Weiss Crypto Ratings confirms Ethereum is still the boss

The narrative that high gas fees are making Ethereum impractical to use is not new. Traders are being forced to look for alternatives in blockchains such as Binance Smart Chain. However, Ethereum’s inherent limitations do not mean it can be easily toppled, at least, not according to Weiss Crypto Ratings.

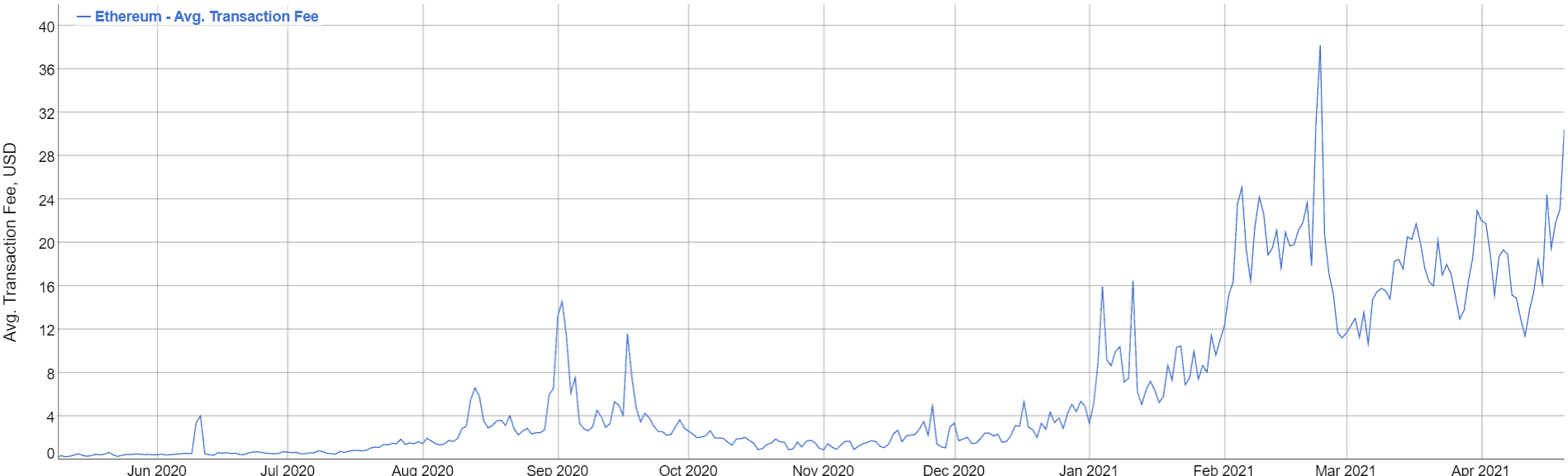

Amid Ethereum’s rising popularity and the DeFi/NFT boom, the network’s transaction fees have surged to new levels. The average transaction fee currently sits at nearly $22 after reaching an all-time high of $38.2 on February 23, 2021.

In the face of Ethereum’s rising gas fees, several alternative projects are battling to establish themselves as a better option. Some have even earned the now cliché title of “Ethereum Killer.” The real question remains whether any of these alternative projects can unseat the king of altcoins.

Experts are not sure

Weiss Ratings, a market analysis and risk rating firm, is not sure that any of the “wannabe” Ethereum Killers will be able to do the job. In a recent tweet, the crypto branch of the firm, Weiss Crypto Ratings explained that it is highly unlikely that an Ethereum Killer will emerge.

Some say that other L1s are "catching up to #ETH", but we're highly skeptical. It's the same story from 2017 where wannabe $ETH killers sacrificed all semblance of decentralization to be cheaper and faster.

— Weiss Crypto (@WeissCrypto) April 21, 2021

For clarity, L1 refers to layer 1 blockchains. These are base blockchains that handle and record transactions directly on-chain. Scaling solutions such as Bitcoin’s Lightning Network or Plasma are L2 because they process transactions differently.

Weiss Crypto Ratings is not very confident of the future of all these Ethereum Killer wannabes. They took a cue from the cryptocurrency boom in late 2017. Back then, there were several promising projects such as EOS and NEO that were praised for being Ethereum Killers. Sadly, these projects have struggled to regain their past glory despite the crypto boom of 2020 and 2021.

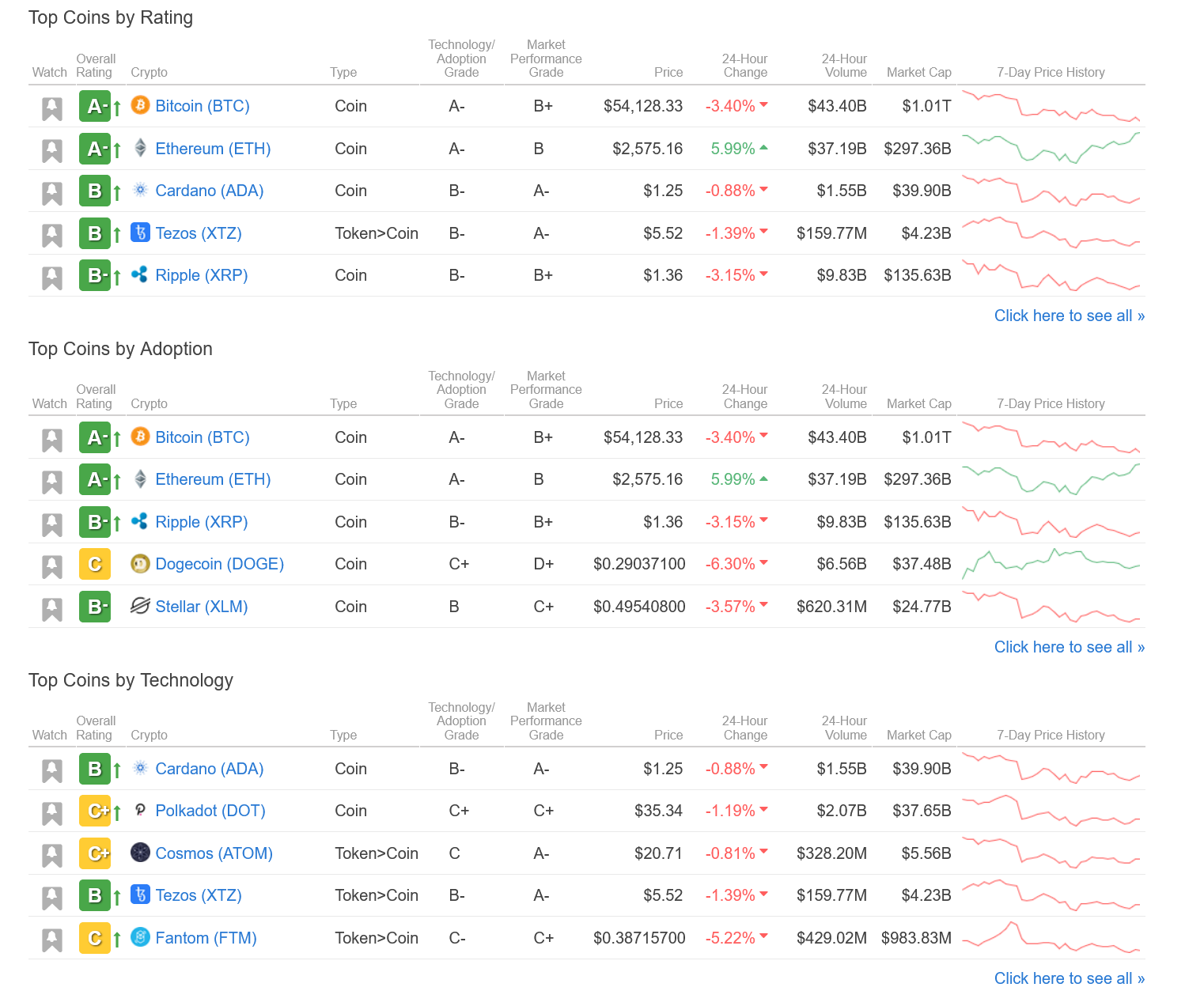

As seen in the image above, Ethereum is only second to Bitcoin on several rankings. In terms of top coins, its closest competitor is Cardano, with a B rating on technology and adoption. EOS, NEO, Polkadot, Binance Smart Chain, and Tron all have a C+ rating.

On the flip side, in terms of pure technological development, Cardano and Polkadot are far ahead of Ethereum. They have an “Excellent” rating, while Ethereum settles for a “Good” rating. Interestingly, Bitcoin’s technological development is rated as “Fair.”

Could there be an Ethereum Killer?

Contrary to the assertions of Weiss, things can change and quite rapidly. No one would have imagined that a day would come when the likes of Tesla would start accepting Bitcoin payments after the crypto winter that followed the Bull Run of late 2017. To most people, the bubble had burst.

One could argue that Ethereum was largely behind the cryptocurrency renaissance. From decentralized apps that kept the market alive during the 2018 winter to the DeFi boom of 2020, Ethereum was the bedrock. The network’s ability to process smart contracts was just the ingredient the market needed to survive.

However, in the face of the boom, Ethereum fees are becoming unbearable. The cost of executing smart contracts has also peaked.

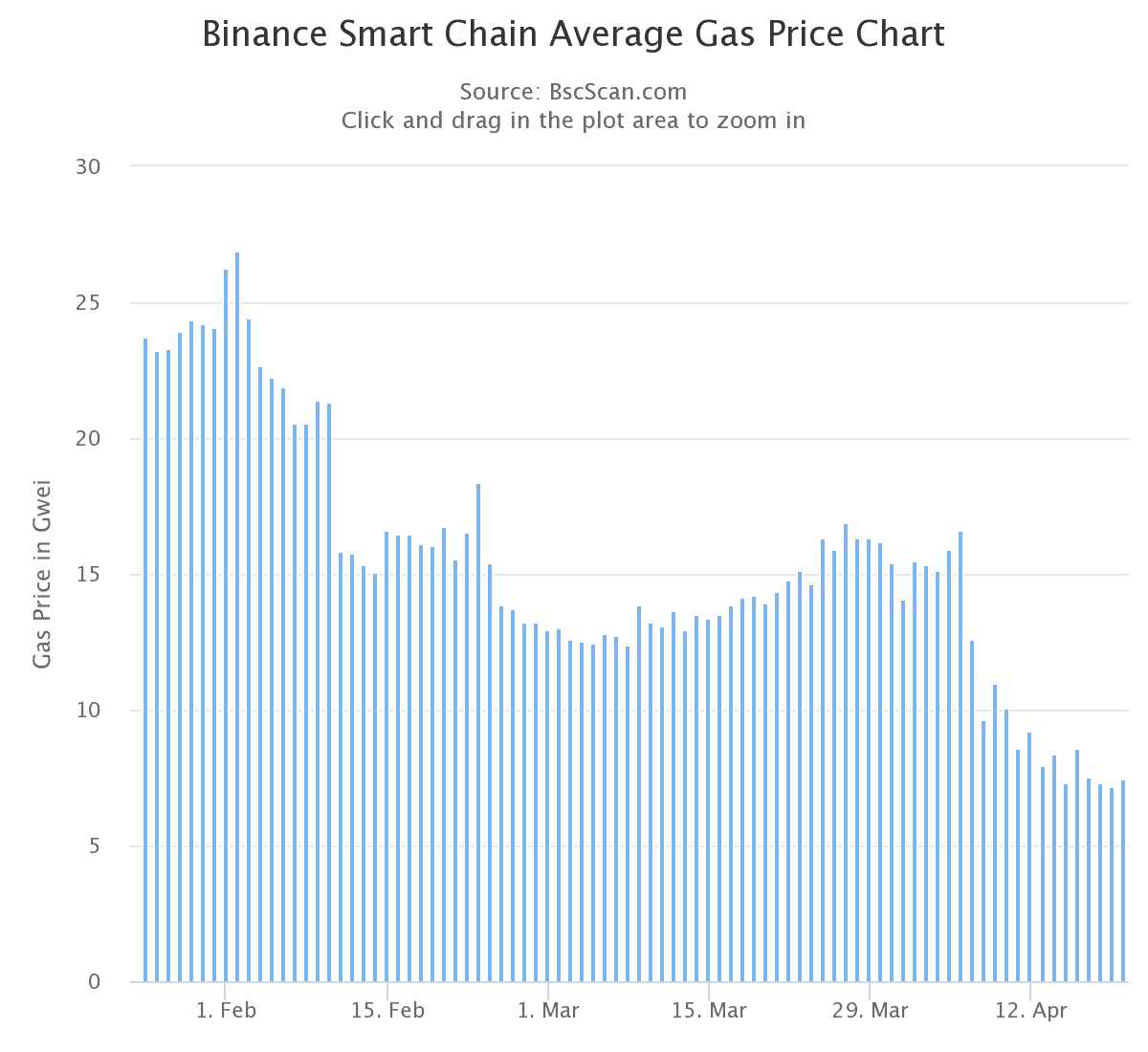

Binance seized this opportunity to consolidate its native Binance Smart Chain blockchain. Particularly, the launch of Pancake Swap, a DeFi exchange like Uniswap but runs on Binance Smart Chain, signaled an important turning point in the DeFi world. It quickly became a cost-effective option for investors who couldn’t keep up with high transaction fees.

With increased usage, the CAKE token also rose parabolically, eventually matching the TVL of Uniswap.

At the moment, Binance Smart Chain appears to be the closest competitor to Ethereum. However, one cannot be so sure. Ethereum’s transition to a Proof-of-Stake network could tilt the scales in its favor once again.