Long-term Bitcoin investors are hodling hard, while new investors take profits

According to data from on-chain analytics provider, Glassnode, 95% of recent Bitcoin trades involve accounts that were last active less than three months ago. On the flip side, long-term holders are aggressively accumulating the digital asset.

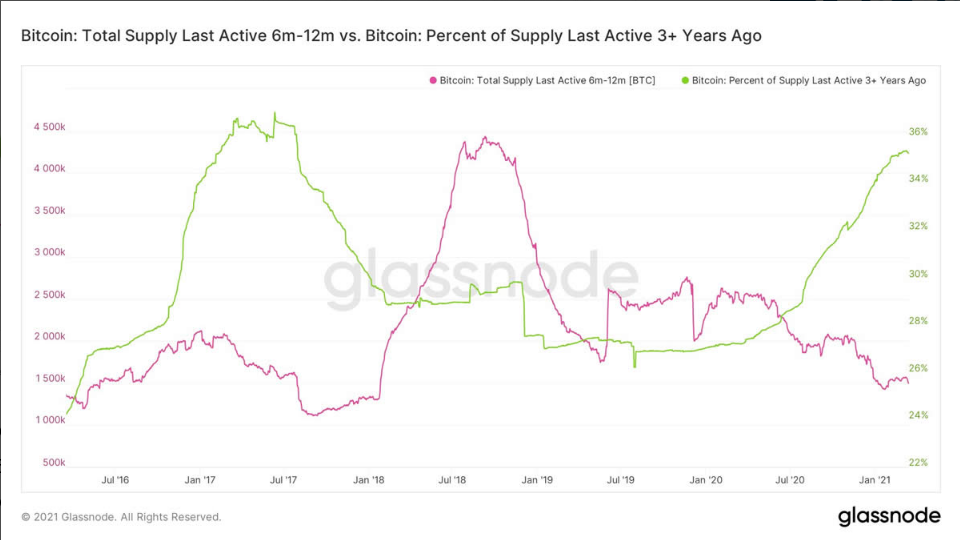

Glassnode in its “The Week On-Chain” report disclosed that only 5% of spent outputs involved accounts that are more than 90 days old, an indication that relatively “newer coins” are actively selling. Meanwhile, another data firm the first shows that the number of addresses that have been hodling Bitcoin for at least three years has significantly increased in the past six to 12 months. Short-term holders, on the other hand, have been taking profits since the beginning of 2020.

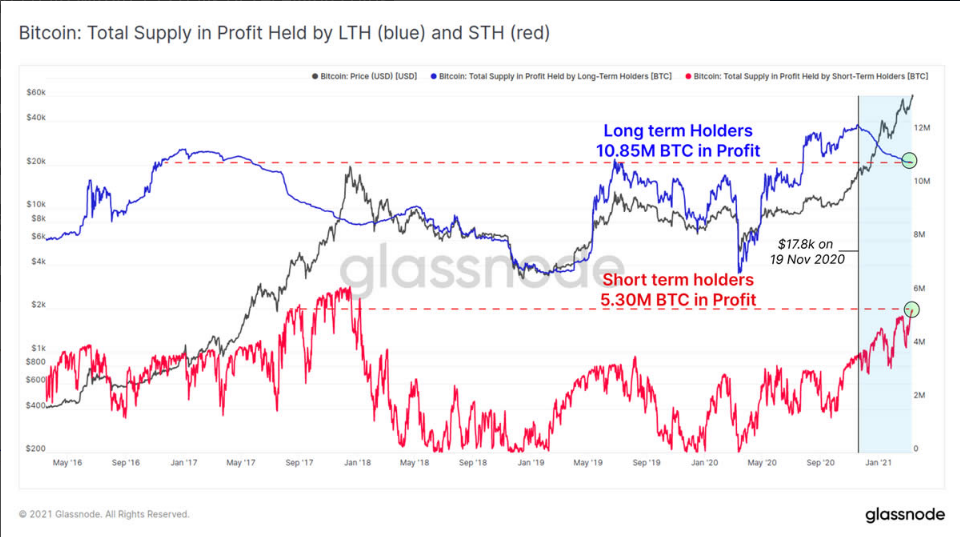

“Long-term Holders” are wallets that have held their digital assets for more than five months, while “Short-term Holders” have either received coins or moved their on-chain Bitcoin holding in the past five months.

According to the report, while long-term holders have a greater knowledge of Bitcoin, actively buying the dip and selling the high, short-term holders are more likely to frequently move value across exchanges.

Glassnode asserts that about 58% of Bitcoin’s liquid supply (equivalent to 10.85 million Bitcoin) is currently sitting on profits based on when they were last moved on-chain.

Check our guide of the most promising crypto