ETH on centralized exchanges continue to drop as investors turn to DeFi offerings

As the amount of Ethereum locked up in DeFi protocols continues to grow, its supply on centralized exchanges is taking a beating.

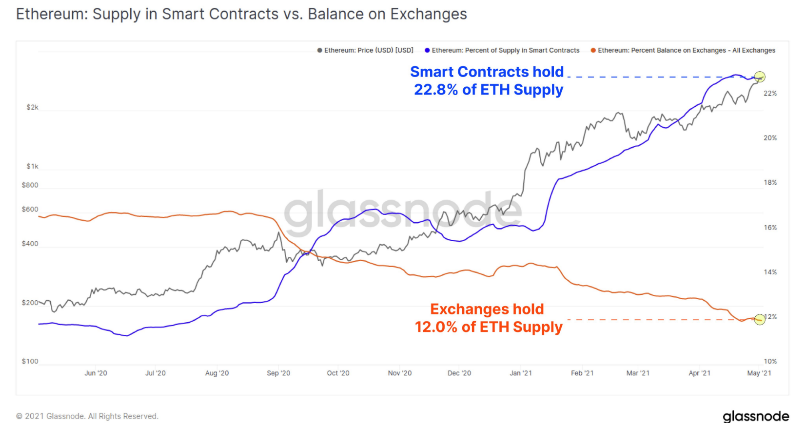

While the number of ETH locked in DeFi protocols has grown by 75% since the beginning of 2020, the number of ETH held on exchanges has fallen by 30% within the same timeframe. According to a chart shared by on-chain analytics provider Glassnode, Ethereum’s supply on centralized exchanges has dropped to 12% from 17% at the start of 2020.

The chart compared the number of ETH deposited in Ethereum-based protocols to the number held on centralized exchanges over the past 17 months.

While the number of centralized exchanges suffered a decline, the percentage of ETH locked in DeFi smart contracts rose by three quarters within the same period. DeFi protocols recorded a growth of 22.8%, up from 13%.

Meanwhile, figures from DeFi Llama, a crypto data aggregator suggest that nearly 9% of ETH’s circulating supply is locked in smart contracts other than the Ethereum mainnet. According to its estimate, about 8.3 million coins (equivalent to 7% of ETH’s circulating supply) are locked in Binance Smart Chain protocols. Solana and Avalanche hold 286,153 ETH and 103,902 ETH, respectively.

As reported by BTC PEERS, Ethereum’s DeFi ecosystem recently surpassed 2 million users. It comes as no surprise that the leading altcoin is moving from centralized exchanges into protocols that promise more gains.