New Bitcoin buyers are not panic selling, Glassnode report says

Blockchain analytics firm Glassnode has shared research about the selling behavior of new Bitcoin buyers. According to the report, Bitcoin buyers in 2021 did not panic sell during the correction.

It is not usual for crypto traders to try to panic sell to cut their losses. However, the morale of Bitcoin hodlers remained high despite the sharp market corrections. After setting an all-time high above $58,000 on February 20, Bitcoin prices sharply fell to $45,000 within 48 hours, BTC PEERS reported.

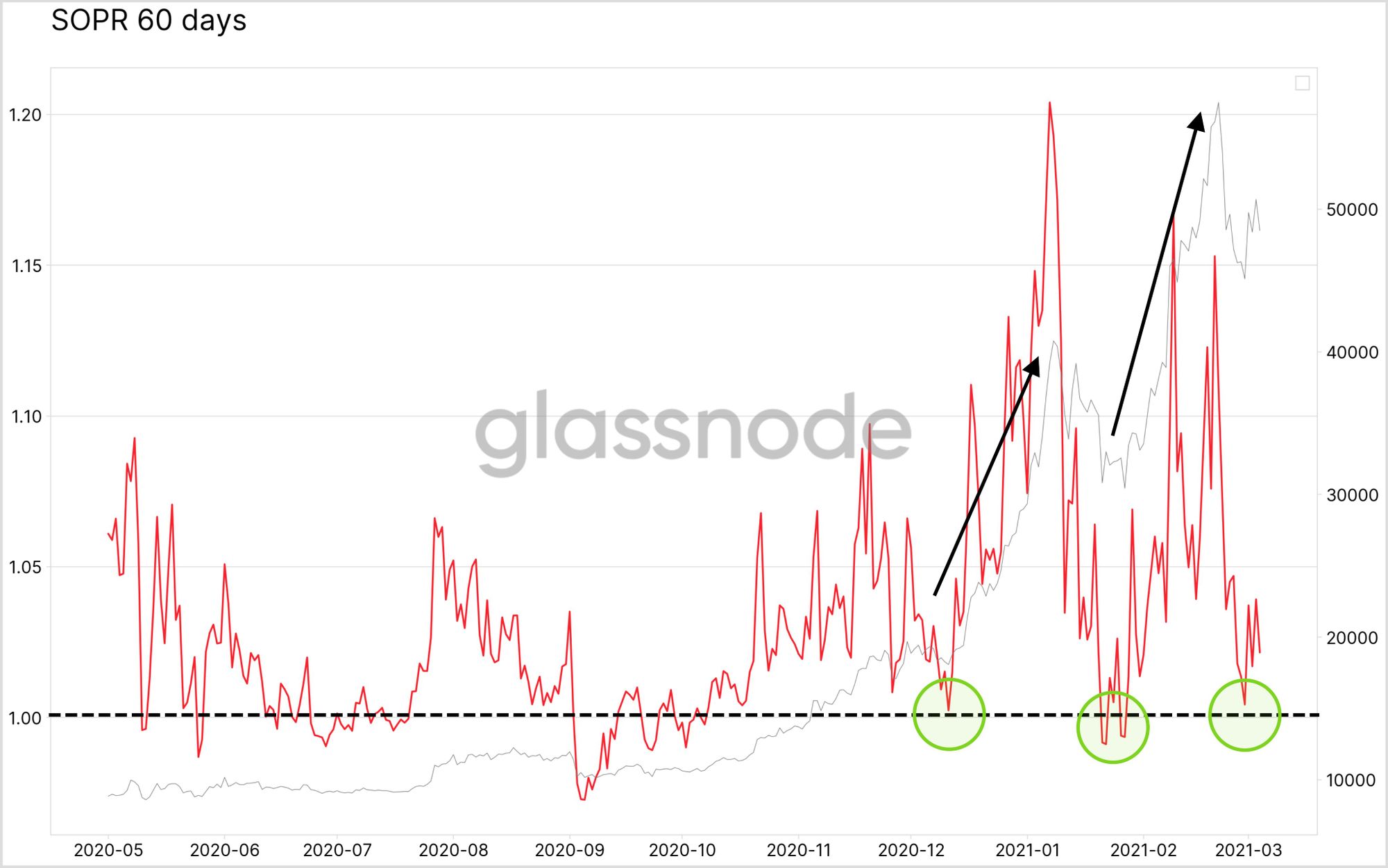

Glassnode shared a chart showing the Spent Output Profit Ratio (SOPR). The SOPR is calculated by dividing the selling price by the paid price. If the SOPR of a digital asset is above 1, it implies sellers are profiting. During bear markets, the value falls below 1 as liquidations pile up, with losses outweighing gains. Glassnode remarked:

This indicates a high HODLing conviction from new investors, as coins that were bought in 2021 did not move at a loss during this last dip.

The only logical explanation for such a behavior is that these new classes of investors believe in the long-term potential of Bitcoin and are not ready to sell at a loss or take short-term profits.