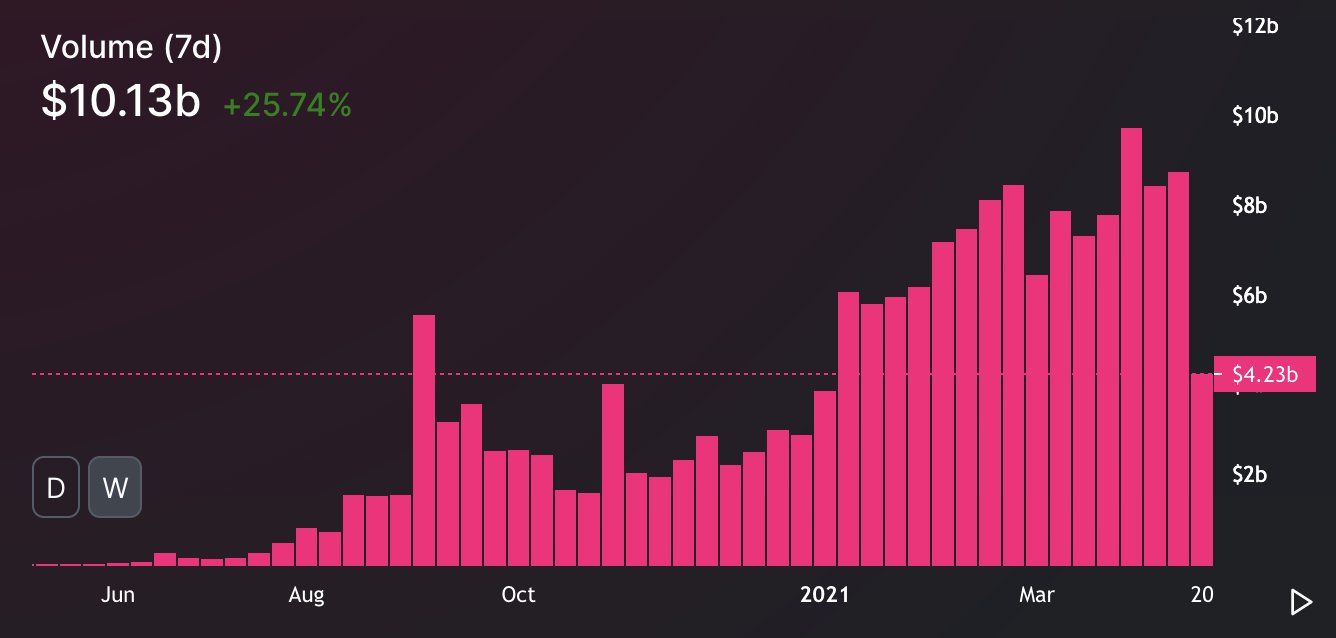

Uniswap hits $10B in weekly trading volume for the first time

Amid Ethereum’s staggeringly high transaction fees, Uniswap has surprisingly performed well in the past few months. A tweet from Hayden Adams on April 20 revealed that the decentralized protocol crossed $10 billion in trading volume for the first time.

Comparatively, weekly trading volumes were around $5 billion six months ago. Hayden’s tweet was accompanied by a chart showing a 25.7% increase in weekly plat volumes.

In addition to rising trading volume, Uniswap has also witnessed an influx of new traders. Adams believes that at the currency rate, the exchange could easily surpass $500 billion in trading volume by the end of 2021.

Uniswap is one of the key players in the DeFi marketplace. The exchange currently dominates the market, with the total value of locked assets on the protocol sitting at over $177 billion.

Analysts speculate that the protocol will continue to grow following the upcoming launch of Uniswap V3. As reported by BTC PEERS, the new version will introduce several new improvements to the platform. Some of these changes include concentrated liquidity and multiple fee tiers. And while the former gives liquidity providers (LPs) more control over the price ranges capital is allocated to, multiple fee tiers ensure that LPs are compensated in proportion to the level of risk they take on.

Check our guide of the most promising crypto