Bitcoin scarcity crises loom as Grayscale buys more Bitcoin than is being mined

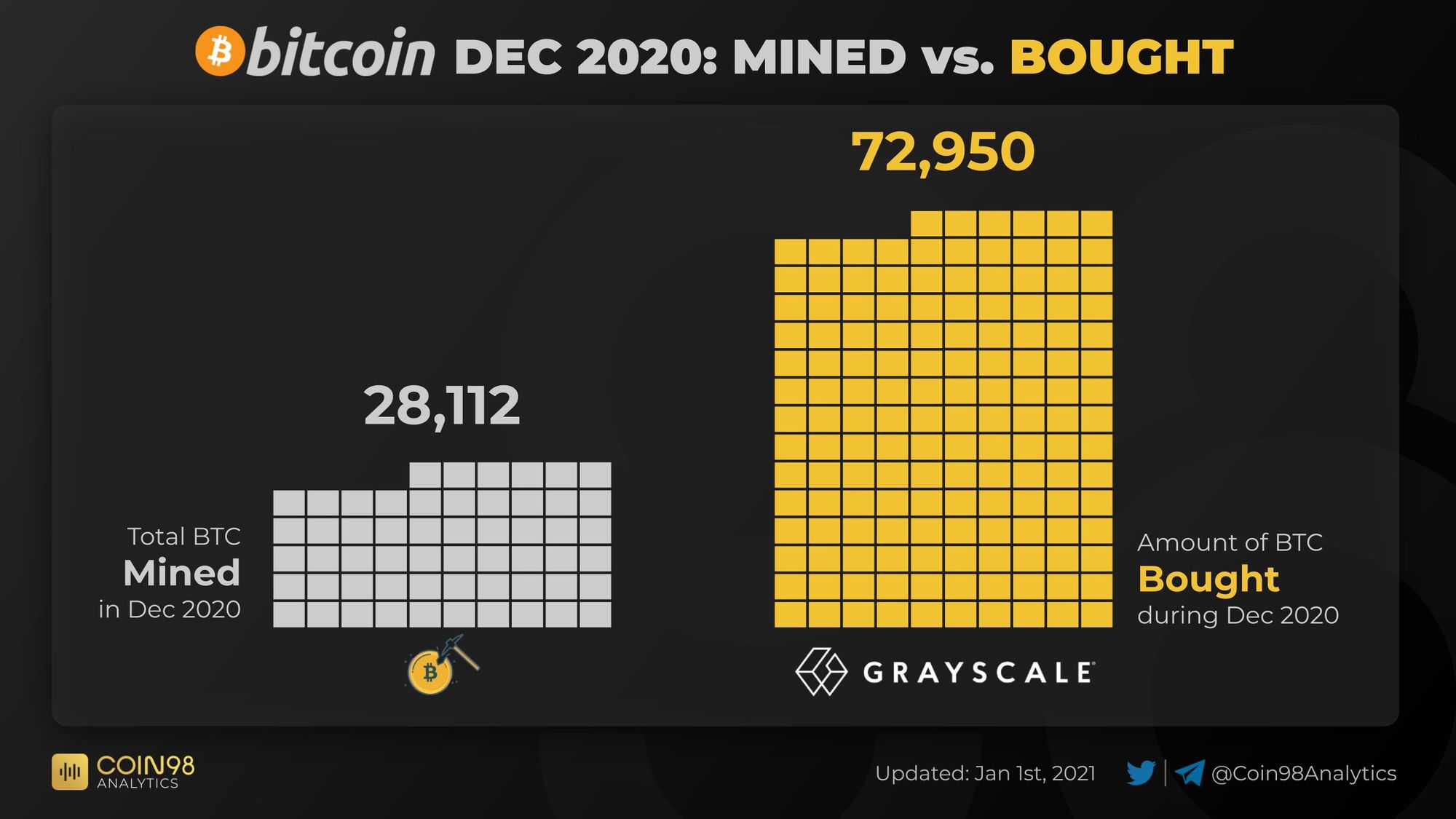

With its total assets under management (AUM) now above $20 billion, Grayscale is pushing Bitcoin to scarcity. New data published by data analysis resource, Coin98 Analytics, showed that Grayscale purchased nearly three times more Bitcoin than what was mined in December 2020.

In December 2020, the company added 72,950 BTC to its AUM, an equivalent of $2.132 billion. On the flip side, miners were only able to add 28,112 BTC to the market, a mere 38.5% of Grayscale’s purchase.

These numbers reinforce what many have described as brewing liquidity crises in Bitcoin. Large buyers are gobbling every available supply and moving it to cold storage for long-term “hodling.”

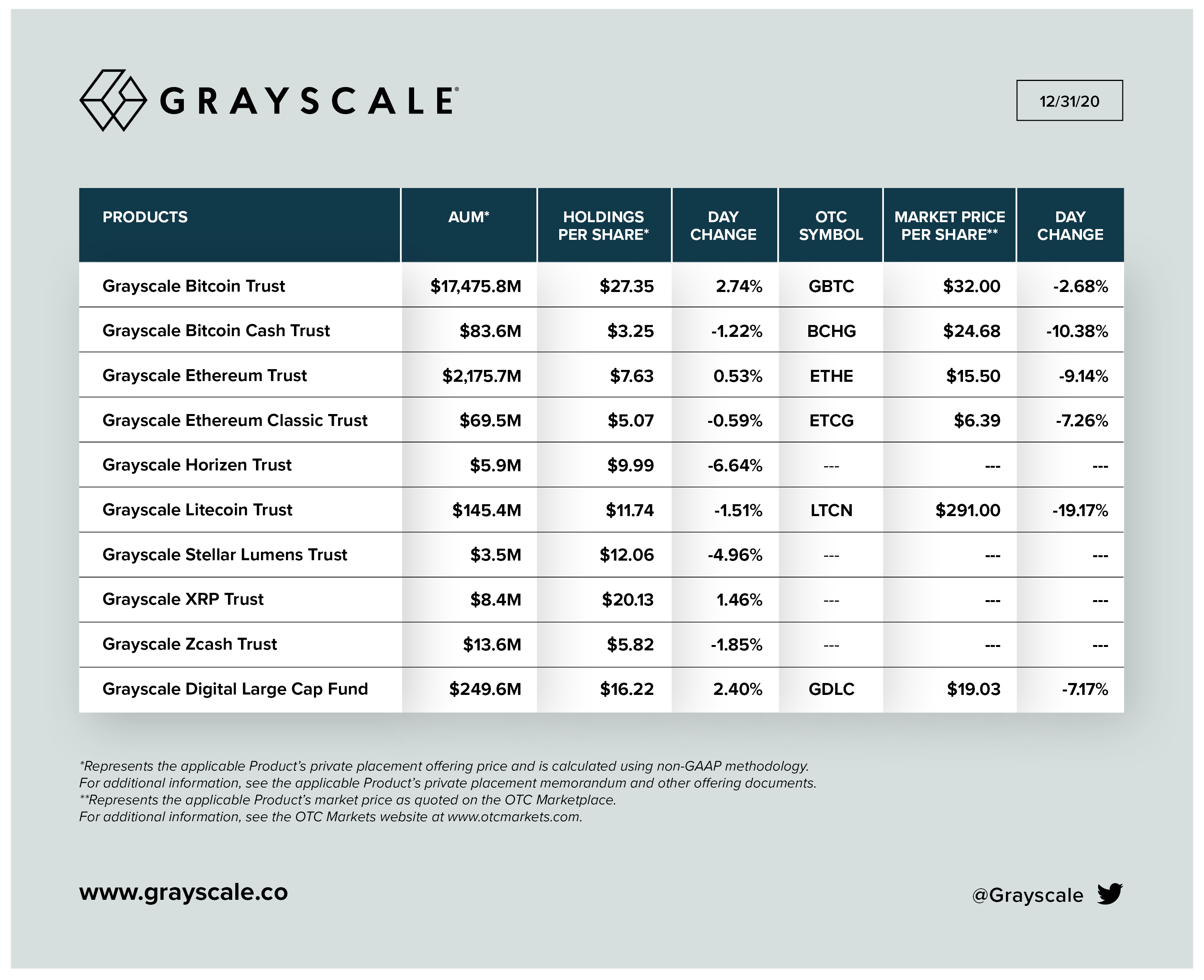

As BTC PEERS reported last month, JPMorgan affirmed that Grayscale was one of the primary players preventing a Bitcoin correction. Right on the verge of 2021, Grayscale posted an update revealing that its AUM had reached $20 billion. This is a phenomenal growth considering the fact that this figure stood at a mere $2 billion just a year ago.

With a $17.475 billion investment in Bitcoin, the company is currently the largest institutional player on the Bitcoin scene.

Bitcoin is only 2.4 million away from reaching its total supply. Analysts predict that the demand for the “fixed supply” of newly mined bitcoins will continue to rise. And this could push the price to new highs.

Check our guide of the most promising crypto