Whales buy the Ethereum dip as retail investors panic sell

The idea of “buy the dip and sell the high” is common knowledge in the cryptocurrency space. However, trying to predict the end of the dip can be difficult.

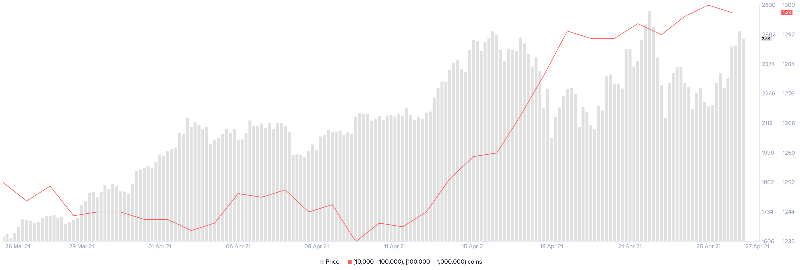

In the face of latest cryptocurrency market correction last week Sunday, many investors panicked and sold their ETH holdings. The second-largest cryptocurrency by market cap has since stabilized above a support wall following the market crash. An even more interesting revelation is the fact that “whale” investors were actively buying the dip.

Data shows that the number of whale investors has increased, and there are predictions that this could force the price of Ethereum to $3,000.

According to the Crypto Fear and Greed Index (CFGI), bullish sentiments about Ethereum dropped to very low levels. The value dropped to 27, a number that suggests “fear.” On the flip side of this negative sentiments were investors who took advantage of the crash to buy Ethereum at discount prices.

Looking at Ethereum’s supply distribution chart, the number of addresses holding between 10,000 and 1,000,000 ETH rose by 0.70% over the past week. Precisely, the network welcomed nine new whales.

While the addition of nine new whales may appear insignificant at first glance, whale addresses hold between $25 million and $2.5 billion in ETH. The high net worth of these individuals could easily translate into billions of dollars.