Bitcoin's 0.19% Price Increase to $27,451.53: Key Insights for Traders

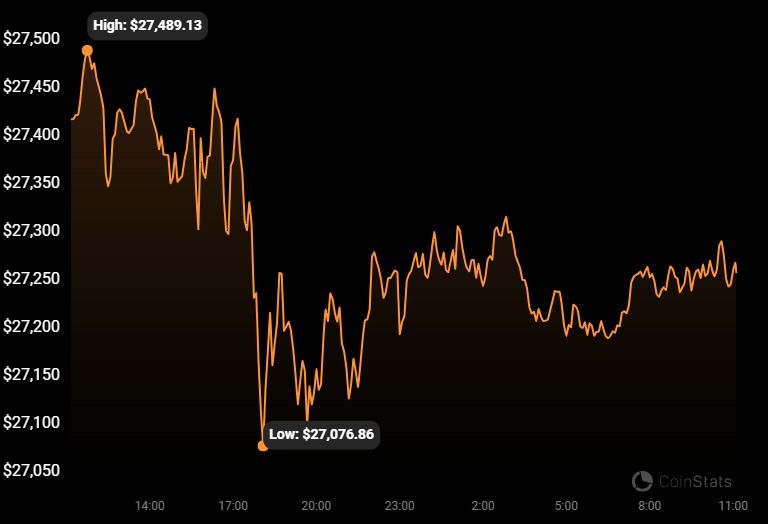

Bitcoin, the world's largest cryptocurrency by market capitalization, saw a slight 0.19% price increase over the past 24 hours to $27,451.53. With a market cap of $534.31 billion, Bitcoin continues to dominate the cryptocurrency market. In this in-depth analysis, we will explore key metrics and trends in Bitcoin's price, volume, and market performance to uncover insights for traders and investors.

Summarizing the provided market data, Bitcoin's 24-hour trading volume reached $20.42 billion as of August 30, 2023. Short term, Bitcoin's price rose 0.19% over the past 1 hour but increased more significantly by 5.75% over the past 24 hours. Zooming out further, Bitcoin remains up 5.57% over the past 7 days but is still down 6.26% over the past 30 days. Looking at the past 6 months, Bitcoin has seen substantial growth of 18.67%, likely related to increasing adoption and more positive market sentiment.

With these metrics in mind, what key takeaways emerge for traders and investors? Overall, Bitcoin appears to be building positive momentum in the near term. The 5.75% 24-hour price increase indicates strengthening buy support, likely boosted by Bitcoin's growing legitimacy as countries like El Salvador adopt it as legal tender. $27,451 marks a psychological threshold, acting as an important price level for bullish continuation.

However, risks remain on the horizon. Bitcoin's trading volume, while substantial at $20 billion, has declined since its 2021 peak. Moreover, downward pressuring lingers from Bitcoin's -6.26% loss over the past month. Macroeconomic factors like rising interest rates may be weighing on investor appetite for high-risk assets. Technical resistance around $30,000 remains a barrier. As a result, traders should watch for a potential pullback or consolidation around current levels before a renewed upswing.

Evaluating Bitcoin's Price Action and Volume

Analyzing Bitcoin's 24-hour price action, the 0.19% gain appears somewhat insignificant on its own. However, putting it in context of the past week's 5.57% rise indicates growing momentum, at least in the short term. Looking at the volume data, the $20.42 billion 24-hour volume shows strong liquidity and trading activity in Bitcoin markets.

However, this volume marks a reduction from Bitcoin's peak volume days in 2021 when prices hit record highs near $60,000. Volume is an indicator of interest and trading activity, so this decline may suggest caution is still warranted. The volume could indicate accumulation by long-term holders rather than new capital inflows.

Overall, Bitcoin's recent uptrend remains intact with buyers supporting prices above $27,000. But a break above $30,000 and increased trading volumes would provide stronger confirmation of a bullish trend reversal. Until then, short-term resistance may slow upside progress.

Impact of Macroeconomic Trends on Bitcoin

In evaluating Bitcoin's mixed price performance over the past month, macroeconomic conditions likely come into play. For example, rising inflation led the U.S. Federal Reserve to raise interest rates sharply in 2022. Higher rates disadvantage non-yielding assets like Bitcoin, especially amid a risk-off investment climate.

Additionally, Bitcoin and equities have traded very correlated recently. With stocks selling off through much of 2022 in reaction to tightening monetary policy, cryptocurrencies faced contagion selling pressure. If an economic slowdown emerges, Bitcoin could continue facing headwinds.

However, some data indicates investors may be decoupling Bitcoin from speculative tech stocks, considering its long-term value as "digital gold." If inflation remains stubbornly high, Bitcoin may regain appeal as an inflation hedge. But extended stock market turbulence would pose risks in the near term.

Price Prediction and Outlook Going Forward

Taking into account Bitcoin's technical price action and the macro backdrop, I expect continued rangebound consolidation between roughly $27,000 and $30,000 in the short term. This recent uptrend likely represents a bear market rally, buoyed by dip-buying, rather than the start of a new bull run.

For substantial upside beyond the recent highs, Bitcoin needs to recapture levels above $40,000 with strong conviction. That would require a spike in trading volumes and influx of new institutional capital. Until clear evidence emerges of a sentiment shift, traders should be cautious of a potential trend reversal.

Upside for 2022 likely remains limited to $35,000-$40,000 if broader equity markets stabilize. But a deeper economic slowdown could see Bitcoin retest 2022 lows near $17,500. The most prudent strategy is accumulating on major dips but avoiding overt bullishness until technical resistance is broken.

Will Bitcoin Reach New All-Time Highs in 2023?

Bitcoin reaching a new all-time high in 2023 remains unlikely barring an unforeseen parabolic rally. For Bitcoin to exceed its former peak near $69,000, fundamental drivers would need to shift dramatically. Double-digit inflation persisting into 2023 could spur renewed interest in Bitcoin as an inflation hedge.

However, if the Fed succeeds at engineering a soft landing, risk asset sentiment would remain fragile. In that environment, Bitcoin may lack the spark needed to drive prices exponentially higher. More likely, more sideways ranging persists before Bitcoin can mount a true rally back to former highs.

Patience is essential for long-term Bitcoin investors. Only substantial adoption advances or signs of hyperbitcoinization taking hold would enable a surge past $69,000 next year. Without clear bullish signals, traders should temper expectations of new all-time highs in the cards for 2023.

Is DeFi Causing ETH and Altcoins to Outperform Bitcoin?

Ethereum and altcoins have substantially outperformed Bitcoin in 2022, partly fueled by the explosive growth of decentralized finance (DeFi). Platforms like Uniswap, Aave, and Compound offer decentralized trading, lending and borrowing services.

Total value locked in DeFi has surpassed $100 billion, up massively from just $10 billion in late 2020. This vibrant ecosystem provides real utility and drives demand for ETH and governance tokens like COMP. Meanwhile, Bitcoin remains primarily a store of value.

While Bitcoin will likely stay dominant as "digital gold”, Ethereum and altcoins may continue outpacing it by attracting more Web3 developers and DeFi users. Thenovation happening in DeFi simply isn't occurring on Bitcoin's network. Unless Bitcoin can tap into decentralized networks or Smart Contract functionality, it may lag behind higher upside potential in DeFi-focused crypto assets.

In conclusion, short-term momentum indicates Bitcoin's price uptrend remains intact, but investors should be cautious of macroeconomic headwinds. Bear market rallies eventually run out of steam, so evidence of reclaimed support above $30,000 is needed for a bullish 2023 outlook. While Bitcoin faces slower growth than innovative DeFi-native cryptos, its staying power as the most trusted store of value in crypto underpins its long-term investment appeal. By utilizing prudent risk management, both short-term traders and long-term holders can strategically navigate Bitcoin's ongoing price volatility.