Bitcoin adoption in Africa, the driving forces

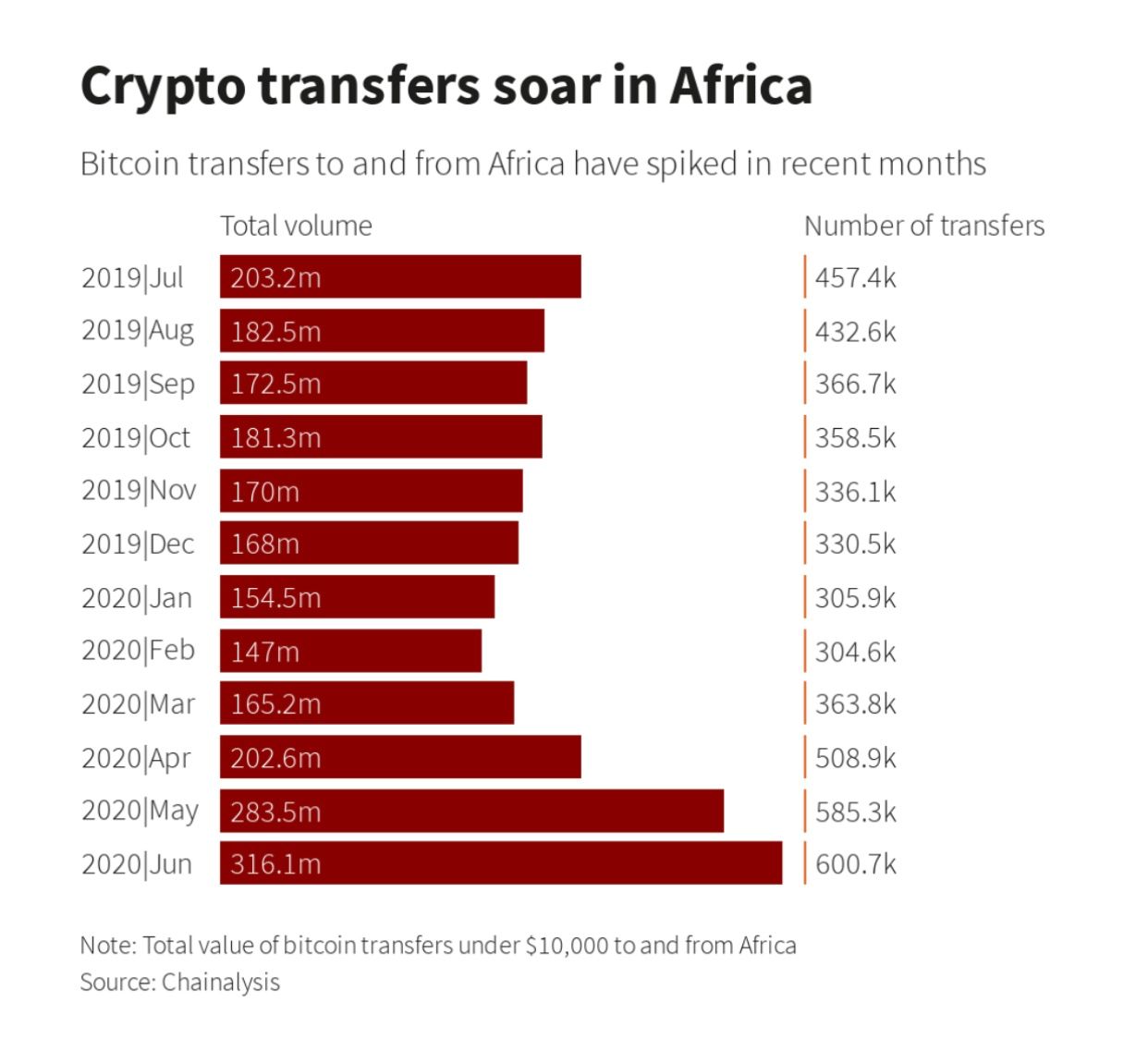

Whilst the price of Bitcoin is plummeting, with experts speculating that Joe Biden's new tax laws could be the driving force, it is quite stunning to ferret out that Africans are jumping on the Bitcoin trend massively.

BTC Peers, today, will highlight the prime movers of this adoption amid unfavorable government policies.

Global Remittance

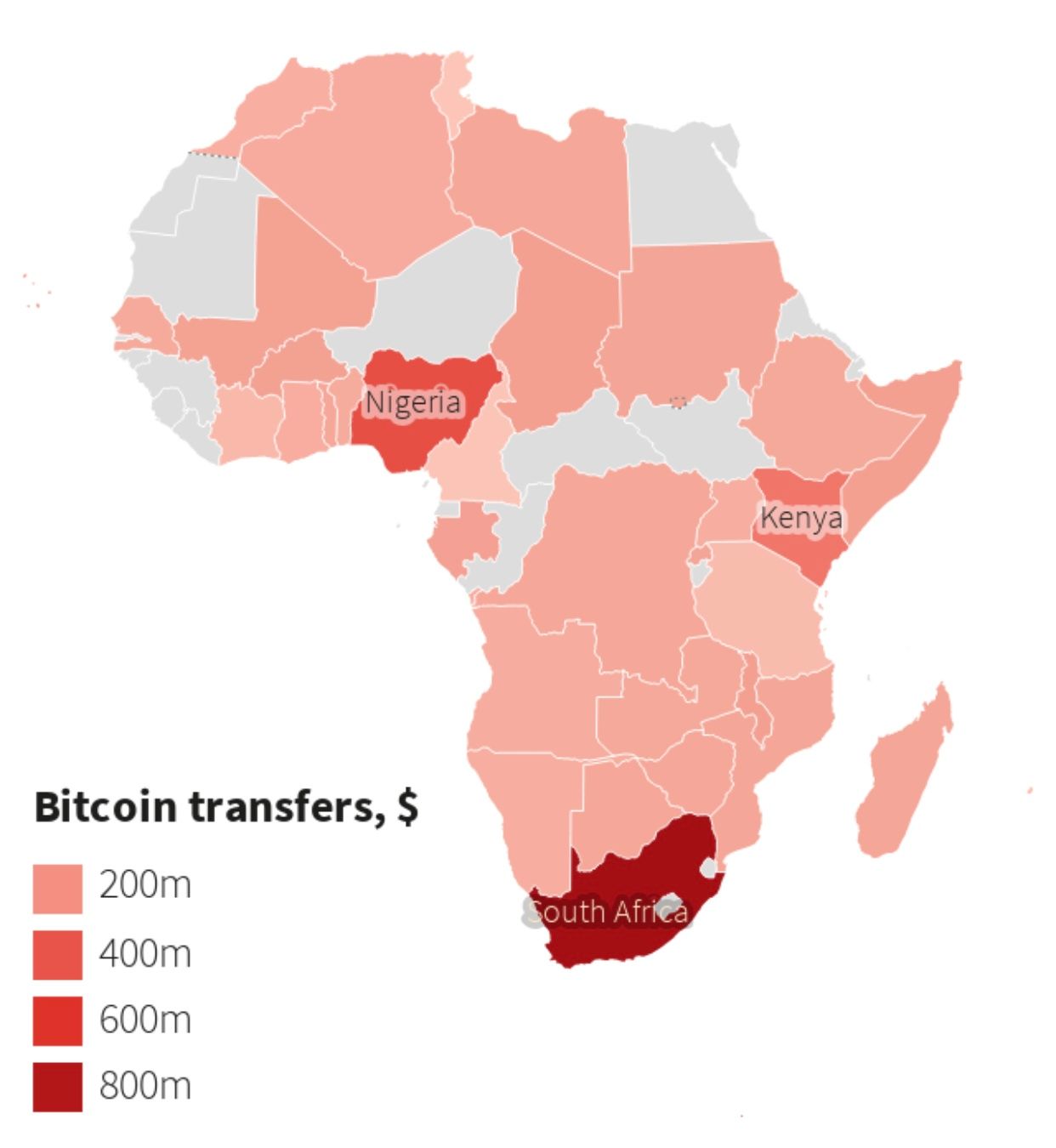

According to a 2020 World Bank report, global remittance in Africa grew by over 10%, taking the total sum to $49 billion, with West African country Nigeria receiving more than half of the remitted funds.

The cited report further revealed that it is more expensive to remit funds to sub-Saharan Africa than it is in other parts of the world. In a bid to reduce transaction costs, which according to the World Bank oftentimes exceed the 8% mark, Africans in the diaspora have resorted to Bitcoin and altcoins.

Currency Depreciation

The last decade, for some African countries, is one to forget quickly. Financial instability and the soaring inflation rate have plagued these countries.

The foremost drivers of Bitcoin adoption Nigeria, Kenya, Ghana, Botswana, and South Africa have all in the last decade experienced a massive depreciation in their respective local currencies. To hedge funds against rising inflation and plummeting local currencies, locals have resorted to BTC, USDT, ETH, BNB, et al as perfect alternatives, thereby increasing adoption and investment funds.

While the Nigerian apex bank has placed a ban on Bitcoin transactions, statistics as reported, claim citizens are still actively investing in Bitcoin via P2P trading.

Check our guide of the most promising crypto