Bitcoin doesn’t use more energy than the banking or gold industries, Galaxy Digital analysis

Amid rising concerns over Bitcoin energy consumption, Galaxy Digital has published a report suggesting that the leading cryptocurrency consumes less energy than the banking and gold industries.

Back in February, BTC PEERS published an article analyzing the amount of energy Bitcoin mining uses. At that time, Bitcoin was reported to consume around 121.36 TWh annually, accounting for about 0.6% of global electricity production. This figure was said to be enough to power Switzerland for more than two years.

Although environmentalists have continued to bash Bitcoin for being an energy-guzzler, Tesla’s CEO Elon Musk recently brought the issue to the limelight when he announced that his car manufacturing company was no longer going to accept Bitcoin payments. Many Bitcoin fanboys felt betrayed by the announcement. But away from the accusations and counter-accusations on the effects of Bitcoin mining, environmentalists may be barking on the wrong tree.

Galaxy Digital’s analysis employs several calculations to determine how much energy the Bitcoin network consumes relative to figures from the financial and gold exploration industry.

The authors of the report began by pointing a very crucial bias, and that is the fact that traditional industries are generally not subjected to the same level of energy usage criticisms as Bitcoin. For instance, Bitcoin is often compared to the traditional banking systems based on speed, settlements, and security. With regards to gold, there have been arguments on its viability as a store of value. But rarely does anyone come out to compare the energy usage of these industries relative to Bitcoin.

That being said, the authors lauded Bitcoin for being transparent in a sector where incumbent companies rarely disclose their energy footprint.

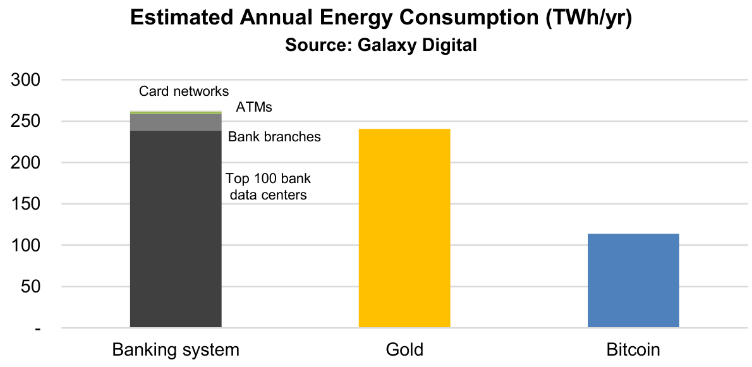

Galaxy Digital was quick to admit that the Bitcoin network does consume a great deal of energy. However, this is what makes the network secure and robust. Galaxy Digital pegs the annual electricity consumption of Bitcoin at 113.89 TWh annually. For some context, the energy consumption of devices that are always on in the U.S. is 1,375 TWh/yr. This is 12.1 times the value of Bitcoin’s consumption.

Entering the banking and gold industries, it becomes harder to estimate how much energy these sectors consume due to a lack of data on energy usage. However, Galaxy Digital zeroed in on a plethora of processes involved in the gold mining process, including those that directly and indirectly emit greenhouse gases and the emissions from refinement and recycling. At the end of the day, the analysts estimate the total energy consumption of the gold industry to be 240.61 TWh/yr.

As for the banking industry, Galaxy Digital considered energy usage from banking data centers, ATMs, bank branches, and card network data centers. The rough estimate for the banking sector is 238.92 TWh/yr. Comparatively, both sectors use up more than twice the energy consumption rate of Bitcoin.

Will Bitcoin’s energy consumption become its greatest undoing?

Tesla is the first major company to dump Bitcoin on the ground of its energy consumption. Interestingly, despite Tesla’s decision, several other institutional players are still running to embrace Bitcoin. For instance, in the wake of the announcement, business intelligence firm MicroStrategy, added $15 million worth of Bitcoin to its stash.

Another argument supporting Bitcoin’s energy consumption is the value it brings. According to BlockTower Capital founder Ari Paul, Bitcoin isn’t “slow and expensive because of an engineering limitation. It’s slow and expensive because it prioritizes decentralization and security.”