Analyzing crypto loan services by the highest LTV ratio

It is no more news that crypto lending and borrowing platforms are increasingly replacing traditional credit systems. Much of this change is attributed to the flexible, cheap, and high yielding nature of crypto-powered lending and borrowing programs. These factors, coupled with the possibility of collateralizing cryptocurrency to raise fiat or stablecoins, make crypto-backed loans the obvious choice for the growing community of digital asset holders.

Unsurprisingly, the explosiveness of this crypto sector has induced healthy competition among market players. For one, crypto loan projects offer some of the lowest interest rates to borrowers. Apart from the low rates that have become a mainstay in the crypto loan market, another vital factor that attracts customers is the range of Loan-to-Value (LTV) ratio available through crypto collateralized loans.

Why Is This So?

Defined as the ratio of the size of a loan to the value of the collateral deposited and expressed in percentage, LTV is a critical measurement that determines the amount that can be borrowed. For instance, if the initial LTV permitted on a platform is 50%, the highest borrowers can receive as loans are half of the value of their collateral. In this case, a borrower with 5 BTC valued at $50,000 as collateral can access a maximum loan amount of $25,000. In other words, the higher the LTV, the more you can borrow against your collateral.

However, owing to the volatility of digital assets, it has become a common practice for crypto loan platforms to set risk management systems that alert borrowers when their loans pass a certain LTV ratio. When borrowers receive such warnings, they are expected to pay part of the loan or deposit more digital assets to ensure that the LTV ratio remains within the permitted threshold. Failure to do so will prompt the crypto loan issuer to liquidate the deposited collateral.

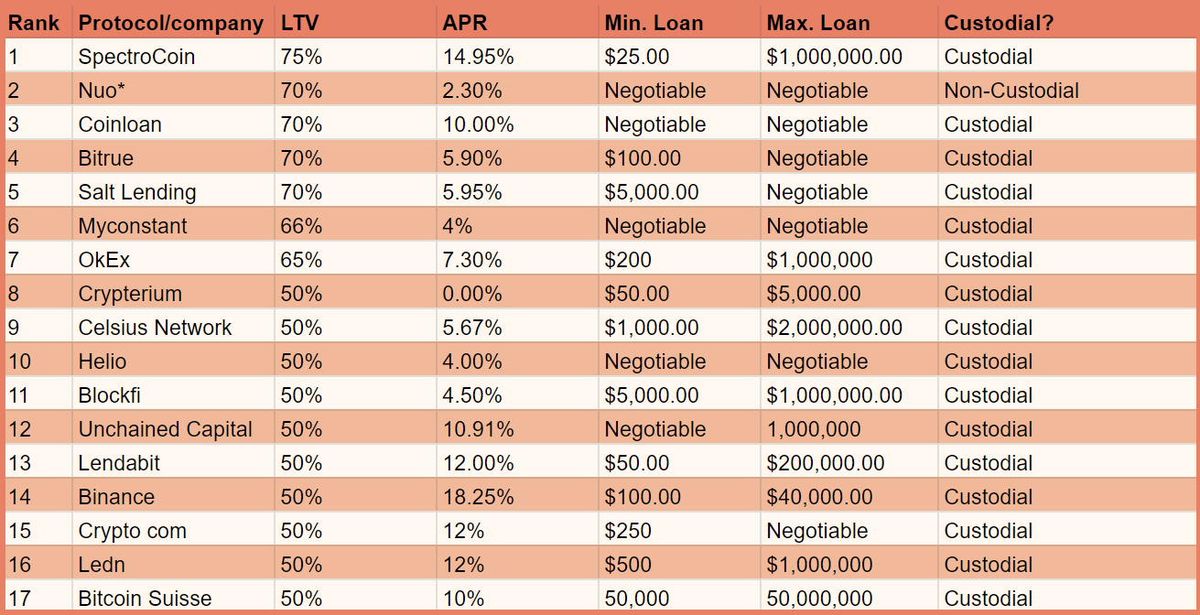

That said, the competitive nature of the crypto loan sector means that platforms are willing to offer high initial LTV ratios to borrowers. Hence, now more than ever, borrowers can access more loan value from crypto holdings. In light of this, I decided to compare crypto loan platforms based on the LTV ratio offered to borrowers. At the end of this analysis, I was able to come up with the top 20 crypto loan services according to their LTV ratios.

Topping this list are SpectroCoin, Nexo, Compound, and Aave, with their maximum LTV ratio pegged at 75%. The cluster at the top of this rankings is indicative of the competitiveness of crypto loan services. Also, I calculated the average LTV ratio of the 20 ranked platforms to be 61% and found that they do not often go below the 50% mark.

Although SpectroCoin has been in operation since 2013 as a financial platform designed to provide a spectrum of services to crypto clients, it was not until 2020 that it expanded into the crypto loan sector. Ever since then, SpectroCoin has established itself as one of the major players. It currently provides a 75% loan-to-value ratio for all BTC and ETH collateralized loans, and borrowers can receive credits valued within the 25 EUR to 1 million EUR range.

Like most crypto loan services, the interest rates on SpectroCoin depend on the size of the loan and the current worth of the collateral deposited. The APR on credits with a 75% LTV ratio starts from 12.95%. For now, the platform accepts collateral in the form of BTC, ETH, XEM, and DASH. Likewise, borrowers can choose from an array of crypto options, including BTC, ETH, XEM, DASH, EUR, BNK, and USDT, when making withdrawals. Note that SpectroCoin offers even lower rates to borrowers opting to accept Banker token (BNK).

Looking at this list of crypto services, I discovered that some specifically focus on businesses or large crypto loans. For instance, Bitcoin Suisse’s minimum loan amount is $50,000, and its maximum is $50 million. Also, more than half of the ranked crypto loan services opted for the less risky 50% LTV, while the average APR is 7.73%.

Final Thoughts

From the analysis above, it is clear that crypto borrowing platforms are expanding the criteria for receiving and maintaining loans to remain competitive. If this continues, I expect these services to offer an even higher loan value than 75% LTV.