Lockdowns and Social Distancing: A Promising Outlook for Crypto Mainstream Adoption

Without any doubt, coronavirus has altered the everyday lives of people with growing numbers of infected cases and fatalities. For one, experts and authorities have advised us to practice social distancing. In some regions, they have imposed lockdowns to flatten the curve and get a handle on unfolding events. In turn, these directives have resulted in an unprecedented transition to the digital world, as people are forced to work from home and rely more on the internet for basic human needs and socialization.

How then does this world-altering turn of events affect the crypto industry? Is the current global gravitation towards digitization favorable to crypto technology? If so, how can proponents capitalize on this trend and drive a new phase of mainstream adoption?

The Crypto Industry Has Thrived Amid the Coronavirus Pandemonium

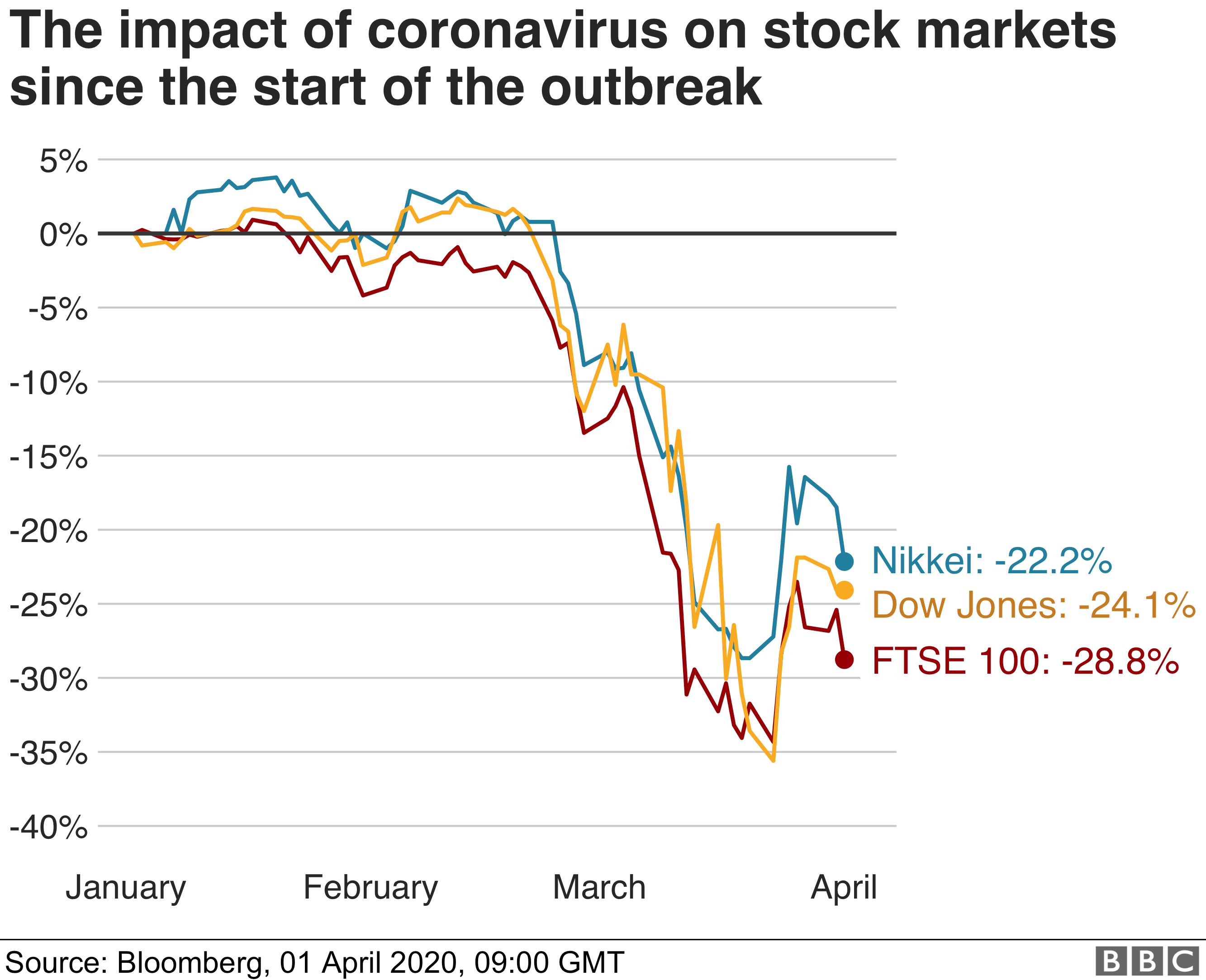

It is no more news that the global economy is under a cataclysmic level of strain as a result of the lockdowns imposed in major economic hubs of the world. Some project that the fragile state of the economy is an ominous precursor to a global recession that already threatens the livelihood of millions in the US alone.

However, amid the economic uncertainties brewing in a majority of industries, the crypto space has continued to thrive. Why is this so? Apparently, this industry is entrenched in the digital landscape, as crypto-related services and products are predominantly solutions based on models promoting the concept of digitization. From the beginning, crypto itself is a digital money devoid of inputs from central authorities or middlemen. Therefore, even if the banking sector buckles under the full impact of the COVID-19 pandemic, cryptocurrency should continue to exist and retain its value.

Also, it is difficult to envision the explosion of internet activities without considering its domino effect on the crypto industry. According to a report by Deutsche Bank on the adoption trend of the internet and blockchain, there is a strong correlation in the global acceptance of both technologies. In essence, blockchain adoption has recorded an uptrend as seen in the internet acceptance graph for the last decade. Likewise, the demand for liquid assets and the strain it has put on the fiat money supply chain might force central banks with existing crypto projects to speed up the testing and issuing of cryptocurrencies.

Whichever way you choose to look at it from, the growing demand for crypto and blockchain technology is inevitable. As such, it doesn’t come as a surprise that some firms have begun to position themselves to capitalize on the forthcoming crypto buzz.

Companies That Try To Help Mass Adoptions Of Crypto

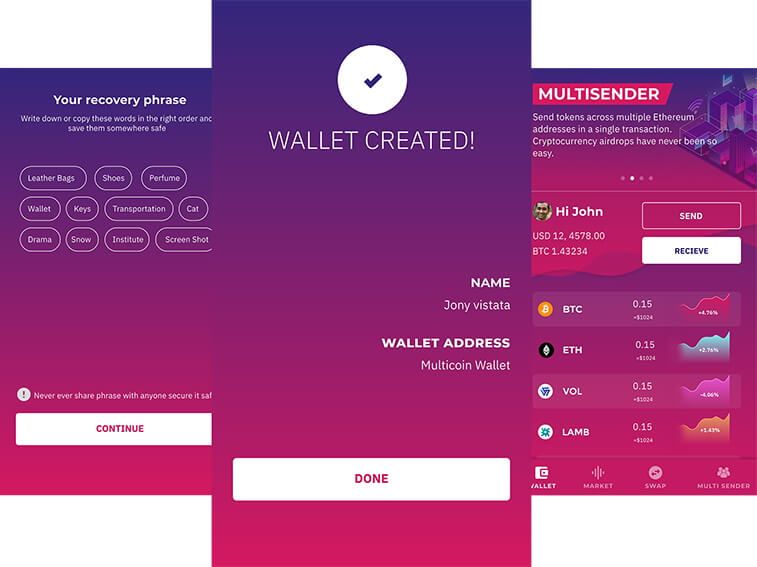

One such entity is Lead Wallet. The Lead Wallet team is aware of the major stumbling block of mainstream crypto adoption and the most effective way to bypass it. Its narrative encapsulates the inability of less technologically inclined individuals to own cryptocurrency without encountering snags and complex systems. For crypto to attain global acceptance, wallet providers must find a way to create sophisticated crypto gateways without foregoing simplicity.

Hence, the Lead team plans to introduce Lead Wallet, a decentralized multi-crypto storage infrastructure that has found the perfect balance between security and simplicity. In essence, the Lead wallet embodies features required for instantly sending, spending, receiving, and swapping and exchanging cryptocurrencies while upholding a decentralized framework. Already, Lead has started working on implementing its plan by taking advantage of the IEO and private funding mechanisms with the LEAD Token IEO sales coming up on Emirex on the 20th of April.

Another well-known company that can help crypto adoption is Binance. This company has always been at the forefront of the crypto adoption narrative since it launched in 2017. In response to the projected demand for cryptocurrency, Binance recently announced its crypto debit card service. Users can pay for services and buy products with the visa-enabled crypto debit card just as they would with a traditional bank card. With this feat, the exchange platform has ensured that its users have access to one more flexible crypto gateway on the Binance ecosystem.

There’s also OKEx that has continued to showcase its innovative power, regardless of the uncertainties brewing in the global economy. Recently they have launched a Convert Small Balances to OKB feature for less than 0.001 BTC balances Since the start of the year, the exchange has embarked on various partnership and development initiatives that have culminated in its emergence as a force to reckon with in the bitcoin options market. Following its successful stint in the crypto derivatives market, OKEx has moved to partner with TradingView to make its data available to the latter’s budding community of traders. In addition to this, this partnership will allow users to trade on OKEx directly from the TradingView platform.

In another report that supports the validity of the increased demand for crypto, Coinbase announced that it has processed over $200 million worth of transactions on its retail platform in its two years of operation. In other words, crypto holders are open to the idea of paying for products and services via crypto payment methods. Besides, the juggernaut has taken the crypto adoption mantra to new heights by integrating various DeFi-based lending protocols with the Coinbase Wallet app.

Final thoughts

The social distancing measures brought about by the spread of the coronavirus present new opportunities for industries at the forefront of the push for global digitization. Consequently, the crypto space, which is a prominent proponent of this narrative, will thrive during these trying times, as evident in the various developments listed in this article. If there’s a time where cryptocurrency will eventually get massively adopted, it should be this year.