Several NFT holders might be left with worthless tokens, blockchain developer opines

Victor Huang, a blockchain developer, researcher, and writer at Coin Companion has lent his voice to the ongoing NFT frenzy. Although the developer is excited about the possible use cases for non-fungible tokens (NFTs), he warned that collectors may be left with some worthless tokens.

Huang started by admitting that the NFT industry was still nascent and could swing in multiple directions. For now, the industry focuses mainly on creators, including art and music.

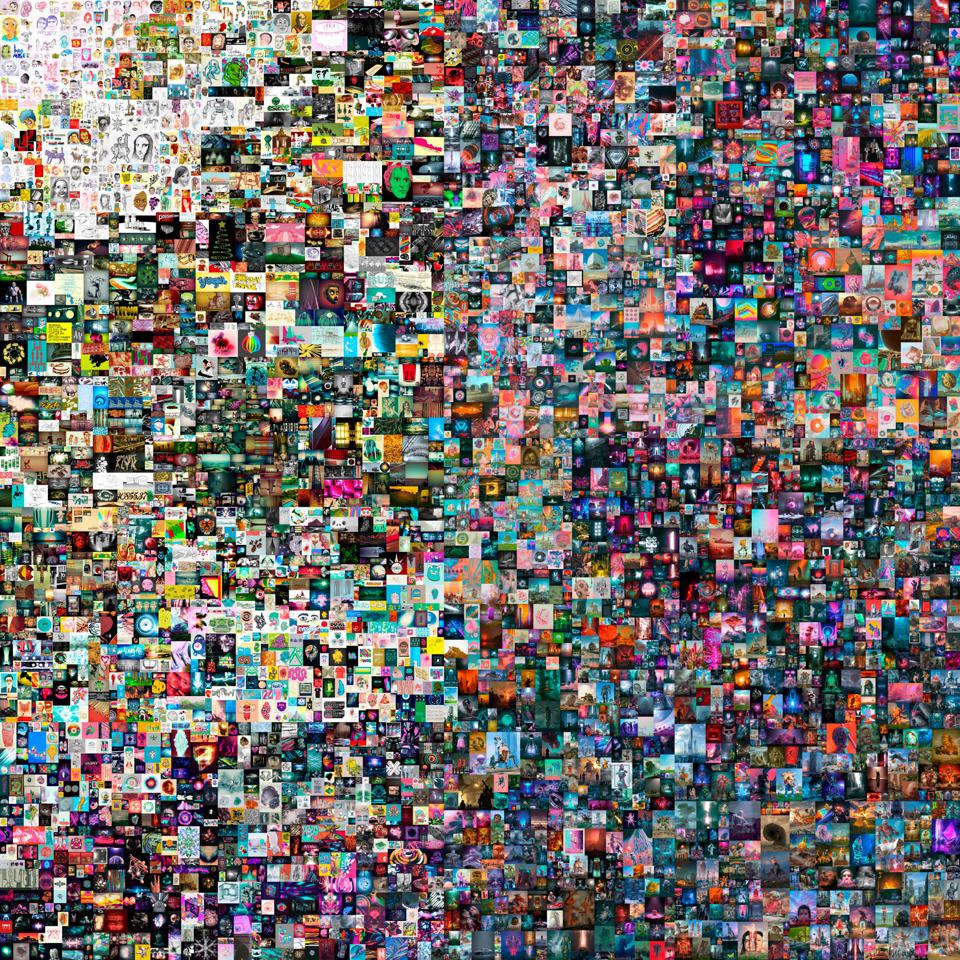

As reported by BTC PEERS, some collections have sold for millions of dollars. The developer, however, pointed out that as the industry matures, some of these early pieces may become worthless. Huang said:

As the market matures, it's likely that people will be left with digital assets that are worthless. The Non-fungibility or uniqueness of digital art may be too difficult to preserve, even with blockchain. It's pretty simple to copy digital art, whereas it's quite difficult to make an exact replica of the Mona Lisa.

Huang shares similar sentiments with Jonty Wareing, a software engineer who had earlier said that NFTs in their current form are built on a “house of cards.” Wareing revealed that contrary to popular belief that NFTs are indestructible, several factors could terminate their existence.

In closing, Huang expects NFTs to find more use cases and expand to other industries, including the tokenization of physical assets.

Check our guide of the most promising crypto