CPI and dVest Launch DeFiVest Liquidity Mining and Yield Farming dApp

CPI and dVest token holders can now capitalize on their tokens with the introduction of the DeFiVest Yield Farms.

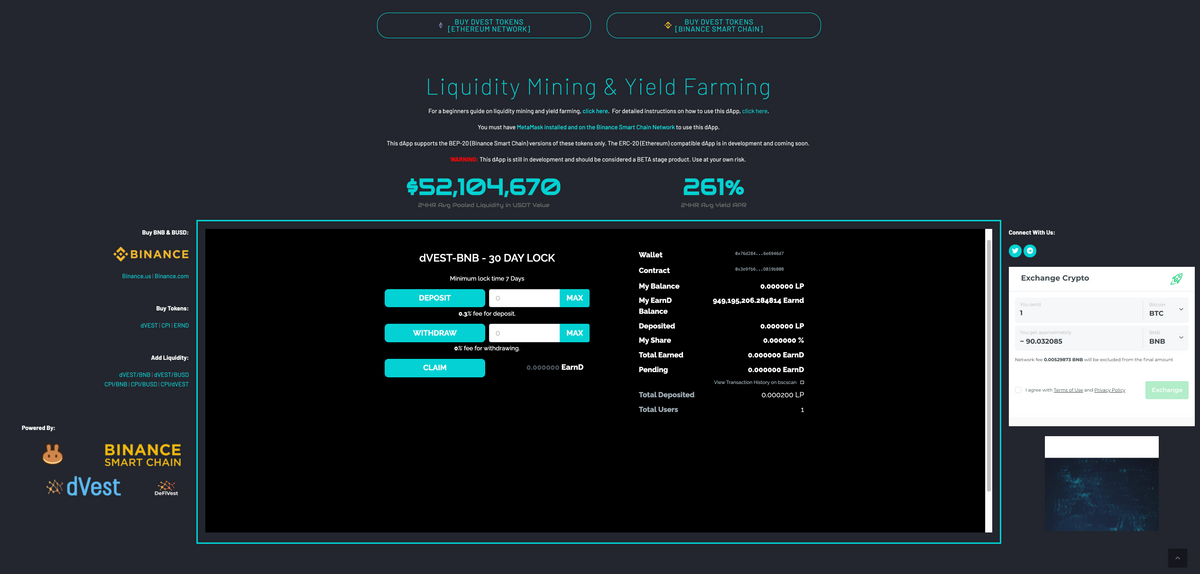

Hot off the recent acquisition of the dVest Project portfolio, CPI Dev Team, Ltd. — the parent company of the Crypto Price Index project — has announced the beta launch of the DeFiVest liquidity mining and yield farming dApp on the Binance Smart Chain.

CPI and dVest token holders can now deposit token pairs such as BNB-dVEST, BNB- CPI, BUSD-dVEST, BUSD-CPI, and others to liquidity pools on PancakeSwap in exchange for LP (liquidity pool) tokens, which they can then stake on the DeFiVest yield farming dApp in order to earn ERND tokens. ERND tokens can easily be swapped for more dVest, CPI, and other cryptocurrencies, resulting in significant potential profit for liquidity providers. This in addition to the fees they earn for providing liquidity on PancakeSwap.

"By providing liquidity to the dVest ecosystem and then staking your LP tokens in the DeFiVest Yield Farm you can really capitalize and make your assets work much harder. You still get fees for providing liquidity, but you're also earning additional CPI, dVest, and ERND tokens as well," said Herbert Law, CEO of dVest and CPI Dev Team, Ltd. "We're looking forward to deploying many more features on both the CPI and dVest networks in 2021."

Here is a beginners guide to liquidity mining and yield farming on DeFiVest.

"At its core, dVest is all about putting control into the hands of the end user, and decentralizing the entire concept of investing. One of the fundamental principles of cryptocurrency is control: Your private keys ensure your control of your assets. With traditional investing, end users don't usually have that kind of control,” said Ben Baldanza, an economist, Forbes contributor, and marketing and finance advisor to the dVest Project. “We want to encourage users to come into the new age of decentralized finance. Stop investing, and start dVesting,” he added.

The DeFiVest dApp is in the beta stage, and as with most DeFi products, there is always a risk of impermanent loss and other price exposure risks. Users should strive to be educated about DeFi and the associated risks before participating.

The dVest team is currently developing a DEX exchange it plans to launch along side the current dVest CEX (dVest.io) later this month. It also plans to expand both the DEX and the dApp to the Ethereum network in the very near future.

For more information about the DeFiVest Project visit www.defivest.io

For more information about dVest, visit www.dvest.org

ABOUT dVEST :

DeFiVest is a non-custodial decentralized finance liquidity protocol that is an integral part of the dVest Ecosystem.

dVest tokens power the dVest ecosystem and earn rewards for token holders from dVest exchange revenues, liquidity mining, staking, and more.

Media Contact Details :

Contact Name: Herbert LawContact Email: herbert@cpiindex.io