Ethereum gas fees on the rise following price rally

In what appears like a replay of the Bull Run of 2017, Ethereum transaction fees are on the rise following recent price actions. According to data from Glassnode, Ethereum gas fees hit a new all-time high of $898,000 in a single day. This is coming as the price of the digital asset broke past $1,000 in the last 24 hours.

#Ethereum fees in the past hour (24h MA): $898,000 USD – All Time High.

— glassnode (@glassnode) January 4, 2021

Chart 👉 https://t.co/CDX7ubaw8E pic.twitter.com/g61U7phCAI

For some context, “gas” is the fee paid to complete a transaction on the Ethereum network. The higher the gas, the faster a transaction on the Ethereum network gets executed. By default, gas fees increase as the pressure on the Ethereum network grows.

Following the Bull Run of 2017 and the advent of CryptoKitties, Ethereum transaction fees went through the roof. A similar scenario is playing out due to the recent increase in the price of Ethereum, making it more expensive to send funds on the Ethereum network.

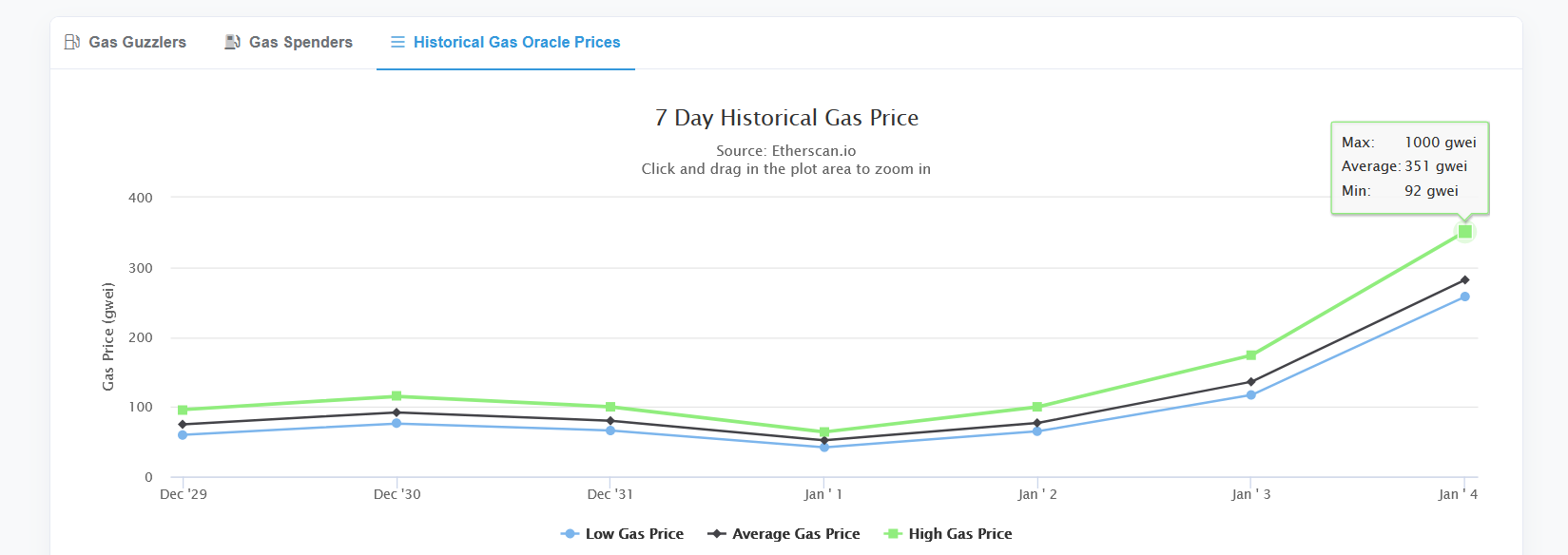

In the last 4 days, gas fees have increased by almost 400%. According to Etherscan.io, a block explorer and analytics platform for Ethereum, gas fees rose from an average of 64 Gwei on January 1 to 351 Gwei as of press time - up by over 500%. Higher gas fees are also on the rise. People are paying more to confirm their transactions quickly.

High fees and congestion have always been a problem with Ethereum and a host of other blockchains. However, these fees become insignificant for large transactions. On the flip side, it becomes unbearable and time-wasting when it comes to small payments.

Check our guide of the most promising crypto