Day traders take profit, rich wallets buy the Bitcoin dip, analyst says

Amid Bitcoin’s plunge to the $46k region on Monday morning, an analyst has revealed that while day traders were cashing out, whale buyers were accumulating the digital asset.

According to the data shared by the independent analyst on Twitter, the number of newly-created Bitcoin addresses and the number of active addresses dropped by 11.5% and 12%, respectively. Meanwhile, wallets holding over 1,000 bitcoin increased by 0.11%.

In the last 24hrs new addresses dropped 11.5%

— xCæsar (@PARABOLIT) February 15, 2021

but

bitcoin adresses with over 1,000 $BTC increased

Big money is buying the dip whilst the market gets shaken out.

as always. pic.twitter.com/o9bhm6Knl5

Bitcoin reached a new all-time high of $49,850 on Sunday. A few hours later, it plunged to around $46k but has since retraced its move upward to reclaim $48,500. Institutional bulls are preventing the digital asset from falling lower. This has raised expectations that Bitcoin could attempt $50,000. If this happens, there are speculations that the next stop could be $65,000.

As reported by BTC PEERS, about 78% of Bitcoin’s circulating supply is now illiquid. Retail traders are selling their Bitcoin holdings to secure short-term gains. On the flip side, institutional investors are fuelling the “HODLing” sentiment by aggressively accumulating. About 3% of Bitcoin’s circulating supply is now in the hands of institutional investors.

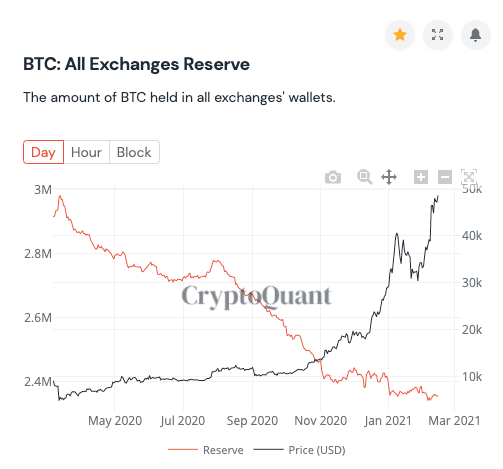

In a related chart, blockchain analytics platform CryptoQuant highlighted a drop in the amount of Bitcoin held by exchanges.

Check our guide of the most promising crypto