EIP-1559 is not the solution to high gas fees on the Ethereum network, report says

According to a new report by analytics provider Coin Metrics, EIP-1559 might not be the Holy Grail to solve Ethereum’s high gas fees.

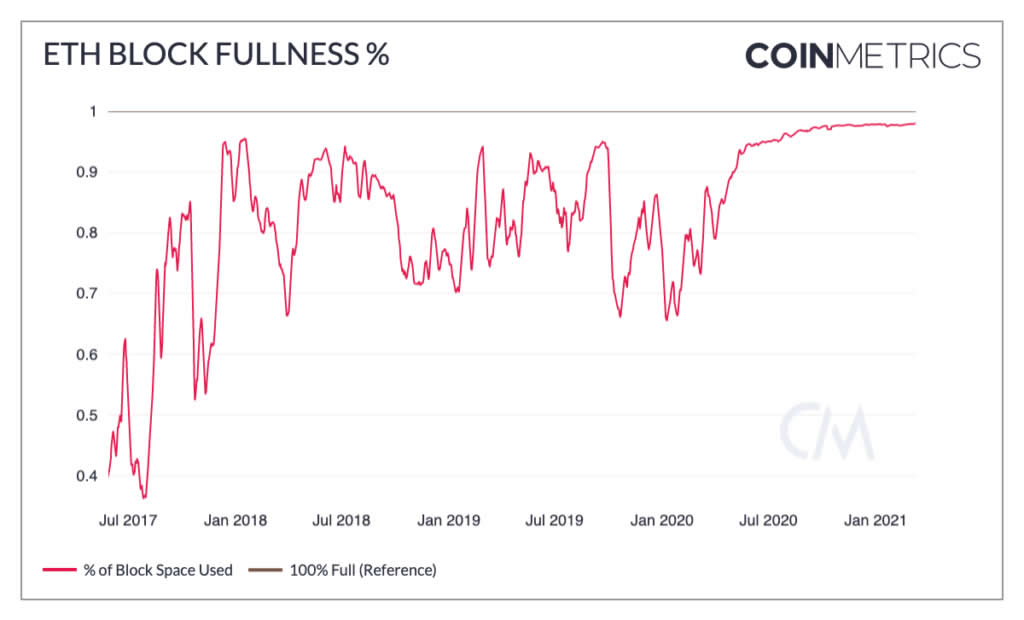

The analytics provider in its Ethereum Gas Report revealed that consistently full blocks are the primary culprit behind rising gas fees. As such, the much anticipated Ethereum Improvement Proposal (EIP)-1559 might do very little to alleviate the current problem.

Since the DeFi boom in mid-2020, blocks on the Ethereum network have remained almost full, with about 95% of block space being used. This value rose to 97%-98% in March 2021, Coin Metrics disclosed.

As per the report, Ethereum transaction fees have stayed above $10 for most of the year. Comparatively, the average gas fee at the heat of the 2017 and 2018 Bull Run was only $5.70.

Coin Metrics admits that Ethereum’s rally to new highs made gas more expensive. However, while the price of the digital asset has risen by 125% to current prices in 2021, the median gas fee has spiked by over 500%.

Since January 2020, the amount of gas used per transaction has trended downwards. This shows that increased transaction complexity is not responsible for high transaction fees.

Ethereum transactions are auctioned and preference is given to those paying more gas. Coin Metrics explained that miners are required to specify the transactions to include when mining new blocks. Furthermore, each block accommodates a limited number of transactions (between 160 and 200) due to a cap on the maximum block size. Coin Metrics wrote:

So miners naturally prioritize the transactions with the highest gas prices since they will earn them more money if these transactions are included.

Coin Metrics concluded its research by revealing that the much-touted EIP-1559 upgrade might not be able to solve the high-gas cost problem. The only viable solution in the long-term would be deploying robust scaling solutions.

As reported by BTC PEERS, EIP-1559 will introduce a mechanism that adjusts the current auction process, allowing users to alter gas fees and pay the lowest bid for the block. Coin Metrics opines that the upgrade will only make fees more transparent and predictable rather than solve the root problem.

If Ethereum can only process a few hundred transactions (on average) per block, there’s going to continue to be high fees as long as DApp usage keeps increasing. Gas prices will continue to be high as long as there’s high competition for block space.

Check our guide of the most promising crypto