from the Central Bank of Nigeria (CBN). Approximately 85 days after the announcement was made, over $103 million has been moved on LocalBitcoins and Paxful crypto channels alone.

Bitcoin has recorded gains in the West African country partly because of its suitability as a perfect fund hedging alternative against the country’s depreciating currency, Naira. Despite the CBN’s ₦5 for every $1 sent rebate scheme, created to encourage citizens in the diaspora to remit funds through the official channels, most have stuck with Bitcoin and altcoins.

With Bitcoin still in reliance on fiat currencies albeit being a digital one, experts and analysts affirm that the country’s apex bank’s stance on Bitcoin transactions has complicated things for not just the country but the African continent. However, this has not stopped Nigerians from investing.

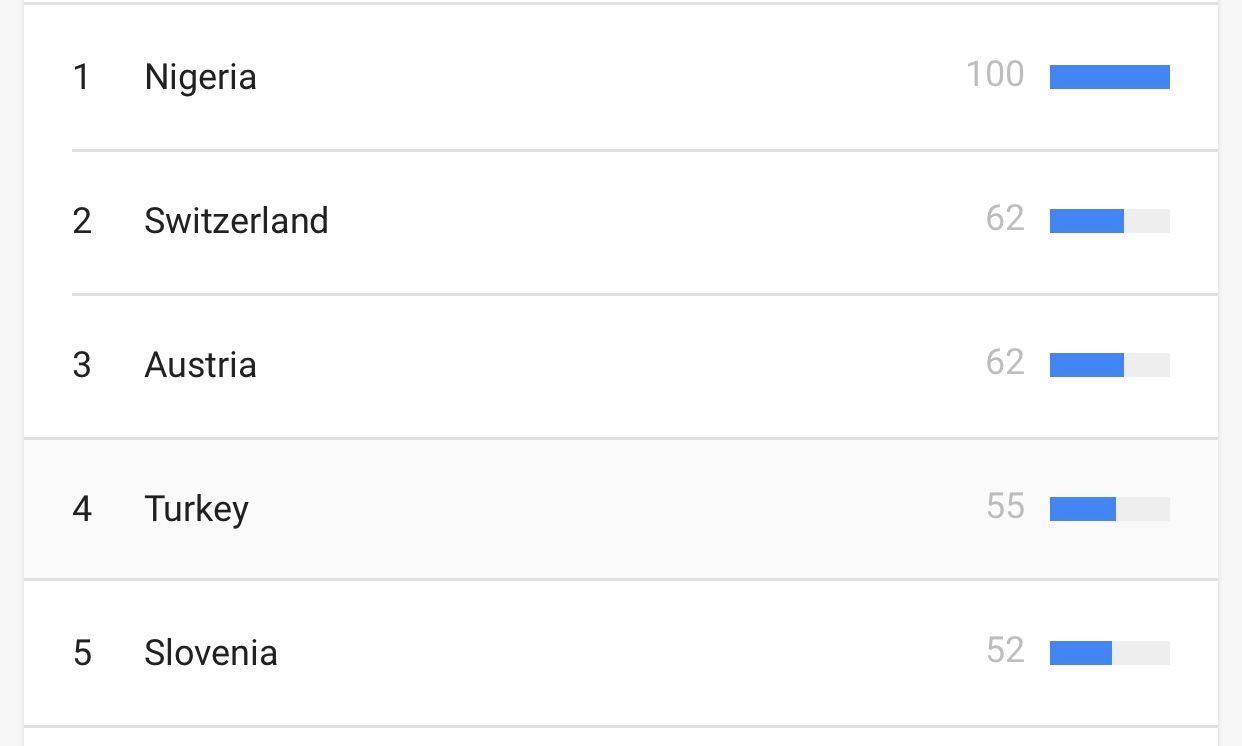

Adding credence to the report from UsefulTulips, information gathered from Google Trends revealed that the West African country appeared first on the list of countries interested in Bitcoin, based on Google searches.