Survey: 71% of Global Finance Executives Believe Bitcoin Will Replace the USD as the Reserve Currency by 2028; 36% Point to Dollar Weaponization.

A new survey of 500 finance executives worldwide reveals strong conviction that Bitcoin will replace the US dollar as the dominant global reserve currency within 5 years.

Cryptocurrencies have come a long way from their fringe beginnings a decade ago. Dismissed as a passing fad by most, Bitcoin and its ilk are now transforming global finance before our eyes. Our new survey of 500 finance executives worldwide reveals seismic shifts underway, with strong conviction that crypto is the inevitable future.

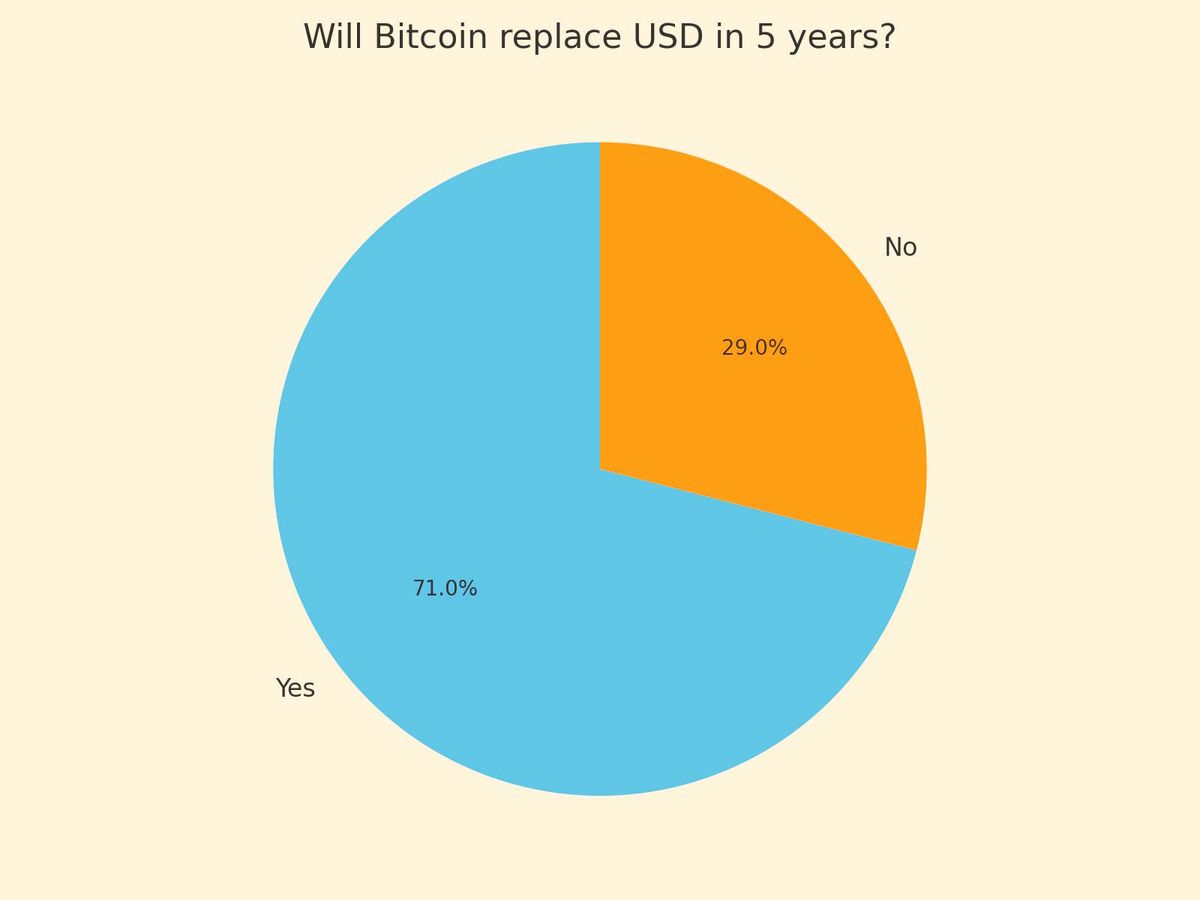

But this monetary revolution also surfaces hard questions. If Bitcoin replaces the US dollar as the dominant reserve currency, as 71% of our respondents predict within 5 years, how will that reshape economic power dynamics between nations? What unintended consequences could arise from decentralizing global finance?

This forward-looking poll captures unprecedented enthusiasm for crypto’s potential to drive positive change. But it also highlights complex transitions and risks ahead if this radically disruptive technology lives up to its promise to revolutionize money.

Key Insights

- 71% say Bitcoin will replace USD as reserve currency within 5 years.

- 51% believe boost to trade is top outcome if Bitcoin rules.

- 40% see syncing global adoption as biggest challenge.

- 36% say weaponizing dollar drives Bitcoin adoption.

- 39% predict economic power will shift toward crypto pioneers

Survey Methodology

BTC Peers conducted a comprehensive survey, aiming to gather forward-looking insights from 500 seasoned finance executives spanning fields such as banking, investments, payments, regulation, and crypto asset management. The respondents included a diverse range of professionals, from CFOs of major banks and compliance chiefs to hedge fund managers, fintech founders, and economists affiliated with global institutions like the IMF and World Bank.

Geographic distribution was:

- Americas (23%)

- Europe (18%)

- Asia (32%)

- Middle East (12%)

- Africa (15%)

We have developed qualifying criteria to ensure that all participants possess deep domain expertise in monetary policy, global finance, and the macroeconomic landscape. Each confirmed functional knowledge of Bitcoin and its underlying blockchain technology. The survey captured a representative sample across regions and roles to yield nuanced perspectives on opportunities and risks ahead.

Participants were informed that aggregate survey data would be publicly reported for market insights. However, individual selected quotes in the article would remain anonymous. Survey questions were randomized and optional demographic questions were separated to avoid bias in responses. Respondents had a 2 week window to complete the survey confidentially. Data analysts screened completed surveys to exclude incomplete or disqualified responses prior to analysis, this ensured only valid data points were included.

Contact us for any questions.

71% of Finance Execs See Bitcoin Replacing USD Within 5 Years

Will Bitcoin replace the USD as the primary global reserve currency within the next 5 years?

- Yes: 71%

- No: 29%

This overwhelming confidence in Bitcoin's imminent rise reveals much about changing perceptions in the finance world. A currency adopted just over a decade ago and once dismissed as a speculative fad is now seen by many as on the inevitable path to revolutionizing the global financial order.

What explains this dramatic shift in outlook? Several factors are driving the embrace of Bitcoin's future as global reserve currency.

First, geopolitical tensions between major economies are eroding confidence in the dollar's long-term viability. With the rapid rise of China, India, and other powers, along with increased weaponization of the dollar for sanctions, the global monetary system is fragmenting. Nations urgently want an alternative reserve currency decoupled from any specific sovereign. This has propelled interest in apolitical cryptocurrencies like Bitcoin.

"The weaponization of the dollar makes a neutral global reserve imperative. Bitcoin provides an escape hatch before monetary manipulation alienates us all."

Second, rampant money printing and inflation are spurring doubts about the dollar's ability to retain value. Bitcoin's programmed scarcity offers a hedge against such debasement. Its stock-to-flow ratio will soon exceed gold's, bolstering perceptions as 'digital gold'. This is enticing many institutional investors seeking assets insulated from inflation.

Third, generational change also plays a role. Younger investors and policymakers are more open to disruptive technologies. Having grown up digital, they are innate believers in the power of decentralized networks. This demographic shift is accelerating mainstream adoption.

Fourth, Bitcoin's brand and first-mover advantage matter. Despite the proliferation of altcoins, Bitcoin dominates the crypto zeitgeist. Its prominence in the public discourse cements its status as the flagship cryptocurrency on track to revolutionize money.

However, risks remain that could derail Bitcoin's path to global reserve currency status. Regulatory uncertainty continues to plague the ecosystem. Volatility and scaling challenges could also hinder adoption. But the optimism apparent in our poll suggests these are seen as temporary roadblocks rather than permanent barriers.

"A currency should empower people, not polarize them. Bitcoin is monetary listening, not monetary lecturing. Its decentralized design may unite where national currencies divide."

The finance world once scorned Bitcoin as a fad. Now belief in its inevitability as the next global reserve currency is going mainstream. Challenges notwithstanding, our poll captures a profound shift in sentiment.

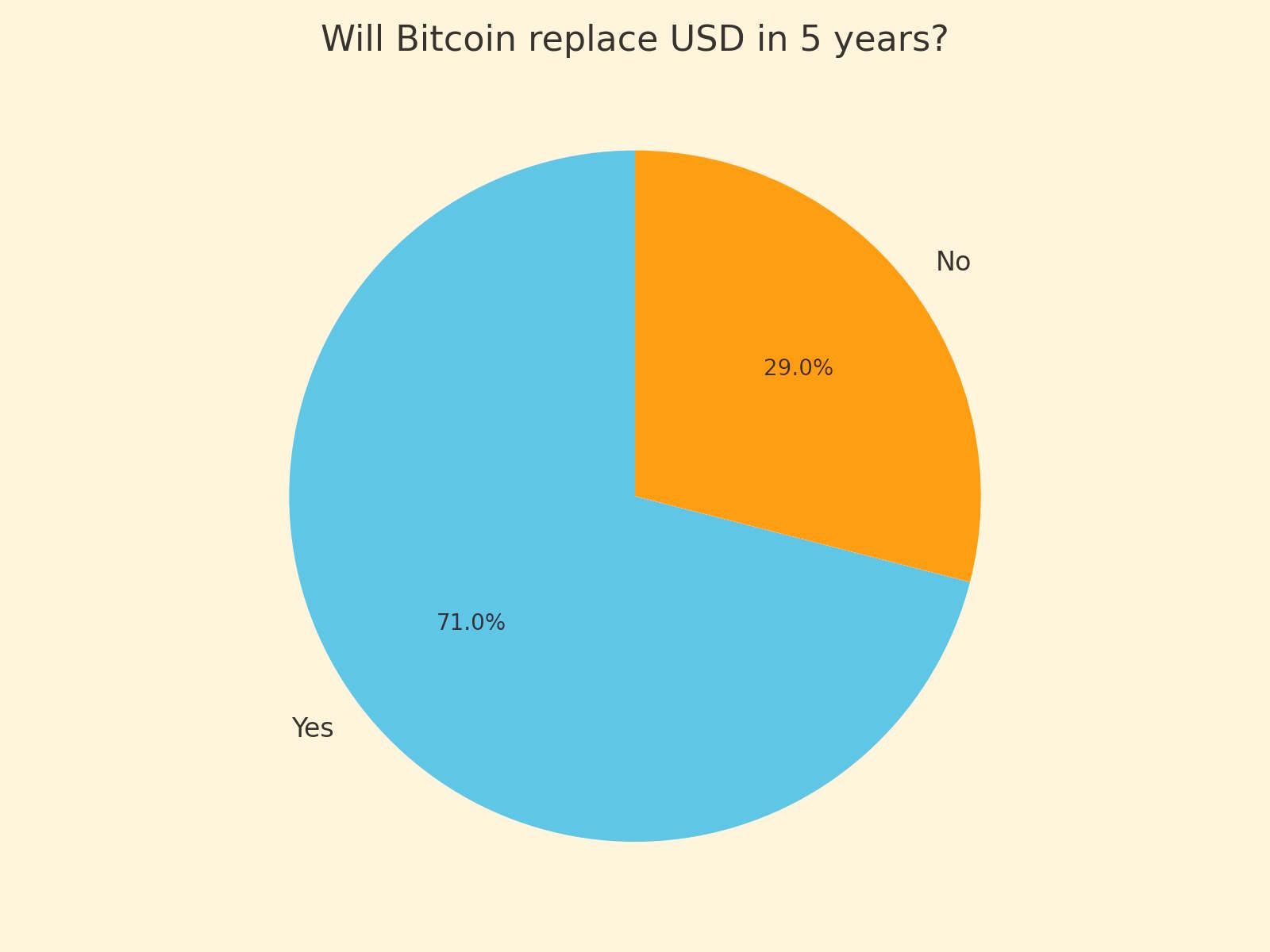

36% Cite Dollar Weaponization as Key Force Behind Bitcoin Rise

What do you believe is the main driving force pushing for the adoption of Bitcoin as a global reserve currency?

- Hedging against inflation: 11%

- Distrust in traditional financial systems: 11%

- Technological innovation: 14%

- Weaponizing of the dollar and sanctions: 36%

- New coalitions seeking independent finance systems: 28%

Our poll asked finance executives what they believe is the main driving force pushing adoption of Bitcoin as a global reserve currency.

The most common response, from 36% of respondents, was the ongoing weaponization of the US dollar and sanctions accelerating the need for an alternative system.

"Economic sanctions imposed unilaterally by the West have catalyzed a rush towards a neutral currency outside the purview of any single nation-state."

28% pointed to new coalitions between major economies, like BRICS, seeking to establish independent financial ecosystems less dominated by the US and its currency policies.

According to a senior banker in Sao Paulo: "Coalitions between emerging economies are spurring development of alternative payment systems. This is laying the groundwork to enable a transition away from the dollar."

14% felt ongoing technological innovation makes the rise of a natively digital global currency inevitable. 11% each attributed the forces driving Bitcoin adoption to inflation hedging and distrust in traditional finance. But geopolitical tensions and shifts in the global financial order were the prime factors cited.

In summary, our poll reveals a consensus that the growing weaponization of the dollar as an economic policy tool is galvanizing the push towards Bitcoin's rise. Coalitions seeking independence from the existing order reinforced by incumbent currencies like the dollar are also seen as a potent force propelling the adoption drive.

Many leaders believe the world is on the cusp of a monetary paradigm shift, with waning viability of the current US-centric model. Bitcoin and cryptocurrencies are increasingly viewed as fulfilling a growing need for a currency system divorced from imperial power dynamics and national self-interests.

How smoothly this momentous transition progresses, and whether Bitcoin lives up to its promise, remains to be seen. But the forces compelling the finance world to take its potential seriously as an alternative global reserve seem to be approaching a tipping point. This trajectory appears driven not just by Bitcoin's attributes, but also by global pressures increasingly calling the dollar's hegemony into question.

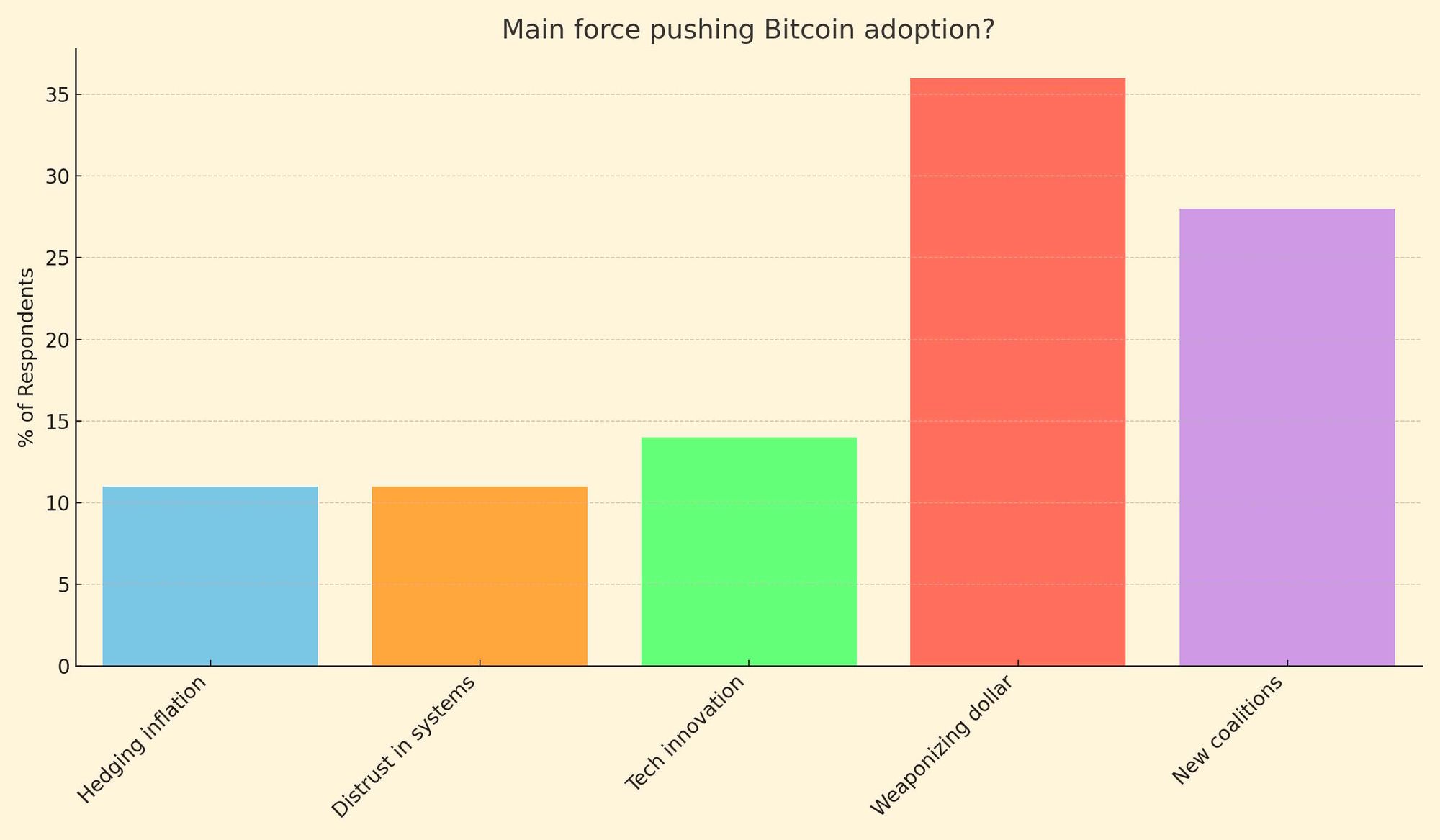

39% See The First Countries That Adopt Bitcoin Will Become Leading Nations

How do you perceive the shift in economic power dynamics between countries if Bitcoin becomes the dominant global reserve currency?

- More equitable distribution of economic power: 16%

- Shift towards technologically advanced nations: 24%

- Potential for new economic superpowers: 21%

- Rise of nations leading in cryptocurrency adoption: 39%

Our poll asked finance leaders how they perceive the shift in economic power dynamics between nations if Bitcoin becomes the dominant global reserve currency.

The most popular view, held by 39% of respondents, was that countries at the forefront of cryptocurrency adoption will gain economic power. By leading the way in crypto infrastructure, regulation and integration, pioneering nations position themselves for competitive advantage.

“Nations normalizing Bitcoin first have the opportunity to build infrastructure, capital pools, and integration to seize competitive advantage as the system scales up. It pays to be first to the digital monetary frontier."

The second most cited view at 24% was that technologically sophisticated nations are poised to leverage Bitcoin to extend their economic might. Crypto fluency may cement strength for already dominant tech powers.

However, 21% felt Bitcoin could enable new economic superpowers to emerge and challenge established hierarchies. As a VC from Nigeria noted: "Bitcoin could trigger a reshuffling where innovative developing countries overcome old barriers to rise up."

Just 16% predicted more equitable distribution of economic power. Some argued Bitcoin's open-access nature makes concentration of power less likely.

In summary, our poll reveals finance leaders predominantly believe Bitcoin's growth as the top currency will empower nations driving cryptocurrency adoption. Crypto-progressive economies are forecast to gain sway as rule-makers in the new monetary order.

There is also a strong expectation that tech-savvy countries will benefit most from Bitcoin's rise. However, some see Bitcoin enabling decentralization that dilutes traditional economic powerholds.

As one executive from Singapore concluded: "The currency of the future favors those moving fast to lead the revolution. Bitcoin will likely reward unconventional players willing to pioneer adoption."

The finance world seems convinced national economic power will increasingly flow through mastering crypto. While risks of conglomeration exist, Bitcoin's potential to disrupt traditional hierarchies adds unpredictability. The race is on to stake first-mover advantage as the monetary system eyes an epochal transition.

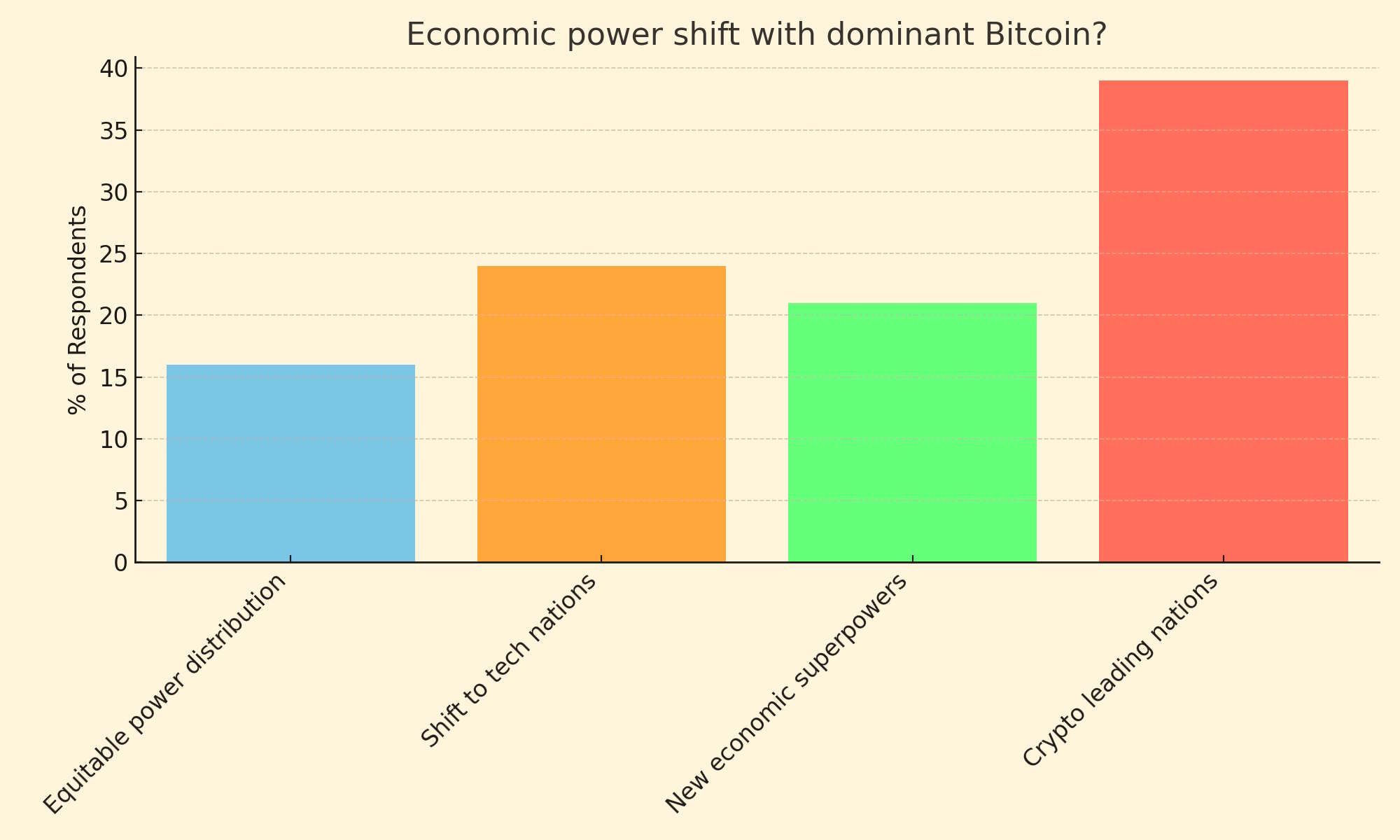

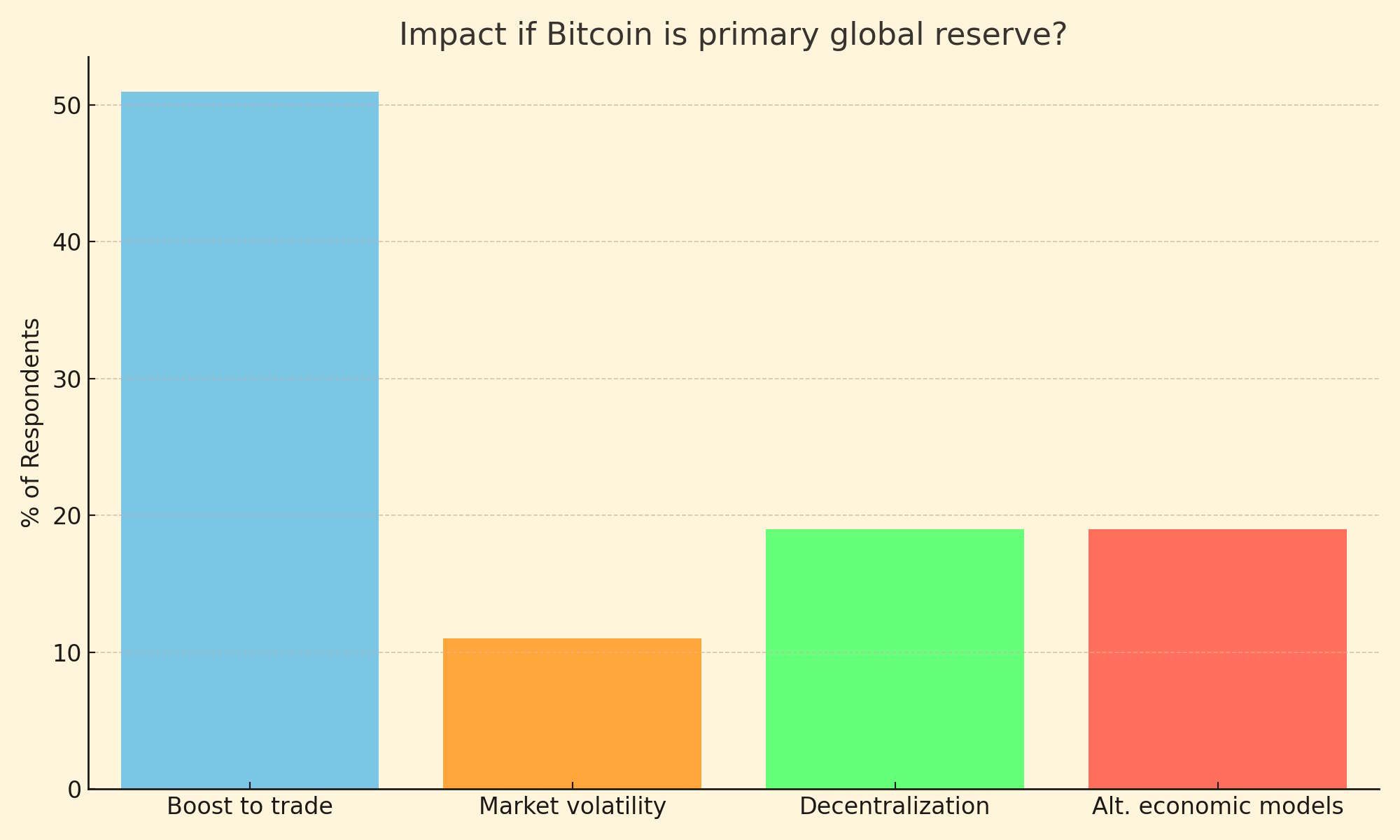

51% Say Expanded Global Trade Would Be Bitcoin's Top Economic Impact

What do you believe will be the most profound economic implication if Bitcoin becomes the primary global reserve currency?

- Boost to global trade: 51%

- Financial market volatility: 11%

- Decentralization of financial power: 19%

- Rise of alternative economic models: 19%

Our poll asked finance executives what they believe would be the most profound economic implication if Bitcoin becomes the primary global reserve currency.

The most popular response, cited by 51% of respondents, was that Bitcoin would provide a major boost to global trade. By enabling faster, lower-cost cross-border payments, Bitcoin makes international trade more efficient. Its borderless nature removes friction and levels the playing field for global commerce.

"With Bitcoin, executing global business becomes as seamless as domestic transactions. This enhanced connectivity will unlock tremendous growth in trade volumes worldwide."

The second most cited effect, at 19%, was the decentralization of financial power. With an apolitical cryptocurrency not tethered to any specific economy or institution, economic influence becomes more dispersed.

Another 19% predicted the rise of novel economic models such as decentralized finance and autonomous organizations operating outside of traditional structures. These innovations expand economic possibilities.

The least cited implication was increased financial market volatility at just 11%. Some argue Bitcoin's legendary price instability could reverberate across wider markets. But most seem unfazed by this concern relative to the transformative upside.

As one executive in Singapore noted: "Periodic volatility is a small price to pay for fundamentally reshaping finance to be more open and user empowered."

In summary, our poll indicates finance leaders see boosting trade as Bitcoin's most profound economic change as the dominant currency. Its efficiency unshackling global commerce is seen as outweighing drawbacks like volatility.

"Bitcoin is like a rebellious teenager - volatile and unpredictable but full of potential."

Many also believe decentralizing economic power creates a more level playing field. Pioneering models like DeFi illustrate Bitcoin's potential to expand financial possibilities.

While risks exist, the predominant sentiment is bullish on Bitcoin revolutionizing finance for the betterment of all. Its borderless design harbors immense latent economic utility waiting to be harnessed for the world's benefit.

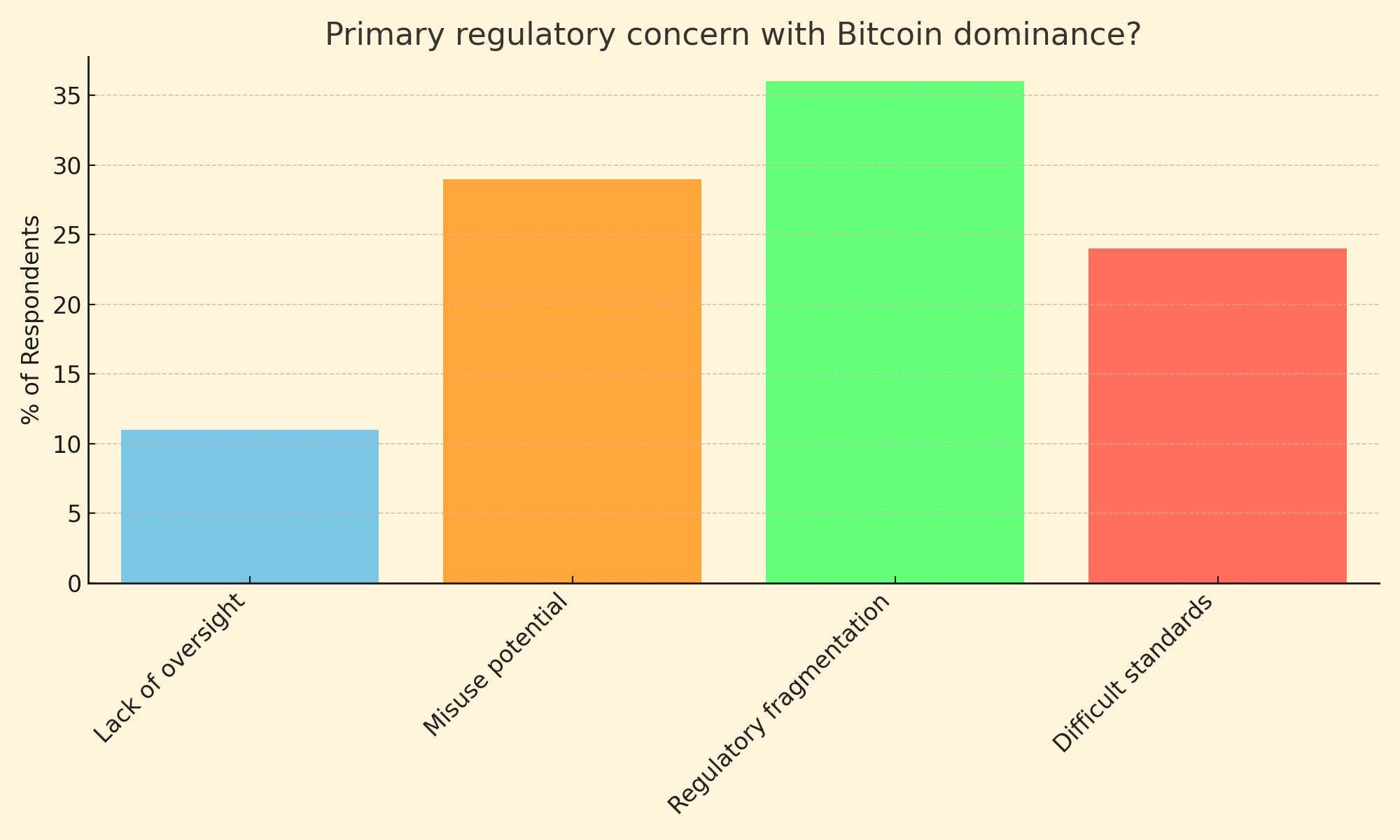

36% Cite Regulatory Inconsistency as Leading Bitcoin Worry

What's your primary regulatory concern regarding Bitcoin's potential rise as the global reserve currency?

- Lack of oversight: 11%

- Potential for misuse: 29%

- Regulatory fragmentation across countries: 36%

- Difficulty in establishing international standards: 24%

Our poll asked finance executives to identify their primary regulatory concern regarding Bitcoin's potential rise as the global reserve currency.

The most common response, from 36% of respondents, was regulatory fragmentation across different countries. If Bitcoin becomes dominant, lack of unified regulatory standards globally could hinder its stability and mainstream adoption.

"Without consistent regulations worldwide, we risk jurisdictional mismatches. This could create loopholes for illegal activity and uncertainty that undermines Bitcoin's viability."

29% cited potential for misuse as the leading worry, such as money laundering, terrorist financing and tax evasion. However, some argued stricter Know Your Customer protocols by exchanges could mitigate such risks.

24% were most concerned about difficulty in establishing international regulatory standards for Bitcoin. Achieving global alignment on oversight poses an unprecedented challenge.

According to the APAC head of compliance at an Australian bank: "The decentralized ethos of Bitcoin makes it inherently hard to regulate uniformly. But strong global partnerships will be essential to provide standardized guardrails."

Just 11% felt lack of oversight was the primary issue, suggesting confidence that prudent regulations can be instituted.

"Bitcoin should not be completely unregulated. Reasonable guardrails that don't stifle innovation are needed."

In summary, our poll indicates that regulatory fragmentation across jurisdictions is the predominant concern about Bitcoin as the global reserve currency. This reflects the complexities of regulating a decentralized digital asset on a worldwide scale.

But most leaders seem confident prudent regulation is possible. And only a small minority see lack of oversight as inherently problematic. The focus is on consistent global standards to support Bitcoin's stable growth.

With thoughtful regulations and proactive international partnerships, the finance world believes the monumental risks of Bitcoin can be responsibly managed. But unified policies will be critical to prevent problematic fragmentation or exploitation. Getting the regulatory formula right is key to realizing Bitcoin's promise without jeopardizing stability.

Conclusion

The insights from our survey make one thing clear - the age of Bitcoin is dawning. The finance world sees its ascendance to become the dominant global currency as inevitable, with 71% predicting it will replace the dollar as a reserve currency within 5 years.

But this monetary revolution is not without risks. Regulatory fragmentation, financial volatility, and unintended impacts on global economic dynamics were cited as top concerns. Proactive solutions will be needed to ensure smooth transition.

However, great optimism remains about Bitcoin's potential to unlock new paradigms for global prosperity. Lower-cost cross-border commerce, financial inclusion, and decentralized models like DeFi can empower people worldwide.

As we stand at this financial crossroads, wise leadership is essential. The technological transformation of money through crypto is here to stay. But its impact depends on collaborative governance to realize the benefits while minimizing harms.

This pivotal moment calls on us all to think big, act carefully, and partner meaningfully. With prudent guardrails and moral imagination, Bitcoin can help build a more just and equitable economic order for the 21st century. The promise awaits.

The financial veterans in our survey make clear - we have entered an era of great monetary promise, and great responsibility. The decisions we make today will resonate through history. Bitcoin's moment has arrived - now is the time to come together and steer its ascendance toward the common good.