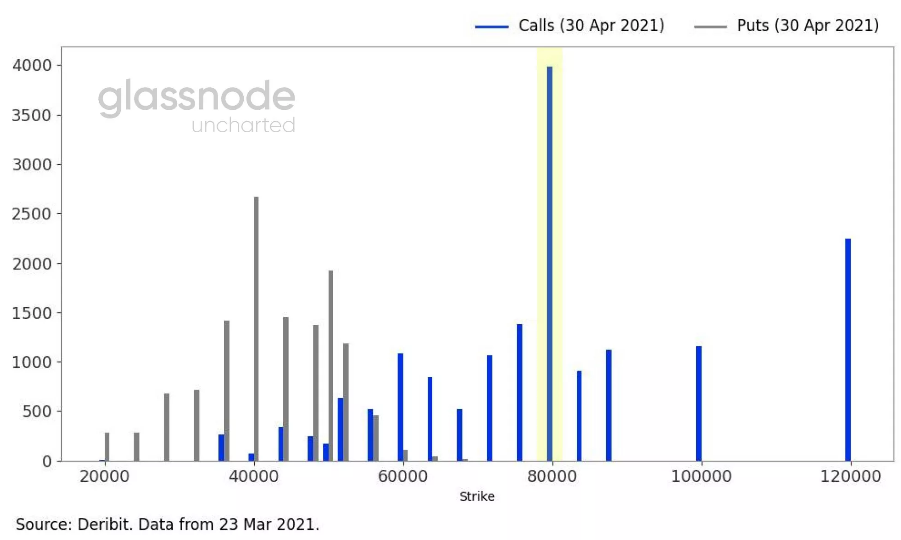

Traders bet big on Bitcoin, expect $80k by next month

Many Bitcoin traders are bullish on the price of the leading cryptocurrency. According to data compiled by analytics firm Glassnode, $80,000 is the most crowded options trade in April, with some traders betting on Bitcoin reaching $120,000. At the lower end of the scale, some traders expected Bitcoin to return to $40,000.

It is worth clarifying that many of these options contracts may not be speculative bets but a hedge of future positions or margins. The traders may not also be expecting a price of $80,000. Instead, they may be betting on the price of Bitcoin going up, and as a result, their options contract price will rise.

For the uninitiated, an options contract is a right, but not an obligation, to buy an asset at a certain price. This right is purchased at a premium, which is lost regardless of the price movement.

About 446 options were purchased for $80,000. Traders will be required to pay $1,000 for the $80k option. This is up by $300 from just a few days ago.

Generally speaking, Bitcoin has continued to welcome a lot of institutional investors and mainstream adoption. Tesla is the latest to announce that it will start accepting Bitcoin payments for its cars.