Ethereum fees on the rise again, surpasses $300

The cost of using the Ethereum network has skyrocketed to insane levels, thanks to the latest meme coin craze.

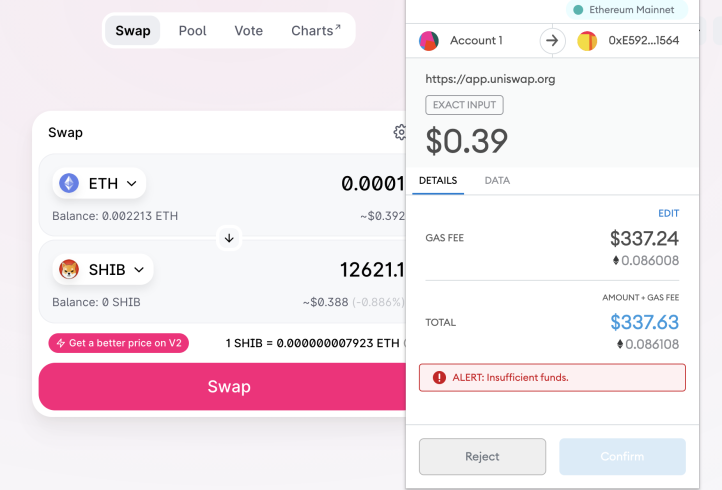

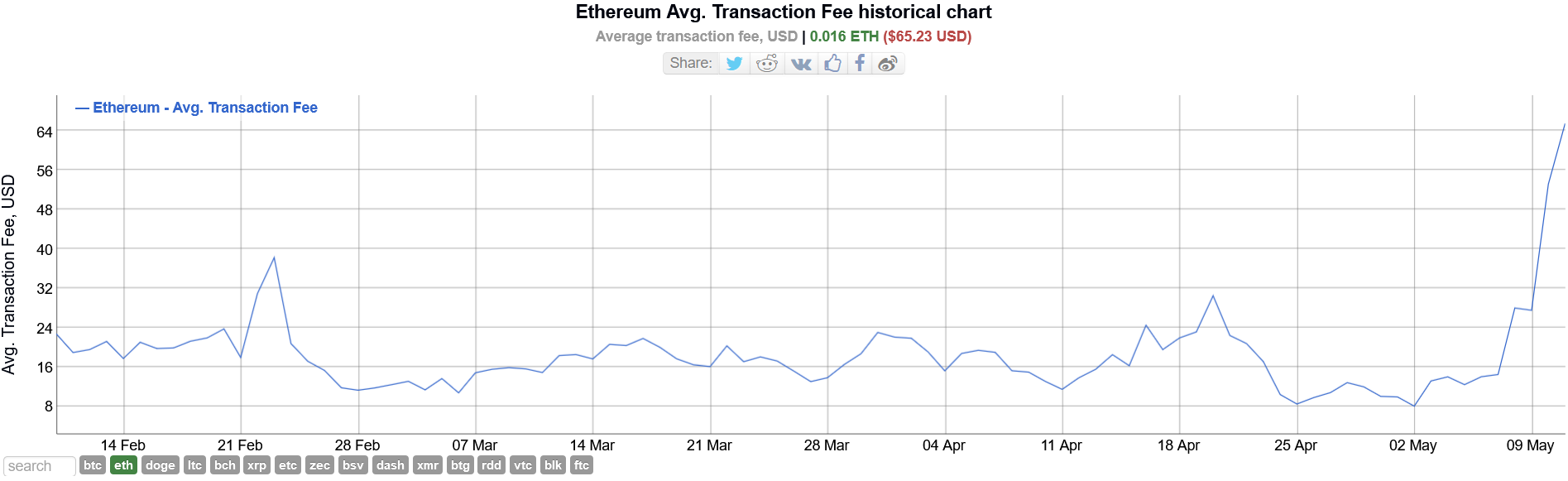

In the past week, Ethereum network fees have climbed by 470%, eventually reaching a record high on May 11. As seen in the image below, a single swap transaction costs more than $300. Average transaction fees have also spiked to new highs.

Data on Bitinfocharts shows that the average transaction fee on the Ethereum network fell to around $12 this time last week. Sadly, while community members were celebrating the lower fees reportedly introduced by the recent Berlin upgrade, the network quickly became congested following the latest Dogecoin and Shiba Inu craze.

As of press time, the average transaction fee on the Ethereum network was $65.23. The new value dwarfs February’s numbers when the transaction fees nearly reached $40.

As already noted, the numbers from Bitinfocharts are a mere representation of the average cost of using the network. Other operations such as token swaps and smart contract interactions can cost significantly higher in terms of gas fees. For instance, Eth Gas Station reports that the average fee for performing a token swap on Uniswap currently sits at $200, with fees going as high as $240. Similarly, adding or removing liquidity from a DeFi smart contract costs up to $210.

Meme coins are taking over

Trustnodes, another crypto news site, asserts that the high gas fees and network congestion is being fueled by the meme token craze initiated by Dogecoin. They wrote:

The reason for this congestion seems to be some ‘meme’ tokens that are probably just organized opportunistic pumps and dumps.

Beyond Dogecoin, which has dominated crypto news for the past few weeks, a new meme coin is taking center stage. Shiba Inu (SHIB) is one of the major culprits that are putting pressure on the Ethereum network. The project describes itself as a “Dogecoin killer.” Shiba Inu is up by 36,585.89% and has even been listed on Binance. In less than a week, SHIB has pumped by over 1,400%, but it appears that the dump has already begun.

A quick look at CoinMarketCap’s “recently added” tells a tale of the number of pump and dump projects that are hitting the crypto scenes. These so-called rallies are reminiscent of the pump and dump patterns of ICOs in the 2017/2018 Bull Run. And it always turns out bad for individuals who FOMO in.