Bitcoin miners rake in $1.4 billion in May despite BTC’s crash

Although May was a rather challenging month for Bitcoin and the entire cryptocurrency market, Bitcoin miners are still sitting on impressive profits.

Data collated by BTC PEERS indicates that Bitcoin miners earned at least $1.45 billion in May. The value represents a drop of 15.01% from April’s figure of $1.7 billion. Considering Bitcoin’s significant price correction by over 50% from its ATH in May, the slight drop in revenue does not come as a surprise. Between March and April, Bitcoin mining revenue dropped slightly by 2.5%, from $1.75 billion to $1.7 billion.

Looking at Bitcoin’s daily mining revenue over the past three months, the highest daily value was on April 15th, when figures climbed to $77 million. The lowest daily return was recorded on May 29th at $26 million. Meanwhile, as of press time, the daily BTC miner revenue stood at $41.03 million.

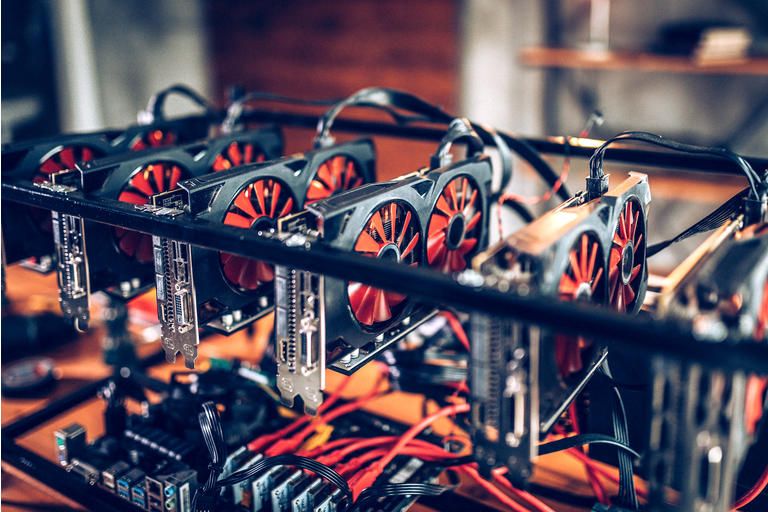

Bitcoin energy usage debates and mining ban

Last month was laced with a lot of hurdles for the leading cryptocurrency. It began with critics focusing on the digital asset’s energy consumption rate. Tesla CEO Elon Musk brought the issue of Bitcoin’s carbon footprint to the limelight when he announced that his electric car manufacturing company would no longer accept the cryptocurrency for payments, citing concerns over Bitcoin’s environmental impact.

As expected, a tweet from one of the world’s richest men was all it took to send the price of Bitcoin crashing below $50k after climbing to an all-time high of nearly $65k. Back in February Tesla announced a $1.5 billion investment in Bitcoin, making the firm a big Bitcoin proponent. Following Musk’s announcement, rumors also spread that his firm may be dumping its Bitcoin holdings, spreading more fear and doubt in the market. Musk has however refuted claims suggesting that Tesla will sell its Bitcoin.

Historically, investors rush to sell their digital assets in a bear market. As reported by BTC PEERS, a lot of short-term investors sold their BTC holdings at a loss following the recent crash. A drop in Bitcoin’s price also translates to a loss of interest in trading the asset, thus, leading to fewer transactions to confirm.

The market condition was further exacerbated by news that China will be banning Bitcoin mining and trading. The Asian country accounts for a significant percentage of global Bitcoin mining activities, and a clampdown from the region could spell doom for the cryptocurrency. Notably, some Chinese provinces dominated by mining such as Inner Mongolia have proposed stiffer regulations to checkmate the exercise.