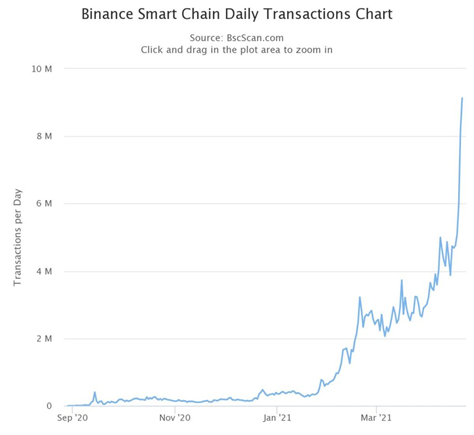

BSC dusts Ethereum’s daily transaction by 600%

Binance Smart Chain is reaping the benefits of Ethereum’s rising transaction costs. The network is quickly becoming a preferred choice by developers, thanks to its versatility, fast transaction speed, and low transaction costs.

As of April 22, 2021, Binance Smart Chain (BSC) had surpassed Ethereum’s daily transactions by about 600%. While Ethereum’s daily transactions sat at a mere 1.5 million, Binance was able to hit a whopping 9 million transactions.

Judging by the stats, Binance Smart Chain could eventually become a top competitor in the decentralized finance space. But until that happens, Ethereum is still the boss.

Many of the biggest DeFi platforms are built on Ethereum – Uniswap, Maker, Aave, Curve Finance, and several others. The total value locked (TVL) in ETH-based DeFi protocols is over $55 billion. However, the Binance Smart Chain appears to be catching up. The TVL of BSC’s DeFi ecosystem is about $34 billion. Furthermore, in terms of projects, BSC is the cornerstone of more than 480 projects.

The reason for the increase in transaction volumes is not farfetched. Binance Smart Chain is several times cheaper. It also draws its credibility from Binance, a platform that has already established itself as the world’s leading cryptocurrency exchange.