NFTs are built on a “House of Cards,” software engineer warns

Jonty Wareing, a software engineer has sounded the horns of warning amid the ongoing NFT frenzy. He shared some rather interesting findings on non-fungible tokens (NFTs).

According to him, contrary to popular belief that non-fungible tokens (NFTs) will last forever on the blockchain, a number of factors can terminate their existence.

The software engineer scrutinized the blockchain data of two prominent NFTs. He discovered that they contained either a URL address or an IPFS hash. Put differently, the existence of these tokens is tied to the continued operations of the marketplaces where they were purchases. Wareing tweeted:

The NFT token you bought either points to a URL on the internet or an IPFS hash. In most circumstances, it references an IPFS gateway on the internet run by the startup you bought the NFT from. Oh, and that URL is not the media. That URL is a JSON metadata file.

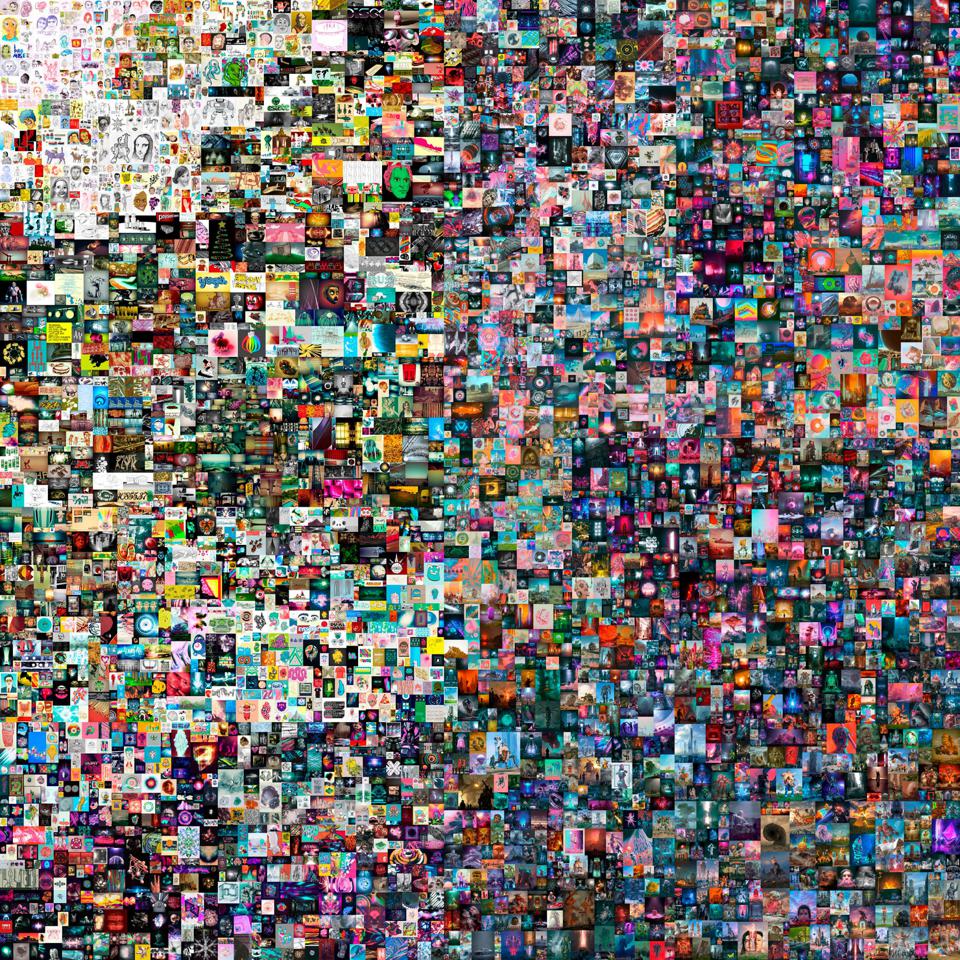

Wareing opines that NFTs are built on a very shaky foundation. He examined two of Beeple’s NFTs – “CROSSROADS” and “The First 5000 Days.” Both collections sold for millions of dollars. While CROSSROADS generated $6.6 million in February this year, “The First 5000 Days” raked in over $69 million via the Nifty Gateway marketplace.

According to Wareing, the NTF token for CROSSROADS s a JSON file being hosted on Nifty Gateway servers. What this means is that the token might cease to exist if the marketplace stops trading. If this happens, the token could become worthless.

That file refers to the actual media you just “bought,” which in this case is hosted via a @cloudinary CDN, served by Nifty’s servers again. So if Nifty goes bust, your token is now worthless. It refers to nothing. This can’t be changed.

In the case of Beeple’s “5000 Days,” the NFT points to an IFPS hash, which then references a JSON metadata file linked to an IFPS gateway on the Makersplace, another NFT marketplace.

In both cases, the buyers of these tokens will no longer be able to prove their ownership if these NFT marketplaces go out of business. Wareing asserts that the industry is built on a “house of cards,” predicting that every NFT sold so far will eventually become “broken” within the next ten years.

Right now NFT’s are built on an absolute house of cards constructed by the people selling them. It is likely that _every_ NFT sold so far will be broken within a decade. Will that make them worthless? Hard to say.

Check our guide of the most promising crypto