PrimeXBT Research: Volatility Ahead As Critical Bitcoin ETF Decision Looms

The month of October isn’t even halfway over, and the leading cryptocurrency by market cap, Bitcoin, is already back near local all-time highs set earlier in the year. Bitcoin’s dramatic bull run came to a screeching halt in April at around $65,000, crashing back to $28,000, where a recovery began.

Now, Bitcoin price is back at just below $60,000, and a potential Bitcoin ETF approval is potentially just around the corner. The speculation alone has caused FOMO into BTC and prices to soar.

In a new PrimeXBT research report, analysts warn that volatility is ahead of either way – up or down – depending on the outcome of this critical Bitcoin ETF approval decision. Making things even more interesting, the United States SEC issued a tweet referencing a Bitcoin Futures-based “fund,” which could hint at a possible approval just days away.

Bitcoin Back At $60K: What Are The Factors?

Over the last several months, Bitcoin price action had a high timeframe correction, taking the cryptocurrency’s value down by more than 50% in just a couple of weeks. The shocking move resulted from extensive negative news coming out of China, including FUD, bans, and a crackdown on BTC mining that crushed the cryptocurrency’s hash rate.

Several Bitcoin technical indicators showed that although the correction was severe, the bull market wasn’t over. On-chain metrics show that BTC supply on exchanges is now at the lowest levels historically, along with illiquid coin supply – essentially saying that any coins currently held aren’t on exchanges and are instead held by diamond hands that won’t sell until $100,000 or more.

With no supply, high demand, and both bullish fundamentals and technicals, Bitcoin is already back at final resistance at $60,000. Bitcoin never closed a weekly candle above that level and only spent under ten days in total above it before correcting. It is here where a trend defining decision will be made.

Reports Say Bitcoin ETF Approval Possible

A new PrimeXBT research report highlights the potential impact of a Bitcoin ETF approval or denial before the month of October is over. VanEck, ProShares, Invesco, Valkyrie, and Galaxy Digital all have proposals up for approval before the clock strikes midnight on November 1. Past denials have resulted in sharp declines for Bitcoin, which could result in a double top formation and narrative.

An approval, however, could cause serious FOMO in Bitcoin, unlike ever before. Either way, PrimeXBT warns that traders and investors should prepare for potential volatility no matter the outcome, without commenting on a direction.

All eyes are on this possible inflection point, but given the bullish technicals and fundamentals, the only thing standing in the way of an approval and new all-time highs would be a denial from regulators. Interestingly, however, just ahead of these decisions being made, an official SEC Twitter account shared a bulletin regarding Bitcoin Futures-based “funds,” which could be in reference to a Bitcoin ETF, also called an exchange-traded “fund.”

How To Trade The Bitcoin Volatility With PrimeXBT

In terms of what traders can do, it is time to prepare for just about any scenario. Setting stop losses is a must. Bitcoin price is at resistance, so that means the typical move is to go short or at least hedge. However, when Bitcoin is this bullish, the last thing you want to do is short a trending cryptocurrency.

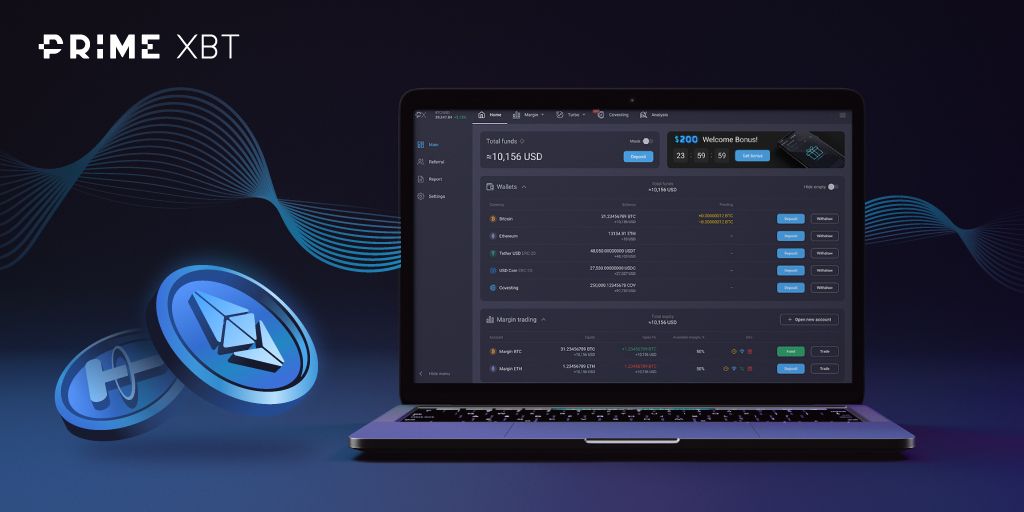

PrimeXBT is a one-stop shop for all things trading. Traders can carefully plan their positions using built-in technical analysis software, available from the same account and platform you can access copy trading with, yield accounts, or margin trading on forex, commodities, stock indices, and crypto.

Going long was best back in the low $30K or $40K zone, so be careful of entering new positions in a rush. If FOMO truly is back at this point of a bull market, there won’t be many dips left for buying. If Bitcoin does set new highs from here, a parabolic curve could be confirmed and, according to the base-building structure, could cause the price per BTC to double in the shortest amount of time.