Tesla has sold most of its Bitcoin holdings

In the face of the ongoing crypto winter, Elon Musk’s electric car company, Tesla, has dumped a large percentage of its Bitcoin holdings. The company has converted approximately 75% of its Bitcoin into fiat currency.

In February 2021, a SEC filing revealed that Musk’s Tesla had invested a whopping $1.5 billion into Bitcoin a month earlier. Bitcoin quickly climbed to a then all-time high of $43,457 as news of the purchase trickled in. However, in its Q2 earnings report released on Wednesday, Tesla wrote:

As of the end of Q2, we have converted approximately 75% of our Bitcoin purchases into fiat currency. Conversions in Q2 added $936M of cash to our balance sheet.

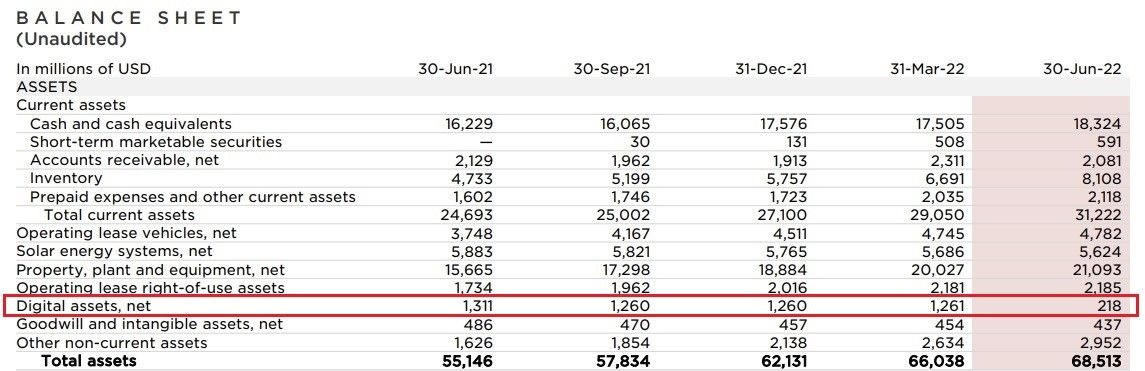

According to Tesla’s Q2 balance sheet for its net digital assets, the company now holds just $218 million worth of cryptocurrencies, down from $1.26 billion in the previous quarter. Furthermore, the company’s Q2 year-on-year operating income was affected by Bitcoin impairment.

In a call in with analysts on Wednesday, Musk explained:

It should be mentioned that the reason we sold a bunch of our bitcoin holdings was that we were uncertain as to when the Covid lockdowns in China would alleviate. So, it was important for us to maximize our cash position, given the uncertainty of the Covid lockdowns in China.

Although Musk has pegged the decision on Covid 19 lockdowns, he was quick to state that Tesla’s move was not a verdict on the future of Bitcoin. He said:

We are certainly open to increasing our Bitcoin holdings in future, so this should not be taken as some verdict on Bitcoin. It’s just that we were concerned about overall liquidity for the company, given Covid shutdowns in China. And we have not sold any of our Dogecoin.

Speaking of Dogecoin, Tesla is yet to buy the meme cryptocurrency for its balance sheet. However, it began accepting payments in DOGE for some merchandise in January. Musk had previously opined that while Bitcoin is ideal as a store of value, Dogecoin is more suitable for payments.

While Tesla has failed to disclose the number of Bitcoin it holds, Musk hinted that the company held about 42K Bitcoin last July.

Meanwhile, Tesla said in a February filing with the U.S. Securities and Exchange Commission (SEC) that it could “increase or decrease [its] holdings of digital assets at any time based on the needs of the business and on [its] view of market and environmental conditions … We believe in the long-term potential of digital assets both as an investment and also as a liquid alternative to cash.”

Tesla’s involvement with the flagship cryptocurrency has been quite controversial. In February 2021, the e-vehicle manufacturer opened its arms to payments in Bitcoin. However, in May, the decision was revoked, citing environmental concerns. Last October, Tesla also told the SEC that it may start accepting payments in cryptocurrencies again. Musk subsequently said that the company would resume accepting Bitcoin if there was “confirmation of reasonable (about 50%) clean energy usage by miners with positive future trend.”