Ronin blockchain exceeds $4 billion in all-time NFT sales volume

Despite the wobbly state of the NFT and crypto markets, the popular play-to-earn blockchain platform “Ronin” has reached a new milestone, accumulating over $4 billion in its total sales volume.

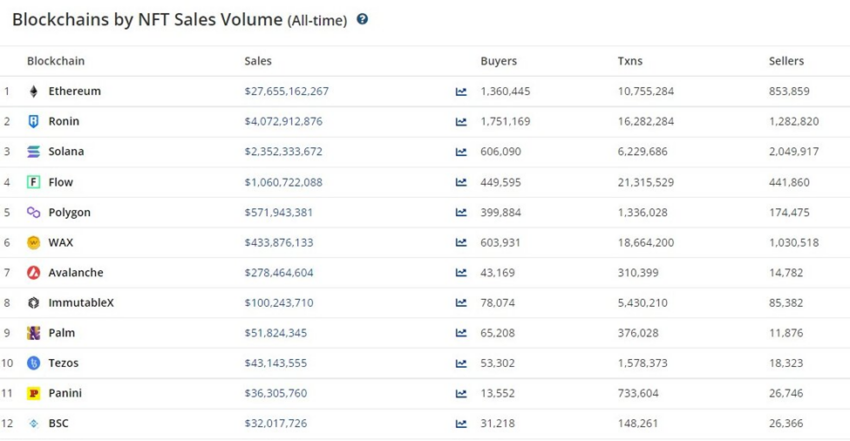

The new record places Ronin ahead of Solana, Flow, Polygon, and several others, and just behind Ethereum, which holds the top spot as the biggest blockchain for digital collectibles by all-time sales volume.

Ronin was created in 2020 by Sky Mavis, the same company responsible for popular play-to-earn game “Axie Infinity.” It was built after its developers noticed that Ethereum’s base layer was too expensive and inefficient to process the transactions needed to power the game.

As of June 5, Ronin’s total sales volume was approximately $4.07 billion, a welcome development for the platform whose native token (RON) plummeted to record lows in the May market crash.

RON opened at $3.56 when it became a crypto trading asset in January 2022. It reached an all-time high of $4.32 on the same day and witnessed a low of $0.4275 on May 27.

As of press time, the coin’s price stands at $0.47, indicating an 87% decline in the whole of 2022.

An increase in sales last August led to the chain’s spike in total transaction counts, with 305,127 unique buyers and 1,853,437 transactions. This coincided with its peak in monthly sales volume of about $848.24 million.

Ronin also made significant sales progress in July ($666.17 million), September ($518.87 million), October ($545.79 million), and November 2021 ($754.76 million), which have all contributed to the recent milestone.