Crunching the numbers: How much energy does Bitcoin mining consume?

One of the major grey areas of Bitcoin as a medium of exchange or store of value is its energy consumption. Critics and environmentalists have continued to slam the digital asset for being power-hungry, amid rising global warming concerns. However, the billion-dollar question that everyone is asking - “how much energy does Bitcoin mining consume?”

Quite frankly, there are different answers to this question, depending on who is asked.

Different Sources & Different Figures

A June 2019 issue of energy magazine Joule estimated the value to be around 45.1 terawatt-hours (TWh) annually. This was about 0.2% of the entire global electricity produced, with a carbon footprint standing at 22.0 to 22.9 Mt CO2. This estimate is expected to have risen given the rising popularity of Bitcoin over the past year. However, one could argue that they are now more energy-efficient miners.

Digiconomist, a site that keeps track of Bitcoin’s Energy Consumption Index pegs the annual electricity consumption of Bitcoin at 77.78 TWh.

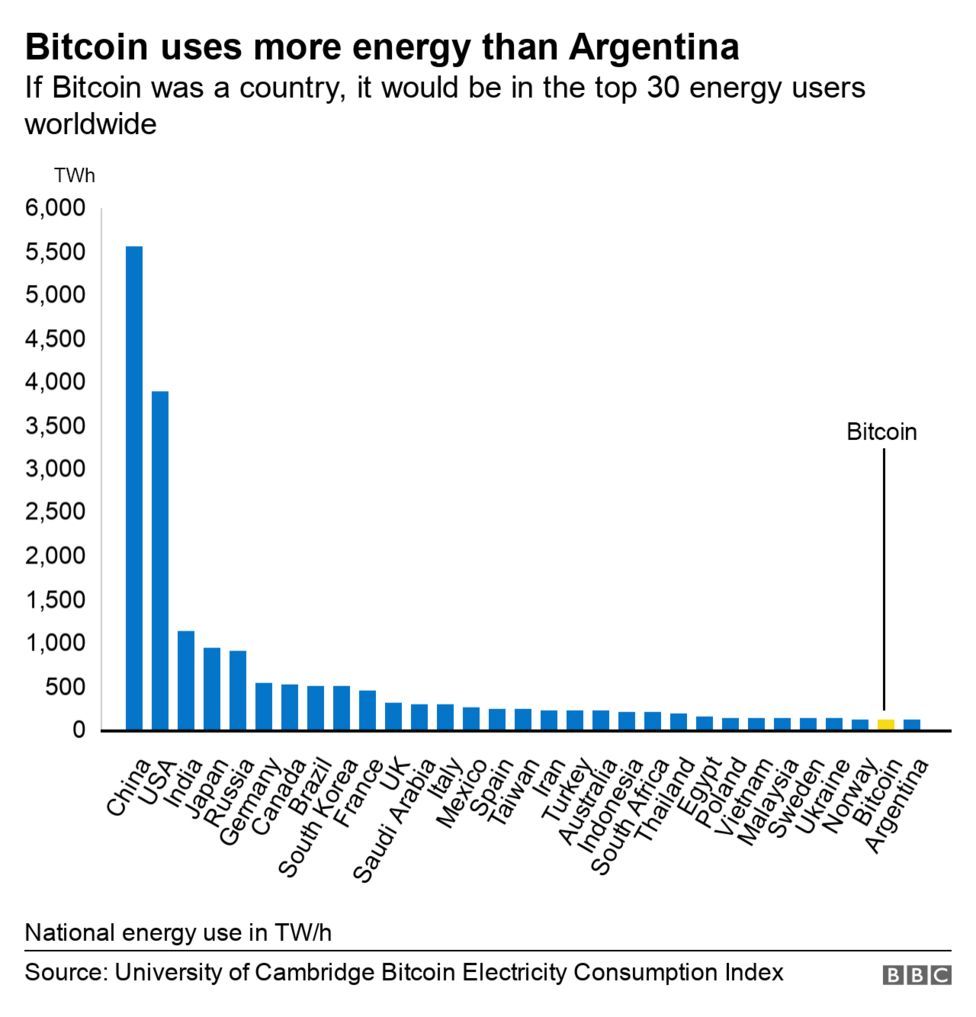

These figures may appear conservative when compared with Cambridge’s Bitcoin Electricity Consumption Index. A recent analysis by the University of Cambridge revealed that Bitcoin consumes more electricity than the whole of Argentina. The researchers estimated that the digital asset consumes around 121.36 TWh annually.

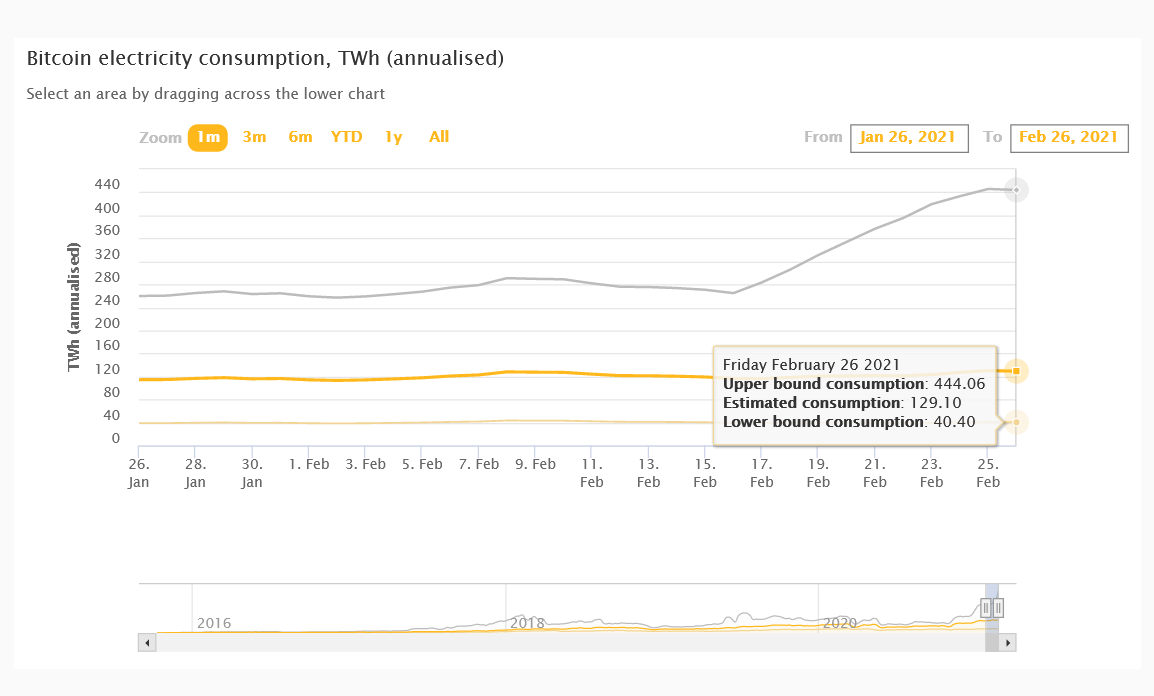

As of February 26, 2021, Cambridge estimated Bitcoin’s annual energy consumption to be 129.1 TWh, with lower bound consumption of 40.4 TWh and higher bound consumption of 444 TWh.

To put things in perspective, as of 2018, the global energy consumption was 171,240 Twh. Bitcoin takes up about 0.6% of global electricity production. As meager as this may appear, experts say that this is enough to power Switzerland for more than two years. Some others have suggested that if Bitcoin were a country, it would be in the top-30 energy users worldwide.

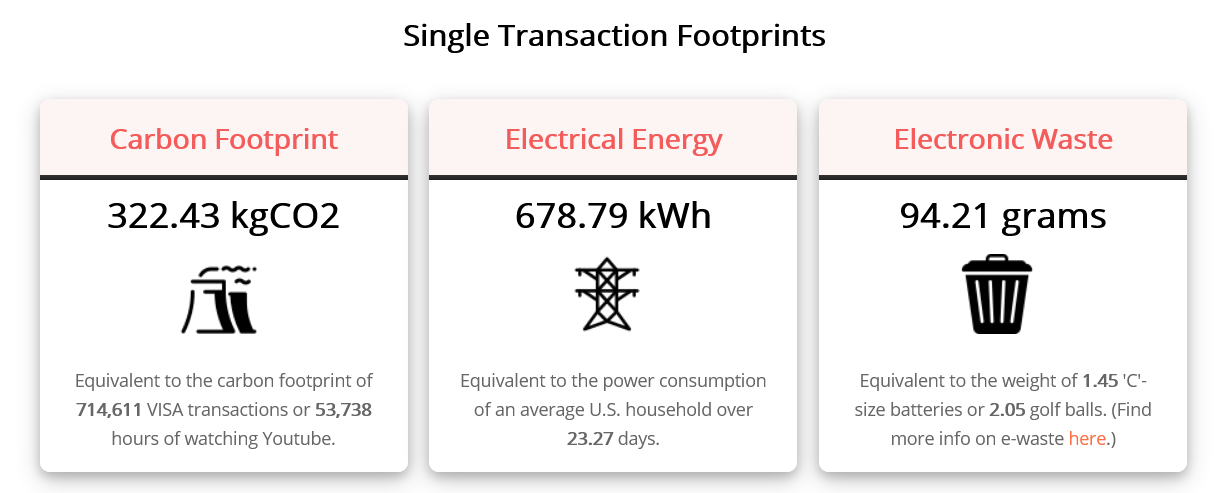

Data from Digiconomist shows that Bitcoin’s carbon footprint is ginormous. The digital asset accounts for 36.95 Mt CO2 yearly. This is comparable to the carbon footprint of New Zealand. Breaking this even further, a single Bitcoin transaction releases about 322.43kg of CO2 into the atmosphere. Comparatively, this is equivalent to the carbon footprint of 714,611 Visa transactions or 53,738 hours of watching YouTube videos.

Despite the varying figures, experts have found a common ground and that is in the fact that Bitcoin’s level of energy consumption is unlikely to go down unless the price of the digital asset slumps, making it unattractive to miners.

A Miner’s Delight

Bitcoin has grown to become the delight of miners. Following an influx of institutional investors in late December and the meteoric rise that followed thereafter, most people are struggling to get in on the action.

As reported by BTC PEERS earlier this year, Bitmain, a leading bitcoin mining rig manufacturer, disclosed that its ASIC miners were sold out through August 2021. This was despite a price increase of almost 100%. The report also stated that the secondary mining machine market climbed to new highs.

Commenting on Bitcoin’s consensus architecture, Bohdan Prylepa, Chief Operating Officer (COO) and co-founder of Prof-it Blockchain Ltd admitted that Bitcoin is inherently flawed. He is however hopeful for a solution that solves Bitcoin’s scalability problem without compromising on security. The COO said:

Yes, there are obvious scalability limitations in Bitcoin, routed directly to the Proof-of-Work consensus algorithm. With increasing concerns on environment preservation and conservation, alternate consensus algorithms must be designed… I’m particularly interested in the one that places the end use at the center. There are several models present but the one that combines Leased Proof-of-Stake (LPoS) and Proof-of-Authority (PoA) dubbed UPoS appear robust without compromising security or impacting decentralization.

An interesting twist to Bitcoin’s energy consumption saga is a theory from CoinShares suggesting that the network mainly runs on renewable energy. In 2019, the crypto asset management and analysis firm published a report claiming that 74.1% of Bitcoin energy consumption comes from renewables, making Bitcoin “more renewables-driven than almost every other large-scale industry in the world.”

The claim was largely disputed, with several players noting that fossil fuels are still the primary sources of energy.

Amid the back and forth, it is an established fact that Bitcoin mining consumes a lot of energy.