Ethereum Classic's 2.62% Price Surge to $16.06: Key Takeaways for August 30, 2023

Ethereum Classic's price has seen a notable 2.62% surge over the past 24 hours to $16.06. This comes after a period of declining prices over the past month, with ETC dropping 13.10% over the last 30 days. However, this recent uptick shows a reversal of the downward trend and brings hope for Ethereum Classic holders.

In this report, we will analyze the key metrics behind Ethereum Classic's price action and uncover insights into what traders can expect going forward. With a market capitalization of $2.33B, ETC remains one of the top cryptocurrencies in terms of market value. Its 24-hour trading volume reached $224.24M, showing strong interest in the asset.

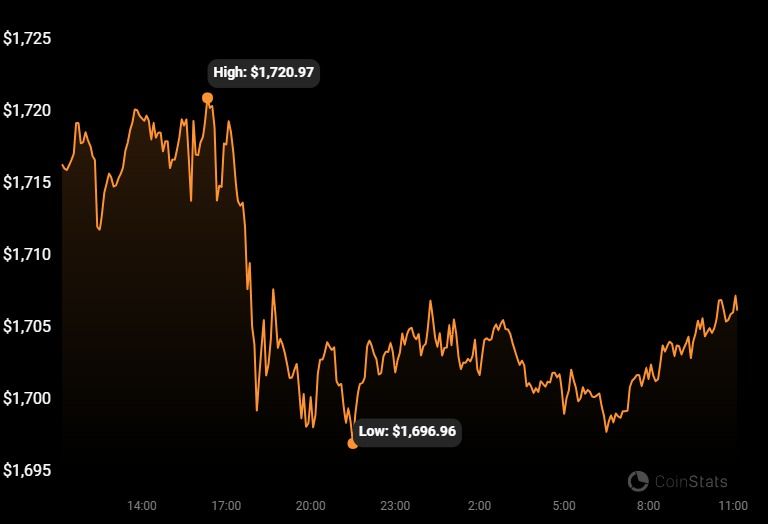

While ETC's price rose 2.62% over the past day, its 1-hour change tells a slightly different story. ETC dropped 1.89% over the last 60 minutes, suggesting some short-term profit-taking and consolidation around the $16 level. Zooming out further, ETC gained 1.88% over the previous 7 days, showing an overall upward trajectory.

When looking at the past 6 months, ETC has struggled, dropping over 13%. This coincides with the broader crypto bear market throughout 2022 that has weighed down prices. However, Ethereum Classic's long-term fundamentals remain strong.

As one of the original Ethereum blockchain's based cryptocurrencies, ETC offers a smart contract platform with a deflationary monetary policy. ETC utilizes a Proof of Work consensus mechanism, allowing for decentralized validation of transactions. While ETH has transitioned to Proof of Stake, ETC remains committed to PoW and aligns more with Bitcoin's ideology.

What's Behind Ethereum Classic's Recent Gains?

Ethereum Classic's positive price action over the past day comes amid an improvement in overall crypto market sentiment. Bitcoin, the leading cryptocurrency by market cap, has stabilized above $20,000 after previously dropping below that psychological level. With Bitcoin finding its footing, altcoins like ETC have also bounced.

Additionally, while the past month has been difficult for the crypto sector, the previous week saw strong gains across top assets like BTC and ETH. Ethereum Classic seems to be benefiting from this return of bullish momentum. Its correlation with Ethereum likely also gives it sympathy gains when ETH prices rise.

Looking deeper, Ethereum Classic may also be getting a boost from its upcoming Thanos network upgrade scheduled for September. This upgrade will bring increased interoperability and support for multi-chain applications. The closer the network gets to this milestone, the more anticipation there is around ETC prices.

Ethereum Classic 6-Month Price Prediction

Analyzing the recent price action and trends, my prediction is that Ethereum Classic will trade between $14-$20 over the next 6 months. Here are some factors that support this outlook:

- Broader crypto markets remain turbulent but appear to be stabilizing and finding a bottom after a difficult H1 2022. This will provide tailwinds for ETC.

- As crypto adoption continues growing, interest in "Web3" and smart contract platforms like Ethereum Classic should also increase.

- ETC's upcoming Thanos upgrade will further develop the network and can act as a potential positive catalyst.

- From a technical perspective, ETC has found support around $13-$14 and is facing resistance around $20. This range is likely to persist short-term.

- However, there are also risks such as further regulatory pressure on the crypto industry that could weigh on prices. Competition from other Layer 1 blockchains also poses a challenge.

Overall, Ethereum Classic seems poised to trade sideways for now after its recent gains. While major upside appears limited, its strong community and committed PoW miners should provide a valuation floor and stability.

Is Ethereum Classic's PoW Consensus a Strength or Weakness?

As one of the few major PoW cryptocurrencies outside of Bitcoin, Ethereum Classic stakes its identity on PoW. This leads to an important question - does ETC's commitment to PoW consensus give it a unique advantage in the market, or is it an Achilles' heel? There are strong cases on both sides.

On the positive side, PoW aligns Ethereum Classic with the cypherpunk ethos of decentralization and censorship-resistance. By retaining energy-intensive mining, ETC upholds the values of an permissionless, digital monetary system. PoW is also battle-tested, having secured Bitcoin for over a decade never being hacked.

However, PoW comes under frequent criticism for its environmental impact with mining's energy consumption. As crypto faces more scrutiny, greener alternatives like PoS gain favor. There are also centralization risks with PoW if too much mining power consolidates into a few hands.

Right now, Ethereum Classic's commitment to keeping PoW mining has contributed to its ardent community. But it also limits adoption for those focused on sustainability. Ultimately, striking the right balance between principles and pragmatism will determine if PoW remains a strength or weakness. A hybrid model with PoW and PoS could offer a potential middle-ground.

Should You Buy Ethereum Classic (ETC) in 2023?

2023 is shaping up to be another uncertain but potentially positive year for the cryptocurrency markets. In this environment, Ethereum Classic presents an intriguing investment case for investors to consider. While not without risks, ETC has key factors that could fuel growth next year.

First, as a popular and established coin with strong fundamentals, ETC has staying power. Its community remains devoted and development continues. Investor interest is also likely to return to the crypto space if macro conditions improve. With a sub-$20 billion market cap, ETC has room to capture more market share.

However, weighing the bull case is ETC's reliance on PoW mining. Regulatory headwinds, environmental concerns, and security risks exist. ETC also faces fierce competition from Ethereum and other chains. But its first-mover advantage in PoW smart contracts is an edge.

On balance, Ethereum Classic deserves consideration as part of a diversified crypto portfolio in 2023. Its risk/reward profile stacks up well at current prices around $16. Of course, only invest what you can afford to lose and be prepared for volatility. Upside potential remains if adoption grows while downside is limited from these levels.