Analysis: Is Bitcoin really decentralized?

One of the major highlights and selling points of Bitcoin is decentralization. Satoshi Nakamoto in his original Bitcoin whitepaper wrote:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

In simpler terms, Bitcoin is supposed to allow anyone to send money from any part of the world without using a bank or third-party processor. The network is not owned or managed by a single entity. Instead, security is provided by several decentralized nodes. According to Bitnodes.io, a site that tracks the global distribution of bitcoin nodes, there are 11,625 bitcoin nodes scattered across the globe.

Although Bitcoin and cryptocurrencies, in general, are yet to go mainstream, significant progress has been made in the last 12 years. From being dubbed a “useless” and “senseless” asset, Bitcoin can now be used in the same sentence as gold and big tech. More recently, institutional investors are scrambling for the digital asset, and major tech players such as PayPal are beginning to roll out support for cryptocurrencies. Overall, it is becoming increasingly easier for just anyone to buy or sell Bitcoin.

The next milestone should be using Bitcoin in everyday transactions like paying for a cup of coffee or buying a bus ticket.

With reference to enabling trustless transactions and relying on a distributed ledger technology, Bitcoin has performed excellently well. And this brings me to my next point.

Who controls Bitcoin?

Although the consensus is that Bitcoin has no face and therefore is not being controlled by anyone, this argument is slightly flawed.

Let’s be honest, most people are not buying Bitcoin or any other cryptocurrency for their function as a medium of payment. The sudden influx of institutional investors is for one thing and one thing alone – profits. Retail investors are also in for the profits; we all are. If Bitcoin drops to $3k today, chances are that many investors would panic sell.

That being said, Bitcoin is being controlled by its price, which in turn is controlled by the laws of supply and demand. The Bull Run of later 2020 began when institutional players started accumulating Bitcoin.

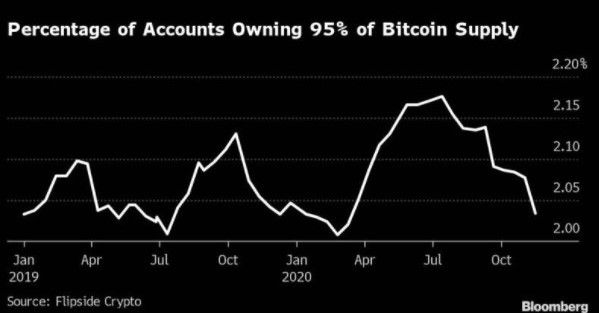

The fact remains that there is nothing like widespread ownership of Bitcoin. A few large holders, aka whales, own and control most of the Bitcoin. Take Grayscale’s Bitcoin Trust, for instance, the crypto hedge fund manager controls over $23 billion in Bitcoin. According to researcher Flipside Crypto, 95% of tracked Bitcoin is being controlled by just 2% of anonymous accounts. Commenting on the matter, Eric Stone, head of data science at Flipside said:

The story is that as the price has surged upwards lately, the concentration in the hands of the largest accounts has also risen.

What this means is that a selloff from a Bitcoin whale could easily outsize the impact on the highly illiquid market. Retail investors who are without protection or data are susceptible to massive price swings.

What do you think would happen if Grayscale decides to liquidate half of its Bitcoin holdings? Your guess is as good as mine. This may never happen since large players would most likely cautiously liquidate small amounts of Bitcoin over an extended period. But we cannot rule out the possibility. One harsh regulation from the authorities may be all it takes to send institutional investors packing.

Conclusion

In closing, if Bitcoin’s decentralization is being judged by its relative ease-of-use and accessibility to millions of people, one could say that the digital asset is decentralized. However, decentralization is a measure of who controls the price of the digital asset, then what we are witnessing is merely an exodus of “big money” players from traditional finance to digital currencies. The same monopoly will exist since the price of Bitcoin is still subject to manipulation from these actors.

Data on BitInfoCharts, reveals that more than 70% of Bitcoin addresses own less than 0.01 Bitcoin. On this note, Bitcoin is still a playground for the big fishes.