Bitcoin’s hash rate and difficulty rebounds as miners recover from the China-induced exodus

Following the most dramatic disruption to Bitcoin mining activities fueled by China’s clampdown on crypto-related activities, it appears the industry is back on its feet and is on a path to full recovery.

In its Monday “Week On-chain” report, Glassnode said that the hash rate of the Bitcoin network had recovered despite losing half of its capacity in May.

Glassnode confirmed that both the hash rate and mining difficulty, which measures competition among miners seeking to solve the network’s next block, are both on a “consistent path to recovery.”

Mining difficulty has almost regained its pre-China exodus levels, having increased by 39% since late July. With Bitcoin now trading at above $50k, the network’s difficulty is expected to make some more upward adjustments this week.

The analytics provider also reported that the difficulty ribbon has signaled its strongest reversal since December 2018.

Meanwhile, Chinese media outlet Wu Blockchain observed that Bitcoin’s difficulty had increased by 4.71% at block height 703,584 on Tuesday, its sixth consecutive increase since July 31.

Bitcoin mining difficulty increased by 4.71% at block height 703584 at 7:35 this morning, the sixth consecutive increase since July 31, with an adjusted difficulty of 19.89t. pic.twitter.com/1KtNW7RCIG

— Wu Blockchain (@WuBlockchain) October 5, 2021

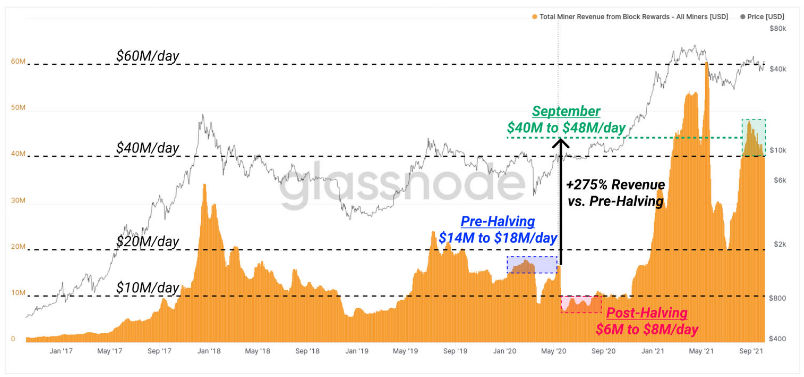

Mining profitability has also increased significantly since the May 2020 halving event when block rewards were slashed by 50% from 12.5 Bitcoin (BTC) to 6.25 BTC. Glassnode noted that prior to Bitcoin’s May 2020 halving, the current mining profitability was up 275% ($40 million daily) and has increased by roughly 630% compared to June 2020’s lows of between $6 million and $8 million.

Despite dramatic shifts in the mining market, multiple deep price corrections, and a halving event in May 2020, the Bitcoin block reward value continues to rise, creating incentives for the market to adapt, innovate and recover.