BlackRock CEO acknowledges cryptos, says they could become a “great asset class”

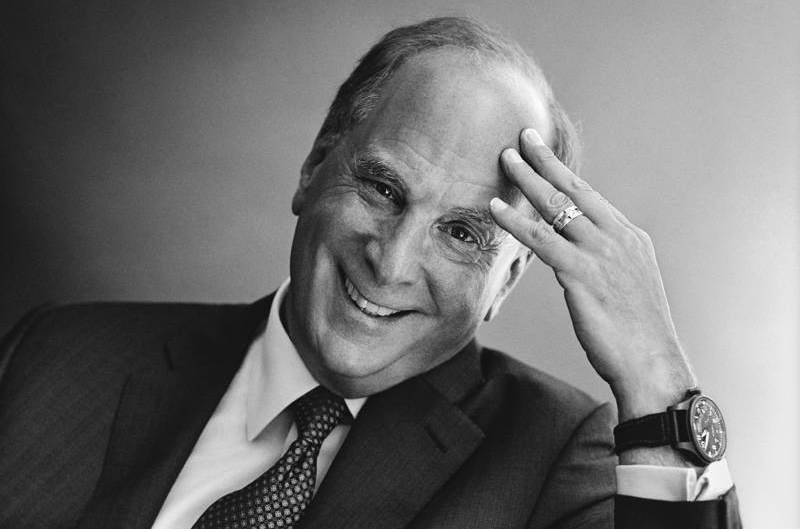

Larry Fink, CEO of BlackRock, said cryptocurrencies could grow into “a great asset class” during an appearance on CNBC’s “Squawk Box.”

At the other end of his optimism, Fink thinks that digital assets will not be able to replace government-issued currencies. Ironically, back in December, the CEO said that digital assets could evolve into a global market and eventually threaten the U.S. Dollar. He remarked:

I'm still fascinated about it. I'm encouraged by how many people are focusing on it. I'm encouraged by the narrative. It may become a great asset class… We are studying it. We've made money on it, but I'm not here to tell you that we are seeing broad-based interest from institutions worldwide.

Speaking of making money, a March 31 filing with the U.S. Securities and Exchange Commission recently exposed BlackRock’s romance with Bitcoin. The BlackRock Global Allocation fund bought 37 units of CME’s March 2021 Bitcoin futures. This came right after the company filed to add cash-settled Bitcoin futures as investment options for two of its funds.

BlackRock’s move into crypto was widely expected. Company officials have been leaving clues. In November, Rick Rieder, chief investment officer at the firm predicted that Bitcoin could displace gold.