Institutional investors now control up to 1.6 million BTC, about 8% of Bitcoin’s total supply

According to data from Bitcoin Treasuries, companies that hold bitcoin on their balance sheets now control up to 1,660,473 BTC. This accounts for almost 8% of Bitcoin’s total supply.

The said data covers the portfolio of publicly traded companies, private firms, governments, and ETF-like offerings. However, it does not account for lost or inaccessible bitcoin, meaning that the percentage of usable coins could be higher.

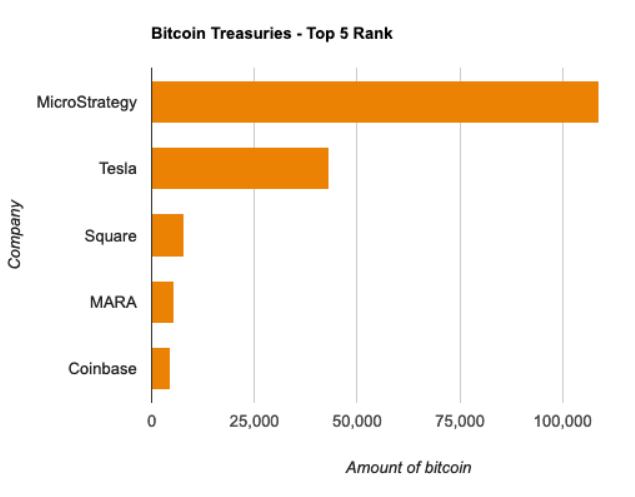

Leading the pack is Michael Saylor’s MicroStrategy. The business intelligence firm holds 108,991 BTC (about 0.5% of the total supply). Interestingly, the firm’s Bitcoin portfolio has grown to represents 75% of its total market caps.

MicroStrategy has the highest allocation both in absolute terms and relative to its market cap. The firm purchased an additional 3,907 bitcoin for $177 million on Aug 24, BTC PEERS reported.

Tesla is in second place. The electric car company still holds the 43,200 bitcoin it acquired at the beginning of 2021.

Square with just above 8,000 BTC, Marathon Digital Holdings with 5,425 BTC, and Coinbase with 4,487 BTC occupy the next three spots.

Most of the companies that bought Bitcoin did so between 2020 and 2021, and it could be that the corporate Bitcoin accumulation race has just begun. More firms will likely jump on the Bitcoin frenzy as they realize the unique potential of the digital currency.

Check our guide of the most promising crypto