Deciphering the Data: A Technical Analysis of 10 Major Cryptocurrencies

The cryptocurrency market has seen immense growth and adoption over the past few years. With over 10,000 cryptocurrencies in existence today, it can be challenging to make sense of the market landscape and identify promising investment opportunities.

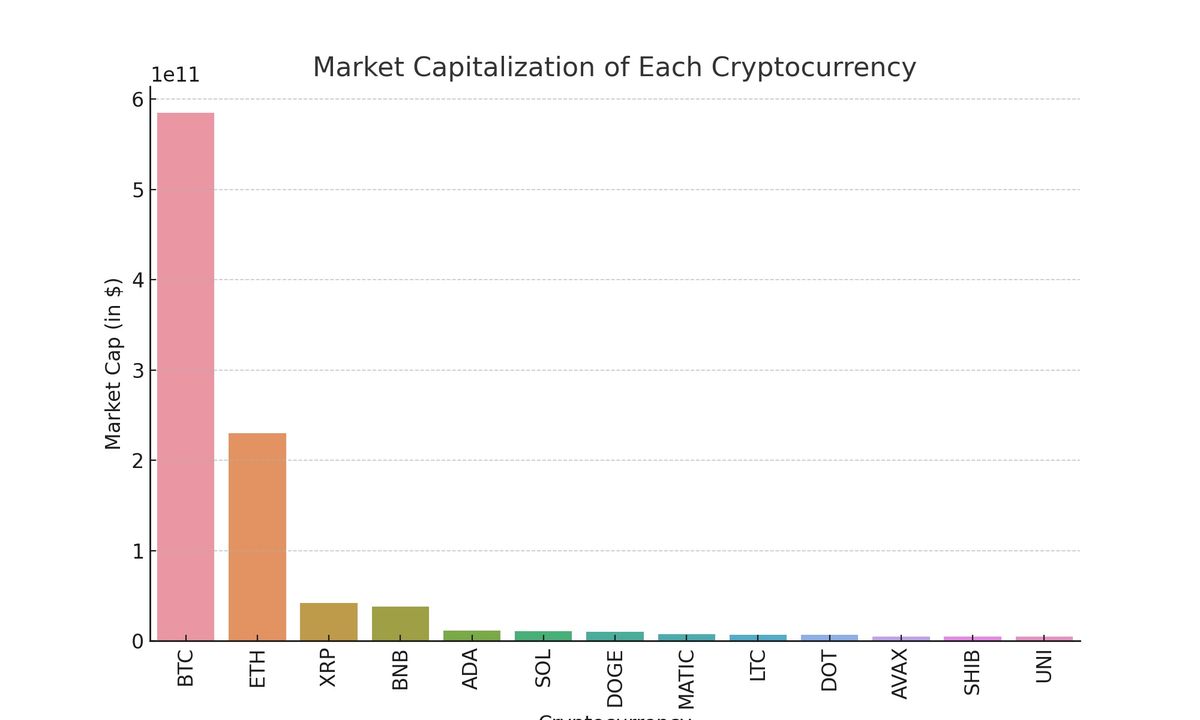

In this extensive technical analysis, we will delve into the key data points of 10 major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), XRP, Binance Coin (BNB), Cardano (ADA), Solana (SOL), Dogecoin (DOGE), Polygon (MATIC), Litecoin (LTC), and Polkadot (DOT).

By closely examining their price statistics, volatility, market dominance, all-time highs and lows, we aim to decipher the numbers and uncover insights into the potential value of each crypto asset.

Scrutinizing the Metrics of the Top Cryptocurrency, Bitcoin

As the first and largest cryptocurrency, Bitcoin dominates the market in many respects. With a current price hovering around $30,100, Bitcoin has a gargantuan market capitalization of nearly $585 billion. This gives it a 46.7% market dominance, meaning nearly half the total crypto market value is tied to Bitcoin.

Despite its market leader position, Bitcoin has struggled to regain the astronomical highs of November 2021 when prices peaked at $69,000. As of July 2022, Bitcoin remains down 56% from its all-time high. However, zooming out on the long-term chart reveals Bitcoin has seen jaw-dropping growth of over 44,000% from its early years.

In terms of trading volume, Bitcoin sees significant activity totaling over $12 billion in daily volume. However, compared to its market cap, Bitcoin's volume to market cap ratio sits at just 0.0193, pointing to comparatively low liquidity.

Over the past month, Bitcoin has seen a respectable rally of 14%. However, its performance over the past quarter has been lackluster, with 30-day and 90-day returns of just 14% and 37.3% respectively. This points to slowing momentum and waning investor interest.

Overall, while Bitcoin remains the crypto leader, its muted price action signals it may be losing steam. As investors seek higher returns, they could rotate holdings into alternative cryptocurrencies.

Ethereum Flashes Strength with Solid Returns

As the second largest cryptocurrency, Ethereum has firmly established itself as a leading blockchain protocol for decentralized apps and NFTs. With a market cap exceeding $229 billion, Ethereum dominates nearly 20% of the crypto market value.

Despite suffering major losses of 60% from its all-time high, Ethereum has delivered consistent positive returns across short and mid-term timeframes. Over the past month, Ethereum has surged 11.1% compared to Bitcoin’s 14% gain. The mid-term picture looks brighter still, with 3-month and 1-year returns of 25.7% and 37.3% respectively.

Ethereum’s trading volume comes in at a healthy $9.8 billion. However, its volume to market cap ratio stands at just 0.0428, indicating relatively thin liquidity similar to Bitcoin.

Overall, Ethereum's strong multi-month returns and dominance in decentralized finance paint an optimistic picture of its investment potential. As blockchain adoption accelerates, Ethereum looks poised to capitalize on its first-mover advantage in smart contract capabilities.

Surging XRP Attempts to Reclaim Former Glory

The XRP token from the Ripple ecosystem suffered heavy losses after reaching peak prices above $3 in early 2018. However, after bottoming out below 30 cents in July 2022, XRP has undergone a dazzling rally of over 60% in the past two weeks. This momentum surge has propelled XRP’s returns over the past 30 days to a staggering 62.5%.

With strong volume surpassing $2.8 billion daily, XRP liquidity appears high. Its volume to market cap ratio stands at a healthy 0.0682. This implies strong trading interest behind the recent XRP price uptrend.

While XRP maintains a solid market cap of $42 billion, its share of the total crypto market cap comes in at just 3.4%. Thus, despite being a top 10 cryptocurrency, XRP is dwarfed by the likes of Bitcoin and Ethereum in terms of influence and dominance.

After being pummeled from all-time highs above $3, XRP trades at heavy discounts to past peaks. Its current price around $0.80 marks a discount of 76% from highs. This indicates traders see considerable unrealized upside potential if XRP can revisit past highs.

Binance Coin Stable but Lacking Impetus

As the native token of the Binance cryptocurrency exchange, Binance Coin (BNB) plays a pivotal role in cheaply settling trades on the platform. However, despite its utility value and ninth-ranked market cap of $38 billion, BNB has struggled to gain upward momentum.

Over the past month, BNB scraped out a lackluster 0.5% gain. And across the past three months, BNB remains stuck in a rut with negligible price movement. Failing to participate in broader market rallies, BNB's year-to-date returns sit at -6.1%.

With lackluster trading activity compared to market cap, BNB suffers from weaker liquidity metrics. Its volume to market cap ratio resides at just 0.0238, which could explain its tighter price ranges.

Unless Binance Coin can find renewed trading interest and break out of its ranging behavior, its price outlook appears muted. However, as the crucial native asset of the world’s largest cryptocurrency exchange, BNB cannot be discounted over the long-run.

Cardano Builds Momentum after Capitulation

The native ADA token of the Cardano blockchain has suffered brutal declines over the past year, with losses near 90% from all-time highs. However, after capitulating to around 30 cents in June, ADA appears to have posted a durable bottom.

With a parabolic surge of 22% over the past month, ADA now trades around $0.32 - nearly double its June lows. Zooming out further, ADA has gained 9% and 23% over the past 14 days and 30 days respectively. With accelerating momentum, ADA could have legs for further upside, likely aided by its decent liquidity profile.

With a volume to market cap ratio of 0.0282, ADA sees stronger trading activity relative to market cap compared to alternatives like BNB. If buying interest continues climbing, ADA could attempt to revisit the $1.00 level and recoup some of its crushing losses from the past year.

Solana Regains its Footing above $25

Solana (SOL) has endured a catastrophic collapse over the past 8 months, plummeting 90% from a peak of $260 last November. The devastation in SOL price reflects loss of investor confidence in the network after suffering extended outages and reliability issues.

However, after finding a bottom around $21 in June, Solana has regained its footing above the $25 level. The cryptocurrency gained 20% over the past week, powered by strong momentum. In the past month alone, SOL has surged 71% off its lows.

With volumes exceeding $700 million and a healthy volume to market cap ratio of 0.0678, Solana sports decent liquidity metrics. As developers continue building decentralized apps on Solana, the network activity could help resuscitate Solana prices. The deep discounts from all-time highs offer speculative upside potential.

Dogecoin Consolidates After Speculative Mania

Dogecoin captured investor spotlight in 2021 after skyrocketing over 15,000% on pure speculative mania. However, the hyper-volatile rally was unsustainable. After peaking at $0.73 in May 2021, DOGE has bled out over 90% to current levels around $0.07.

With Dogecoin trading firmly below its 2021 highs, the highly-speculative rally appears to have largely unwound. In recent months, Dogecoin has traded range-bound between $0.06 and $0.08, lacking a clear directional bias.

Compared to the glittery promises of Dogecoin proponents last year, its price action has proven rather unremarkable recently. Unless DOGE can recapture investor imagination and break out of its ranges, significant volatility or price spikes seem unlikely.

Still, with the power of memes, anything is possible in crypto. Dogecoin cannot be ruled out as a potential speculative rocket ship if mass interest reignites.

Polygon Exhibits Strength after Deep Correction

As a scaling solution for Ethereum, Polygon (MATIC) enjoys bullish fundamentals with Ethereum ecosystem activity expanding rapidly. However, MATIC tokens faced immense pressure over the past 7 months alongside the broader crypto downturn.

After peaking near $3 in late 2021, MATIC plunged as low as $0.71 in June 2022 - a gut-wrenching decline of 75% from highs. However, MATIC has since rallied sharply after finding its bottom. Over the past month, MATIC has surged 26% as the crypto market regained its footing.

With a reasonably strong liquidity profile, MATIC appears well-positioned to capitalize on renewed investor appetite for risk. As Layer-2 scaling solutions grab attention amidst Ethereum's high fees, MATIC could target a retest of $1.00 resistance. Its current price around $0.75 offers attractive potential upside.

Litecoin Rebound Gains Steam

Litecoin has cemented itself as one of the most popular and recognized cryptocurrency alternatives to Bitcoin. However, LTC has faced no shortage of volatility over its history. After peaking at a record $410 in May 2021, Litecoin collapsed along with the broader crypto sphere to below $100.

However, Litecoin now appears to be back on the recovery trail. With a sizable 21% gain over the past month, Litecoin is building notable upside momentum. If the rally continues, Litecoin could retest overhead resistance around the $150 mark. With strong on-chain activity and liquidity, LTC has fuel in the tank for extended gains.

Still down over 75% from its all-time high, Litecoin has enormous room for appreciation if it can revisit last year's peaks. With strong utility value for fast and cheap transactions, Litecoin appears underpriced at current levels around $94.

Polkadot Trades Range-Bound but Promising Platform Potential

As a novel multichain network protocol, Polkadot (DOT) offers an intriguing vision for a unified decentralized web. However, over the past 8 months, DOT has failed to gain traction amidst the crypto rout. After topping out at $55 in November 2021, DOT has plunged over 90%.

Despite a sharp 15% rally over the past month, DOT remains stuck trading in a range between $5 and $6. Unless DOT can thrust higher and break out of its trading range, significant near-term upside appears limited.

However, with Polkadot’s thesis around interconnected blockchains gaining attention, the project seems well-positioned for long-term adoption. As developers build parachains on Polkadot, real-world usage could strengthen the fundamental investment case for DOT tokens.

Avalanche Attempts to Carve Out Support

As a speedy smart contracts platform, Avalanche (AVAX) looked highly promising in late 2021 on the back of its blazing 3-second transaction finality. Investor enthusiasm catapulted AVAX to a record high of $145 in November 2021. However, the price action quickly soured, with AVAX entering a vicious bear market.

Over the past 8 months, Avalanche has shed over 90% of its value. However, since bottoming out around $13 in June, the cryptocurrency has shown signs of basing and recovering. AVAX has surged 24% in the past 30 days as bullish momentum returns.

With a decent liquidity profile, Avalanche appears well-positioned to continue regaining ground. Moreover, with extremely low fees and fast transaction speeds, the AVAX ecosystem could be poised for growth as developers build DeFi and Web3 applications.

After its parabolic rally and subsequent comedown, AVAX prices seem attractive for accumulation at current levels around $14. But with crypto sentiment still fragile, the road to recovery may prove bumpy.

Shiba Inu Consolidates After Astronomical Rally

The Dogecoin spinoff, Shiba Inu (SHIB), captivated the crypto world in 2021 after delivering mind-blowing returns of over 75,000,000% in a year. However, the vertical price action was patently unsustainable. SHIB has since retraced 90% from its peak, now trading for a fraction of a penny.

In recent months, Shiba Inu has remained relatively calm, lacking any clear price trend. Range-bound action points to consolidation and a potential bottoming formation. However, with purely speculative appeal and no real utility, SHIB lacks catalysts to drive significant renewed upside.

Barring another massive influx of retail traders, Shiba Inu prices seem likely to remain comparatively muted. The days of exponential 1,000% price spikes are likely behind. With most short-term speculators flushed out, those still holding seem inclined to hodl their SHIB tokens.

Uniswap v3 Aims to Recapture Key Levels

As the largest decentralized exchange in the crypto market, Uniswap and its UNI token play a pivotal role in automated crypto trading. However, UNI has plunged severely from its euphoric highs in early 2021 above $45.

After bottoming out around $5.50 in June, Uniswap has rebounded sharply with a 34% gain over the past 30 days. This momentum could propel a retest of the $10 level if the rally continues. UNI appears to have recommitted buyers, which should support prices as long as broader crypto sentiment improves.

With strong protocol usage and volumes, Uniswap seems fundamentally solid despite its 90% drawdown. As decentralized exchanges siphon activity from centralized counterparts, Uniswap looks positioned to capture significant growth in Web3 trading activity.

Key Takeaways from The Analysis

- Bitcoin Dominates but Faces Slowing Momentum - Despite being synonymous with crypto, Bitcoin has lagged alternative cryptocurrencies in recent months. Its returns appear muted and investor interest is pivotin

- Ethereum Leads The Pack - With Ethereum dominating DeFi and NFT activity, its thriving ecosystem could propel its valuation higher as real-world utility continues growing.

- Solana and Cardano Poised To Recover - After facing extreme bearish pressure, Solana and Cardano seem oversold at current levels. Their strong capabilities and discounted prices offer upside potential.

- XRP and Litecoin Rally Picks Up Steam - After deep declines to multi-year lows, XRP and Litecoin appear to be bottoming out. Their impressive rebounds point to renewed bullishness.

- Polkadot and Avalanche Build Promising Ecosystems - Despite muted price action, Polkadot and Avalanche have built impressive decentralized web visions that could drive adoption.

- Meme Coins Consolidate After Mania Deflates - Dogecoin and Shiba Inu have stabilized after their massive rallies in 2021. Lacking catalysts, more subdued action likely lies ahead.

- Decentralized Exchanges Face Growth Potential - With their integral role in Web3, Uniswap and other DEXs seem primed to disrupt traditional exchanges in the years ahead.

Conclusion

Has Bitcoin's Time Passed or Will It Reclaim Dominance?

While Bitcoin was the pioneering cryptocurrency, its first-mover advantage may be fading as investors embrace alternative networks with greater capabilities and speed. However, Bitcoin still maintains its digital gold narrative and role as a reserve store of value in crypto portfolios.

On one hand, Bitcoin’s muted price action signals fading leadership and momentum in the space. But on the other hand, its recognition and liquidity ensure it remains the gateway into cryptocurrency investing. Ultimately, Bitcoin will likely stay influential but see its dominance slowly diluted rather than completely collapsed.

Are Centralized Exchanges at Risk of Disruption from Decentralized Rivals?

The rise of decentralized exchanges like Uniswap offers greater security, transparency, and accessibility compared to centralized exchanges. With no central operator in control, decentralized exchanges align better with crypto ideals and Web3 philosophy.

However, centralized exchanges like Binance still dominate trading volumes because they offer more coins, stability, and a more familiar user experience. While decentralized exchanges seem well-positioned for steady adoption, completely displacing incumbent centralized exchanges seems unlikely.

The cryptocurrency ecosystem will likely support both models serving different needs. But decentralized exchanges have room to continuously capture greater market share through organic Web3 growth in the coming years.