Instagram to start testing NFTs this week

Meta-owned Instagram will start testing out NFTs on its platform this week, CEO Mark Zuckerberg revealed.

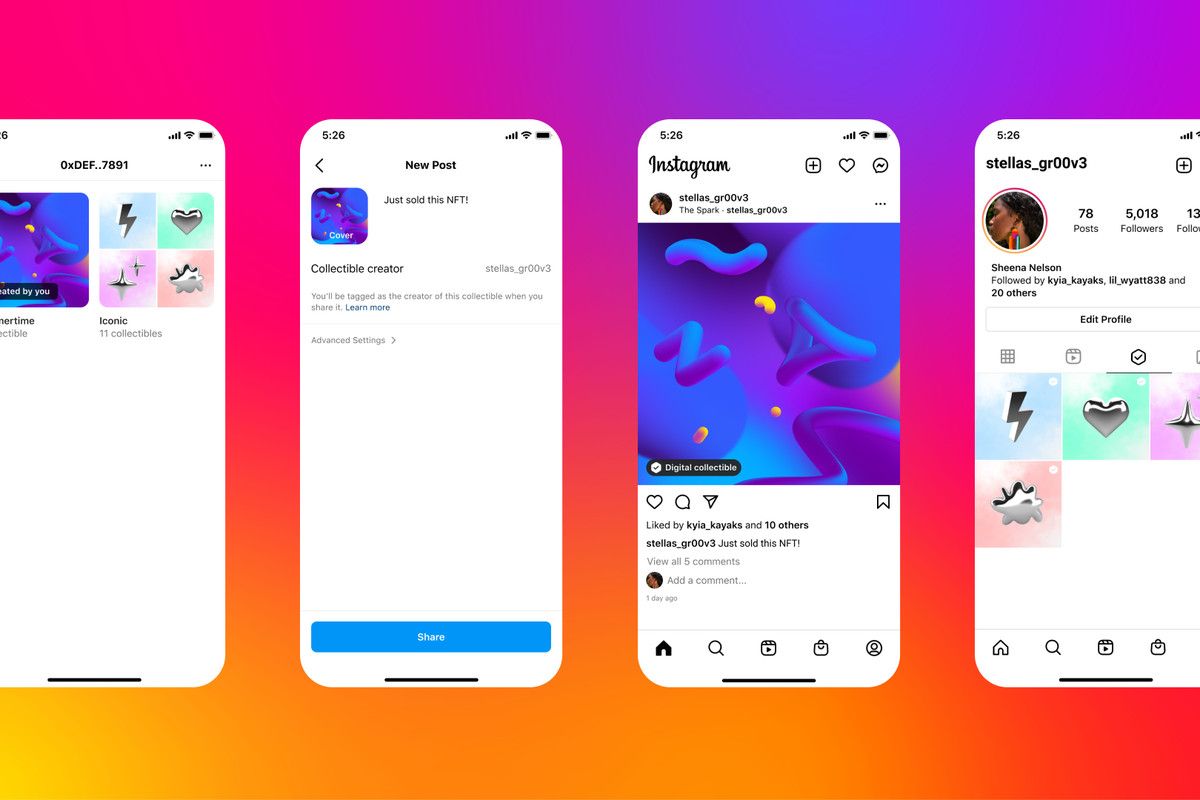

In a Monday video, Instagram head Adam Mosseri confirmed that a small group of US users would be able to display NFTs on their feeds, stories, and messages. He said:

This week we're beginning to test digital collectibles with a handful of US creators and collectors who will be able to share NFTs on Instagram. There will be no fees associated with posting or sharing a digital collectible on Instagram.

At launch, Instagram will support digital collectibles on Ethereum and Polygon blockchains. Support for Flow and Solana NFTs will be enabled later. Furthermore, the compatible third-party wallets will include MetaMask, Trust Wallet, and Rainbow, with support for Phantom, Coinbase, and Dapper coming soon.

Meanwhile, Zuckerberg noted that the social media platform plans on taking its NFT integration a step further. Users will be able to display augmented reality NFTs on their IG stories, a featured that will be powered by Spark AR. He goes on to add that Facebook will roll out similar functionality on its platform in the near future.

Back in January, BTC PEERS confirmed that Meta was working to enable support for NFTs on both Instagram and Facebook. The latest NFT test comes months after Twitter enabled NFT profile picture for its premium users.

Other social media platforms like adult-oriented subscription-based platform OnlyFans have also jumped on the NFT bandwagon. Similarly, YouTube CEO Susan Wojcicki hinted at the possibility of embracing web3 technologies, including NFTs, as a way to help creators make money.

Check our guide of the most promising crypto