How does Binance Margin Trading work?

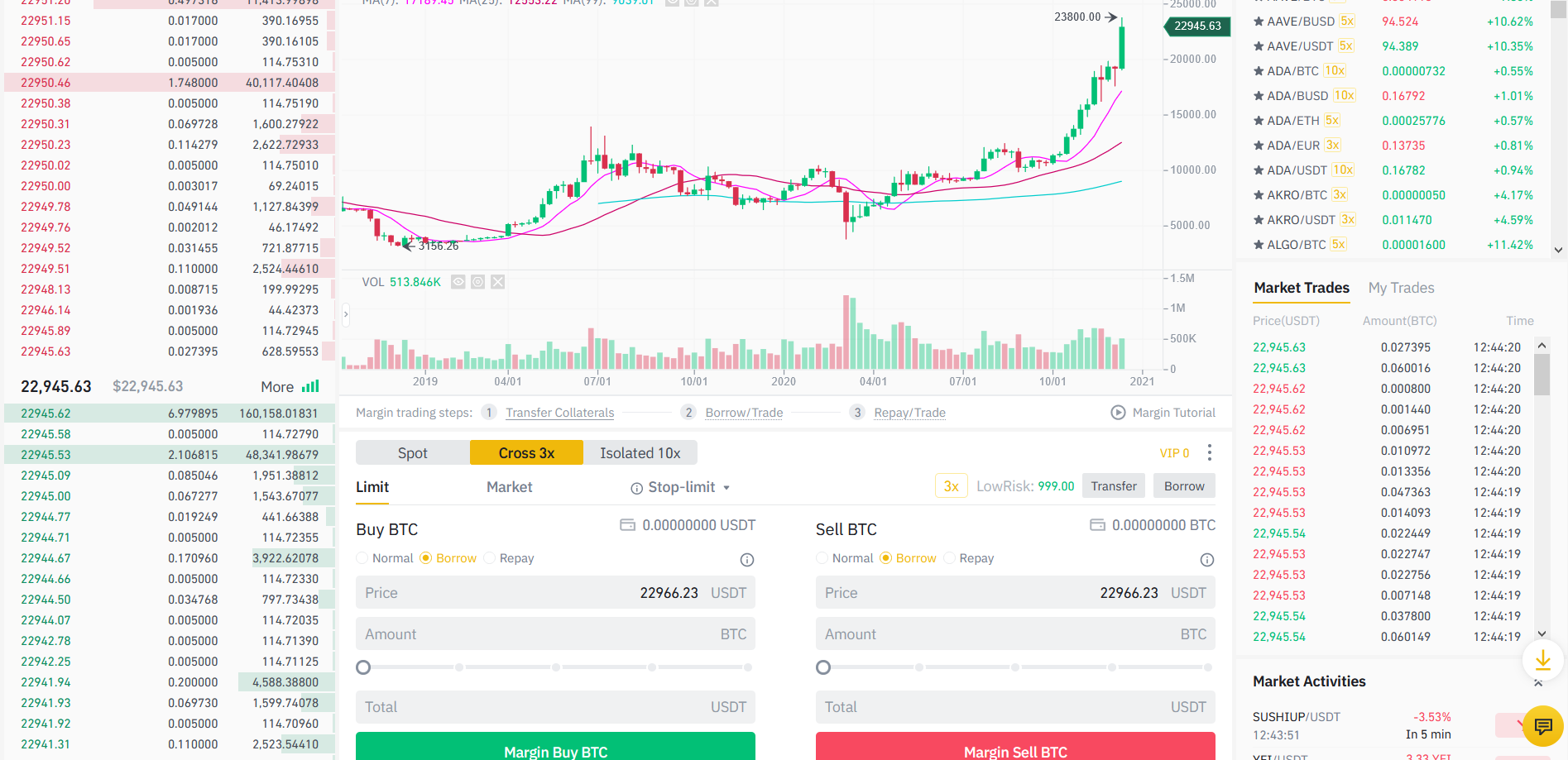

It is no news that the cryptocurrency space is very volatile. For instance, no one expected Bitcoin to quickly rise from less than $20,000 to over $23,000 in less than 24 hours on December 17, 2020. However, with such volatility comes the opportunity to double or even triple your investment. On the flip side, you can also quickly lose your investment. In traditional finance, margin trading is one of the ways traders can make more profit without having the required capital. Thankfully, the same opportunity is available in the cryptocurrency space.

In this article, I’ll share with you how Binance margin trading works, its advantages and disadvantages, and some tips to help you step up your game.

Without further ado, let’s get it on…

Binance Margin Trading

Margin trading is a method of trading assets (which in this case are crypto assets) using borrowed funds from a third-party. This gives you the ability to enter into positions larger than your current account balance. In comparison with spot trading that allows you to make profits from only your current crypto assets, margin trading allows you to amplify your trading results by giving you access to more capital.

Whilst investment brokers act as the third-parties in traditional markets, the borrowed funds in cryptocurrency margin trading are provided by other traders. In return for providing liquidity, these traders earn interest based on market demand for margin funds.

Binance margin trading is a game-changer in the cryptocurrency space. Beyond top-tier digital assets such as Bitcoin, Ethereum, and Ripple, Binance margin trading allows you to leverage trading on several other highly-volatile altcoins. Traders can Margin Long or Short based on the direction of the market.

How Does Binance Margin Trading Work?

As in other markets, when a margin trade is initiated on Binance, you will be required to commit a percentage of the total order value. Your initial investment is known as the “margin”. For Binance Margin Trading, the leverage is limited to 3x or 10x. So, you can open a $30,000 trade by depositing $10,000 as collateral.

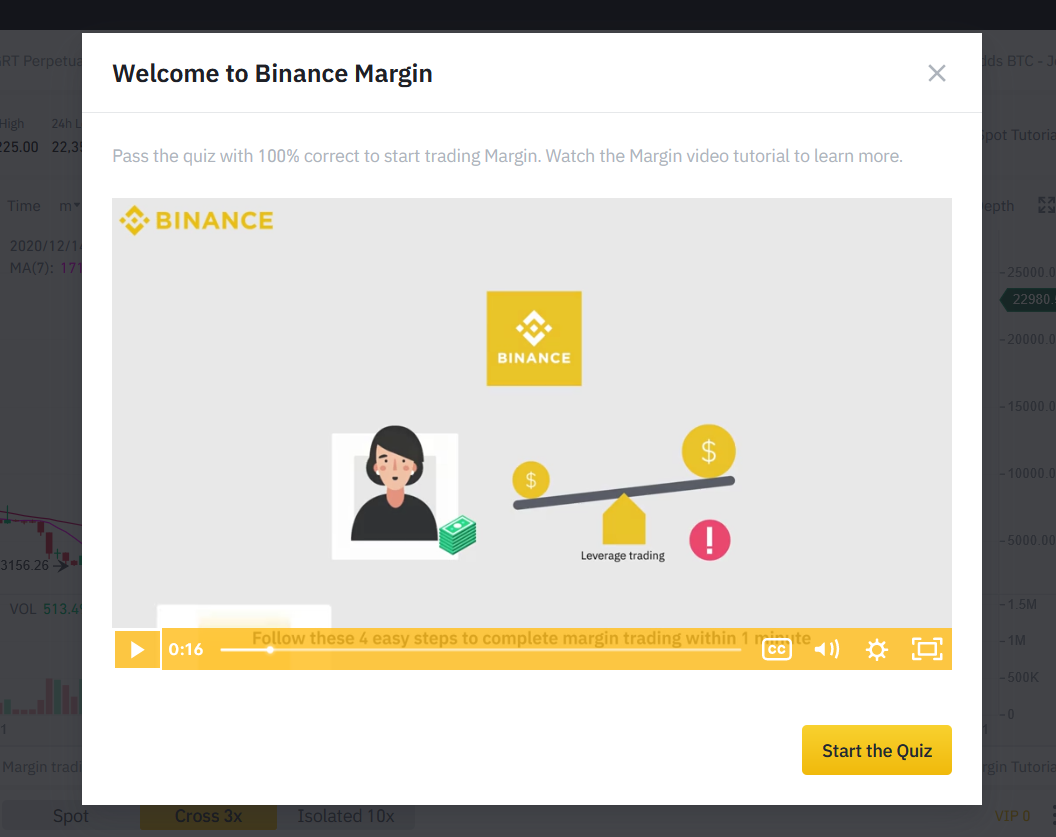

To get started on your margin trading journey on Binance, you will need to take a short quiz after seeing a video that explains how the process works. This is a good thing if you ask me. Here’s a quick rundown of the video:

- Select the cross margin or isolated margin tab from the trade section, and then open the corresponding margin account.

- Transfer the required collateral from your spot wallet to your margin wallet.

- Place an order and borrow funds automatically.

- Once your trade is fulfilled, place an order to repay the borrowed amount.

Pros

The primary advantage of Binance margin trading is the ability to make larger profits from a significantly smaller investment. It is also a useful tool in diversifying your portfolio. As a trader, you can open several long or short positions with relatively smaller amounts of investment capital.

Finally, considering how slow blockchain networks can get during massive price actions, margin trading makes it easy for you to quickly open a position without having to wait for large transfers or network confirmations.

Cons

As for its cons, margin trading is potentially risky. It can exponentially increase your losses in the same way it can increase your gains. Losses can exceed your initial investment, unlike in regular spot trading. This is why margin trading is not recommended for total beginners. And if you decide to get your hands dirty, don’t forget to deploy proper risk management strategies and risk mitigation tools, such as stop-limit orders.

5 tips for crypto margin trading

To wrap up this article, here are 5 tips that will help you in your journey.

- Start small: There is no use putting all your investment into a margin trade. It is very risky and could leave you in serious losses.

- Understand technical analysis: While I agree that the crypto market runs on speculations, you must also learn to back it up with charts. As a beginner, before you make any margin call based on market reactions, understand what the charts say. Don’t fall victim to wild speculation.

- Make Stop Loss your friend: This is the ultimate risk management tool in margin trading. Peradventure your trades begin to move in the wrong direction while you are asleep; a stop loss can help you prevent significant losses.

- Spread out your purchase orders: Don’t go all in at the same time. Instead, take positions at different times in the day or week. This lowers your risk and helps you maintain a more balanced portfolio.

- Have a strategy and stick to it: Before you margin trade make sure you have a plan. Develop a strategy that works for you and stick to it.

So, there you have it. This is how Binance margin trading works.