The Combination of AI and Finance: Suggested directions

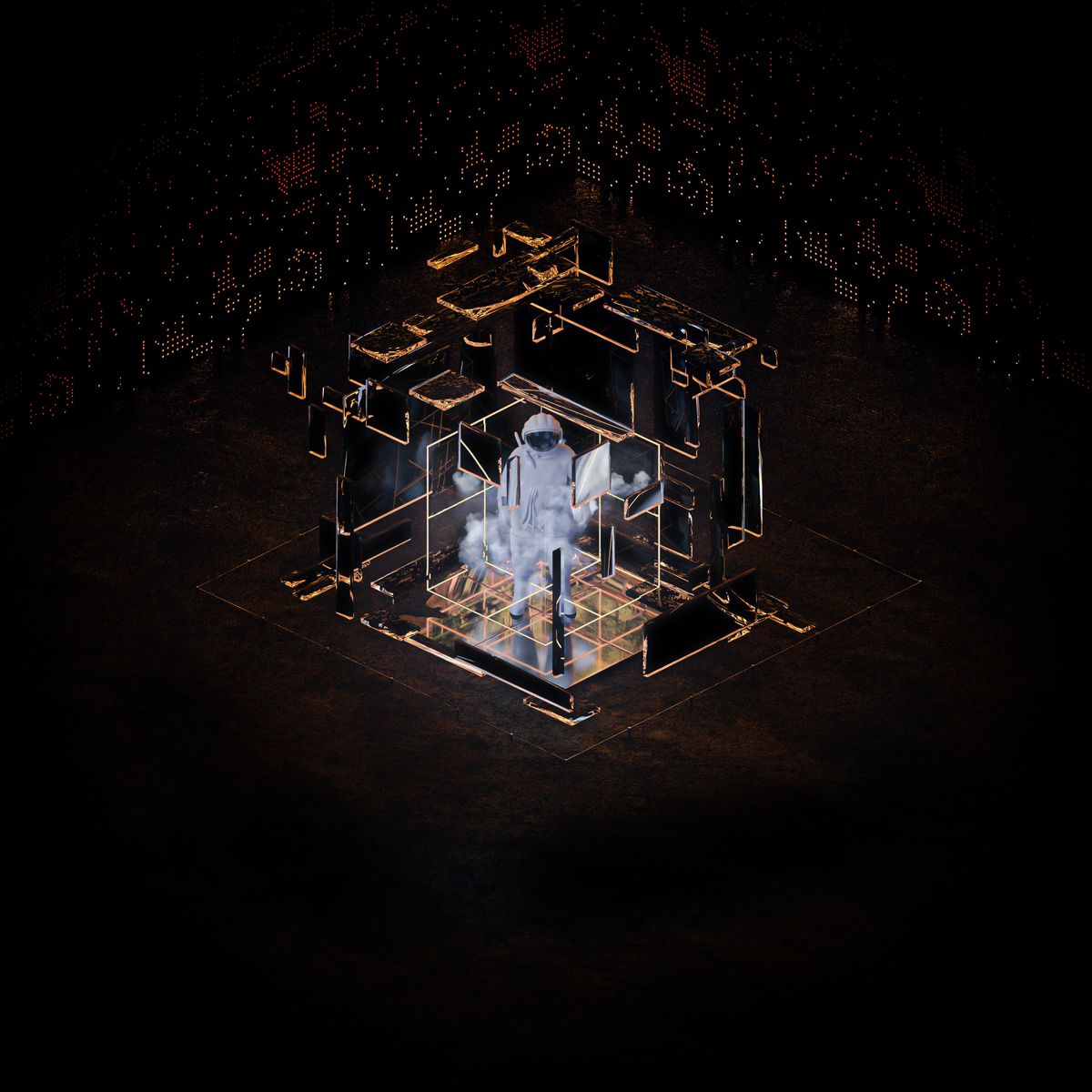

The recent European blockchain project SP4C3 Network with AI cloud computing and distributed storage as the core is not only an very interesting application in the financial field, but also very realizable.

Luckily, we had the opportunity to interview the SP4C3 Network team members and AI engineers, and gained an in-depth understanding of how SP4C3 Network is planned and will be implemented in financial applications.

The core of SP4C3 Network in the combination of AI and financial field consists of three parts

- Joint AI modeling based on federated migration learning;

- Provide related applications including financial data analysis and decision-making suggestions through AI algorithms;

- Application of human-computer interaction technology.

To achieve these three goals, we need better network and hardware foundation, accelerate federated learning, develop better AI algorithms and relevant smart contracts on the existing basis, and combine blockchain technology with federated learning. The intelligent identification, reasoning and data security of multi-modules and formats will be gradually realized.

The core of the financial system and the applications is still to serve the users, so the above three parts need different end-to-end coordination.

In financial AI service eco-system, SP4C3 Network focuses more on online business consulting, identity verification, data audit and other systems, and uses a series of online AI algorithms and reasoning technologies to analyze voice and video in terms of voice, risk control dialogue, OCR and other aspects.

In the financial AI service ecosystem, given financial products are typical high-value low-frequency products, users of such financial products will have a long decision-making period. In view of these characteristics, SP4C3 Network will establish a recommendation model and intelligent operation platform based on data analysis through corresponding AI algorithm, and provide more convenient AI services for third-party financial customers in the form of data + algorithm + data support from third-party financial institutions.

In the financial asset management eco-system, SP4C3 Network makes more use of third-party open source technology to provide auxiliary decision-making applications for asset management on suggestions generated by financial insurance, risk control and intelligent reasoning.

In the financial data service ecosystem, the financial industry is prone to form "data islands" due to relatively closed and independent data, and the industry particularity of data security, secrecy and corresponding REQUIREMENTS of KYC and AML. SP4C3 Network uses distributed hardware devices to deploy corresponding algorithms to jointly model the AI model without data sharing, which is also the core of federated learning.

Considering the existing financial system architecture combined with the existing AI technology, it is more difficult than we expected to cover the whole field and business process with AI. Therefore, the first thing SP4C3 Network can do immediately is to realize more human-computer interaction through AI technology and provide the main factors behind decision making through algorithms and data. To solve the current situation that the financial business process is complicated and cannot be handled online, it is also to try to automate and make all the tedious processes efficient.

The CONCEPT of RPA+AI used by SP4C3 Network is to integrate AI into business to improve efficiency while retaining human knowledge and experience of financial business. In essence, financial business is still the center and AI technology is used to help business upgrade.

Check our guide of the most promising crypto